Category Archives: Prosecution

Medicare/caid Fraud, Tattletails, and How To Self Disclose

On July 13, 2017, Attorney General Jeff Sessions and Department of Health and Human Services (HHS) Secretary Tom Price, M.D., announced the Department of Justice’s (DOJ) biggest-ever health care fraud takedown. 412 health care providers were charged with health care fraud. In total, allegedly, the 412 providers schemed and received $1.3 billion in false billings to Medicare, Medicaid, and TRICARE. Of the 412 defendants, 115 are physicians, nurses, and other licensed medical professionals. Additionally, HHS has begun the suspension process against 295 health care providers’ licenses.

The charges include allegations of billing for medically unnecessary treatments or services that were not really provided. The DOJ has evidence that many of the defendants had illegal kickback schemes set up. More than 120 of the defendants were charged with unlawfully or inappropriately prescribing and distributing opioids and other narcotics.

While this particular sting operation resulted from government investigations, not all health care fraud is discovered through government investigation. A great deal of fraud is uncovered through private citizens coming forward with incriminating information. These private citizens can file suit against the fraudulent parties on behalf of the government; these are known as qui tam suits.

Being a whistleblower goes against what most of us are taught as children. We are taught not to be a tattletail. I have vivid memories from elementary school of other kids acting out, but I would remain silent and not inform the teacher. But in the health care world, tattletails are becoming much more common – and they make money for blowing that metaphoric whistle.

What is a qui tam lawsuit?

Qui tam is Latin for “who as well.” Qui tam lawsuits are a type of civil lawsuit whistleblowers (tattletails) bring under the False Claims Act, a law that rewards whistleblowers if their qui tam cases recover funds for the government. Qui tam cases are a powerful weapon against Medicare and Medicaid fraud. In other words, if an employee at a health care facility witnesses any type of health care fraud, even if the alleged fraud is unknown to the provider, that employee can hire an attorney to file a qui tam lawsuit to recover money on behalf of the government. The government investigates the allegations of fraud and decides whether it will join the lawsuit. Health care entities found guilty in a qui tam lawsuit will be liable to government for three times the government’s losses, plus penalties.

The whistleblower is rewarded for bringing these lawsuits. If the government intervenes in the case and recovers funds through a settlement or a trial, the whistleblower is entitled to 15% – 25% of the recovery. If the government doesn’t intervene in the case and it is pursued by the whistleblower team, the whistleblower reward is between 25% – 30% of the recovery.

These recoveries are not low numbers. On June 22, 2017, a physician and rehabilitative specialist agreed to pay $1.4 million to resolve allegations they violated the False Claims Act by billing federal health care programs for medically unreasonable and unnecessary ultrasound guidance used with routine lab blood draws, and with Botox and trigger point injections. If a whistleblower had brought this lawsuit, he/she would have been awarded $210,000 – 420,000.

On June 16, 2017, a Pennsylvania-based skilled nursing facility operator agreed to pay roughly $53.6 million to settle charges that it and its subsidiaries violated the False Claims Act by causing the submission of false claims to government health care programs for medically unnecessary therapy and hospice services. The allegations originated in a whistleblower lawsuit filed under the qui tam provisions of the False Claims Act by 7 former employees of the company. The whistleblower award – $8,040,000 – 16,080,000.

There are currently two, large qui tam cases against United Health Group (UHG) pending in the Central District of California. The cases are: U.S. ex rel. Benjamin Poehling v. UnitedHealth Group, Inc. and U.S. ex rel. Swoben v. Secure Horizons, et al. Both cases were brought by James Swoben, who was an employee and Benjamin Poehling, who was the former finance director of a UHG group that managed the insurer’s Medicare Advantage Plans. On May 2, 2027, the U.S. government joined the Poehling lawsuit.

The charges include allegations that UHG:

- Submitted invalid codes to the Center for Medicare and Medicaid Services (CMS) that it knew of or should have known that the codes were invalid – some of the dates of services at issue in the case are older than 2008.

- Intentionally avoided learning that some diagnoses codes or categories of codes submitted to their plans by providers were invalid, despite acknowledging in 2010 that it should evaluate the results of its blind chart reviews to find codes that need to be deleted.

- Failed to follow up on and prevent the submissions of invalid codes or submit deletion for invalid codes.

- Attested to CMS each year that the data they submitted was true and accurate while knowing it was not.

UHG would not be in this expensive, litigious pickle had it conducted a self audit and followed the mandatory disclosure requirements.

What are the mandatory disclosure requirements? Glad you asked…

Section 6402(a) of the Affordable Care Act (ACA) creates an express obligation for health care providers to report and return overpayments of Medicare and Medicaid. The disclosure must be made by 60 days days after the date that the overpayment was identified or the date any corresponding cost report is due, if applicable. Identification is defined as the point in which the provider has determined or should have determined through the exercise of due diligence that an overpayment exists. CMS expects the provider to proactively investigate any credible information of a potential overpayment. The consequences of failing to proactively investigate can be seen by the UHG lawsuits above-mentioned. Apparently, UHG had some documents dated in 2010