Category Archives: Personal Care Services

A Court Case in the Time of COVID: The Judge Forgot to Swear in the Witnesses

Since COVID-19, courts across the country have been closed. Judges have been relaxing at home.

As an attorney, I have not been able to relax. No sunbathing for me. Work has increased since COVID-19 (me being a healthcare attorney). I never thought of myself as an essential worker. I still don’t think that I am essential.

On Friday, May 8, my legal team had to appear in court.

“How in the world are we going to do this?” I thought.

My law partner lives in Philadelphia. Our client lives in Charlotte, N.C. I live on a horse farm in Apex, N.C. Who knows where the judge lives, or opposing counsel or their witnesses? How were we going to question a witness? Or exchange documents?

Despite COVID-19, we had to have court, so I needed to buck up, stop whining, and figure it out. “Pull up your bootstraps, girl,” I thought.

First, we practiced on Microsoft Teams. Multiple times. It is not a user-friendly interface. This Microsoft Team app was the judge’s choice, not mine. I had never heard of it. It turns out that it does have some cool features. For example, my paralegal had 100-percent control of the documents. If we needed a document up on the screen, then he made it pop up, at my direction. If I wanted “control” of the document, I simply placed my mouse cursor over it. But then my paralegal did not have control. In other words, two people cannot fight over a document on this new “TV Court.”

The judge forgot to swear in the witnesses. That was the first mess-up “on the record.” I didn’t want to call her out in front of people, so I went with it. She remembered later and did swear everyone in. These are new times.

Then we had to discuss HIPAA, because this was a health care provider asking for immediate relief because of COVID-19. We were sharing personal health information (PHI) over all of our computers and in space. We asked the judge to seal the record before we even got started. All of a sudden, our court case made us all “essentials.” Besides my client, the healthcare provider, no one else involved in this court case was an “essential.” We were all on the computer trying to get this provider back to work during COVID-19. That is what made us essentials!

Interestingly, we had 10 people participating on the Microsoft Team “TV Court” case. The person that I kept forgetting was there was Mr. Carr (because Mr. Carr works at the courthouse and I have never seen him). Also, another woman stepped in for a while, so even though the “name” of the masked attendee was Mr. Carr, for a while Patricia was in charge. A.K.A. Mr. Carr.

You cannot see all 10 people on the Team app. We discovered that whomever spoke, their face would pop up on the screen. I could only see three people at a time on the screen. Automatically, the app chose the three people to be visible based on who had spoken most recently. We were able to hold this hearing because of the mysterious Mr. Carr.

The witnesses stayed on the application the whole time. In real life, witnesses listen to others’ testimony all the time, but with this, you had to remember that everyone could hear everything. You can elect to not video-record yourself and mute yourself. When I asked my client to step away and have a private conversation, my paralegal, my partner, and the client would log off the link and log back on an 8 a.m. link that we used to practice earlier that day. That was our private chat room.

The judge wore no robe. She looked like she was sitting on the back porch of her house. Birds were whistling in the background. It was a pretty day, and there was a bright blue sky…wherever she was. No one wore suits except for me. I wore a nice suit. I wore no shoes, but a nice suit. Everyone one else wore jeans and a shirt.

I didn’t have to drive to the courthouse and find parking. I didn’t even have to wear high heels and walk around in them all day. I didn’t have to tell my paralegal to carry all 1,500 pages of exhibits to the courthouse, or bring him Advil for when he complains that his job is making his back ache.

Whenever I wanted to get a refill of sweet tea or go to the bathroom, I did so quietly. I turned off my video and muted myself and carried my laptop to the bathroom. Although, now, I completely understand why the Supreme Court had its “Supreme Flush.”

All in all, it went as smoothly as one could hope in such an awkward platform.

Oh, and happily, we won the injunction, and now a home healthcare provider can go back to work during COVID-19. All of her aides have PPE. All of her aides want to go to work to earn money. They are willing to take the risk. My client should get back-paid for all her services rendered prior to the injunction. She hadn’t been getting paid for months. However, this provider is still on prepayment review due to N.C. Gen. Stat. 108C-7(e), which legislators should really review. This statute does not work. Especially in the time of COVID. See blog.

I may be among the first civil attorneys to go to court in the time of COVID-19. If I’m honest, I kind of liked it better. I can go to the bathroom whenever I need to, as long as I turn off my audio. Interestingly, Monday, Texas began holding its first jury trial – virtually. I cannot wait to see that cluster! It is streaming live.

Being on RACMonitor for so long definitely helped me prepare for my first remote lawsuit. My next lawsuit will be in New York City, where adult day care centers are not getting properly reimbursed.

RACMonitor Programming Note:

Healthcare attorney Knicole Emanuel is a permanent panelist on Monitor Monday and you can hear her reporting every Monday, 10-10:30 a.m. EST.

COVID-19: Temporary Rate Increases for Medicaid Providers!

Effective March 10, 2020, the Division of Health Benefits (DHB) implemented a 5% rate increase for the Medicaid provider groups listed below. See DHHS Update. (This update was published April 3, 2020, but retroactively effective).

DHB will systematically reprocess claims submitted with dates of service beginning March 10, 2020, through the implementation date of the rate increase.

Claims reprocessing for Skilled Nursing Facility providers will be reflected in the April 7, 2020, checkwrite. All other provider groups claim reprocessing will be included in subsequent checkwrites beginning April 14, 2020.

Providers receiving a 5% increase in fee-for-service reimbursement rates:

- Skilled Nursing Facilities

- Hospice Facilities

- Local Health Departments

- Private Duty Nursing

- Home Health

- Fee for Service Personal Care Services

- Physical, Occupational, Respiratory, Speech and Audiology Therapies

- Community Alternatives for Children (CAP/C) Personal Care Services (PCS)

- Community Alternatives for Disabled Adults (CAP/DA) Personal Care Services (PCS)

- Children’s Developmental Service Agency (CDSA)

[Notice that none of the increased rates include Medicaid services managed by managed care organizations (“MCOs”). No mental health, substance abuse, or developmentally disabled services’ rates are included].

Reprocessed claims will be displayed in a separate section of the paper Remittance Advice (RA) with the unique Explanation of Benefits (EOB) codes 10316 and 10317 – CLAIMS REPROCESSED AS A RESULT OF 5% RATE INCREASE EFFECTIVE MARCH 10, 2020 ASSOCIATED WITH THE COVID-19 PANDEMIC. The 835 electronic transactions will include the reprocessed claims along with other claims submitted for the checkwrite (there is no separate 835). Please note that depending on the number of affected claims you have in the identified checkwrite, you could see an increase in the size of the RA.

Reprocessing does not guarantee payment of the claims. Affected claims will be reprocessed. While some edits may be bypassed as part of the claim reprocessing, changes made to the system since the claims were originally adjudicated may apply to the reprocessed claims. Therefore, the reprocessed claims could deny.

This Medicaid rate increase could not come faster! While it is a small, itsy-bitsy, tiny, minuscule semblance of a “bright side”…a bright side it still is.

Medicaid Incidents: To Report or Not To Report?

The answer resides in the injury, not the quality of the care.

A consumer trips and falls at your long term care facility. It is during her personal care services (PCS). Dorothy, a longtime LPN and one of your most trusted employees, is on duty. According to Dorothy, she was aiding Ms. Brown (the consumer who fell) from the restroom when Ms. Brown sneezed multiple times resulting in a need for a tissue. Dorothy goes to the restroom (only a few feet away) when Ms. Brown’s fourth sneeze sends her reeling backward and falling on her hip.

To report or not to report? That is the question.

What is your answer?

Is Ms. Brown’s fall a Level I, Level II, or a Level III incident? What are your reporting duties?

- If you answered Level II and no requirement to report – you would be correct.

- If you answered Level III and that you must report the incident within 24 hours, you would be correct.

Wait, what? How could both answers be correct? Which is it? A Level II and no reporting it or a Level III and a report due within 24 hours?

It depends on Ms. Brown’s injuries, which is what I find fascinating and a little… how should I put it… wrong?! Think about it…the level of incident and the reporting requirement is not based on whether Dorothy properly provided services to Ms.Brown. No…the answer resides in Ms. Brown’s injuries. Whether Dorothy acted appropriately or not appropriately or rendered sub-par services has no bearing on the level of incident or reporting standards.

According to the Department of Health and Human Services’ (DHHS) Incident Response and Reporting Manual, Ms. Brown’s fall would fall (no pun intended) within a Level II of response if Ms. Brown’s injuries were not a permanent or psychological impairment. She bruised her hip, but there was no major injury.

However, if Ms. Brown’s fall led to a broken hip, surgery, and a replacement of her hip, then her fall would fall within a Level III response that needs to be reported within 24 hours. Furthermore, even at a Level III response, no reporting would be required except that, in my hypothetical, the fall occurred while Dorothy was rendering PCS, which is a billable Medicaid service. Assuming that Ms. Brown is on Medicaid and Medicare (and qualifies for PCS), Dorothy’s employer can be reimbursed for PCS; therefore, the reporting requirement within 24 hours is activated.

In each scenario, Dorothy’s actions remain the same. It is the extent of Ms. Brown’s injury that changes.

See the below tables for further explanation:

INCIDENT RESPONSE AND REPORTING MANUAL

These tables are not exhaustive, so please click on the link above to review the entire Incident Response and Reporting Manual.

Other important points:

- Use the federal Occupational Safety and Health Administration’s (OSHA) guidelines to distinguish between injuries requiring first aid and those requiring treatment by a health professional.

- A visit to an emergency room (in and of itself) is not considered an incident.

- Level I incidents of suspected or alleged cases of abuse, neglect or

exploitation of a child (age 17 or under) or disabled adult must still be reported

pursuant to G.S. 108A Article 6, G.S. 7B Article 3 and 10A NCAC 27G .0610.

Providing residential services to anyone is, inevitably, more highly regulated than providing outpatient services. The chance of injury, no matter the cause, is exponentially greater if the consumer is in your care 24-hours a day. That’s life. But if you do provide residential services, know your reporting mandates or you could suffer penalties, fines, and possible closure.

Lastly, understand that these penalties for not reporting can be subjective, not objective. If Ms. Brown’s fall led to a broken hip that repaired without surgery or without replacement of the hip, is that hip injury considered “permanent?”

In cases of reporting guidelines, it is prudent to keep your attorney on speed dial.

“Bye Felicia” – Closing Your Doors To a Skilled Nursing Facility May Not Be So Easy – You Better Follow the Law Or You May Get “Sniffed!”

There are more than 15,000 nursing homes across the country. Even as the elderly population balloons, more and more nursing homes are closing. The main reason is that Medicare covers little at a nursing home, but Medicare does cover at-home and community-based services; i.e., personal care services at your house. Medicare covers nothing for long term care if the recipient only needs custodial care. If the recipient requires a skilled nursing facility (SNF), Medicare will cover the first 100 days, although a co-pay kicks in on day 21. Plus, Medicare only covers the first 100 days if the recipient meets the 3-day inpatient hospital stay requirement for a covered SNF stay. For these monetary reasons, Individuals are trying to stay in their own homes more than in the past, which negatively impacts nursing homes. Apparently, the long term care facilities need to lobby for changes in Medicare.

Closing a SNF, especially if it is Medicare certified, can be tricky to maneuver the stringent regulations. You cannot just be dismissive and say, “Bye, Felicia,” and walk away. Closing a SNF can be as legally esoteric as opening a SNF. It is imperative that you close a SNF in accordance with all applicable federal regulations; otherwise you could face some “sniff” fines. Bye, Felicia!

Section 6113 of the Affordable Care Act dictates the requirements for closing SNFs. SNF closures can be voluntary or involuntary. So-called involuntary closures occur when health officials rule that homes have provided inadequate care, and Medicaid and Medicare cut off reimbursements. There were 106 terminations of nursing home contracts in 2014, according to the federal Centers for Medicare and Medicaid Services (CMS).

Regardless, according to law, the SNF must provide notice of the impending closure to the State and consumers (or legal representatives) at least 60 days before closure. An exception is if the SNF is shut down by the state or federal government, then the notice is required whenever the Secretary deems appropriate. Notice also must be provided to the State Medicaid agency, the patient’s primary care doctors, the SNF’s medical director, and the CMS regional office. Once notice is provided, the SNF may not admit new patients.

Considering the patients who reside within a SNF, by definition, need skilled care, the SNF also has to plan and organize the relocation of its patients. These relocation plans must be approved by the State.

Further, if the SNF violates these regulations the administrator of the facility and will be subject to civil monetary penalty (CMP) as follows: A minimum of $500 for the first offense; a minimum of $1,500 for the second offense; and a minimum of $3,000 for the third and subsequent offenses. Plus, the administrator could be subject to higher amounts of CMPs (not to exceed ($100,000) based on criteria that CMS will identify in interpretative guidelines.

If you are contemplating closing a SNF, it is imperative that you do so in accordance with the federal rules and regulations. Consult your attorney. Do not be dismissive and say, “Bye, Felicia.” Because you could get “sniffed.”

Another Win for the Good Guys! Gordon & Rees Succeeds in Overturning Yet Another Medicaid Contract Termination!

Getting placed on prepayment review is normally a death sentence for most health care providers. However, our health care team here at Gordon Rees has been successful at overturning the consequences of prepayment review. Special Counsel, Robert Shaw, and team recently won another case for a health care provider, we will call her Provider A. She had been placed on prepayment review for 17 months, informed that her accuracy ratings were all in the single digits, and had her Medicaid contract terminated.

We got her termination overturned!! Provider A is still in business!

(The first thing we did was request the judge to immediately remove her off prepayment review; thereby releasing some funds to her during litigation. The state is only allowed to maintain a provider on prepayment review for 12 months).

Prepayment review is allowed per N.C. Gen. Stat. 108C-7. See my past blogs on my opinion as to prepayment review. “NC Medicaid: CCME’s Comedy of Errors of Prepayment Review” “NC Medicaid and Constitutional Due Process.”

108C-7 states, “a provider may be required to undergo prepayment claims review by the Department. Grounds for being placed on prepayment claims review shall include, but shall not be limited to, receipt by the Department of credible allegations of fraud, identification of aberrant billing practices as a result of investigations or data analysis performed by the Department or other grounds as defined by the Department in rule.”

Being placed on prepayment review results in the immediate withhold of all Medicaid reimbursements pending the Department of Health and Human Services’ (DHHS) contracted entity’s review of all submitted claims and its determination that the claims meet criteria for all rules and regulations.

In Provider A’s situation, the Carolinas Center for Medical Excellence (CCME) conducted her prepayment review. Throughout the prepayment process, CCME found Provider A almost wholly noncompliant. Her monthly accuracy ratings were 1.5%, 7%, and 3%. In order to get off prepayment review, a provider must demonstrate 70% accuracy ratings for 3 consecutive months. Obviously, according to CCME, Provider A was not even close.

We reviewed the same records that CCME reviewed and came to a much different conclusion. Not only did we believe that Provider A met the 70% accuracy ratings for 3 consecutive months, we opined that the records were well over 70% accurate.

Provider A is an in-home care provider agency for adults. Her aides provide personal care services (PCS). Here are a few examples of what CCME claimed were inaccurate:

1. Provider A serves two double amputees. The independent assessments state that the pateint needs help in putting on and taking off shoes. CCME found that there was no indication on the service note that the in-home aide put on or took off the patients’ shoes, so CCME found the dates of service (DOS) noncompliant. But the consumers were double amputees! They did not require shoes!

2. Provider A has a number of consumers who require 6 days of services per week based on the independent assessments. However, many of the consumers do not wish for an in-home aide to come to their homes on days on which their families are visiting. Many patients inform the aides that “if you come on Tuesday, I will not let you in the house.” Therefore, there no service note would be present for Tuesday. CCME found claims inaccurate because the assessment stated services were needed 6 days a week, but the aide only provided services on 5 days. CCME never inquired as to the reason for the discrepancy.

3. CCME found every claim noncompliant because the files did not contain the service authorizations. Provider A had service authorizations for every client and could view the service authorizations on her computer queue. But, because the service authorization was not physically in the file, CCME found noncompliance.

Oh, and here is the best part about #3…CCME was the entity that was authorizing the PCS (providing the service authorizations) and, then, subsequently, finding the claim noncompliant based on no service authorization.

Judge Craig Croom at the Office of Administrative Hearings (OAH) found in our favor that DHHS via CCME terminated Provider A’s Medicaid contract arbitrarily, capriciously, erroneously, exceeded its authority or jurisdiction, and failed to act as accordingly to the law. He ruled that DHHS’ placement of Provider A on prepayment review was random

Because of Judge Croom’s Order, Provider A remains in business. Plus, she can retroactively bill all the unpaid claims over the course of the last year.

Great job, Robert!!! Congratulations, Provider A!!!

Consider Nominating This Blog for the 2015 Best Legal Blog Contest (Please)!

The 2015 Legal Blog Contest is here!

For all you that follow this blog, thank you! I hope that you agree that I provide you with valuable and up-to-date information on Medicaid/care regulatory issues. At least, that is my hope in maintaining this blog. And maintaining this blog takes a lot of time outside my normal, hectic legal career and my time as a mom and wife. Don’t get me wrong…I love blogging about these issues because these issues are near and dear to my heart. I am passionate about health care, health care providers, Medicaid and Medicare, and access to quality care.

If you are a follower, then you know that I try to keep my readers current on Medicaid/care fraud, federal and state laws, legal rights for health care providers, bills in the General Assembly germane to health care, extrapolation issues, CMS rulings, managed care matters, reimbursement rates, RAC audits and much, much more!

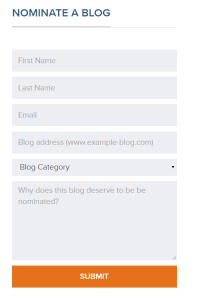

If you enjoy my blog, I ask a favor. Please consider nominating my blog for the 2015 Best Legal Blog Contest.

If you want to nominate my blog, please click here.

Scroll down until you see this:

Enter your name, email address, my blog address. which is:

For category, click on “Niche and Specialty.” I do not believe the other categories correctly describe my blog.

And type a reason why you enjoy my blog. Much appreciated!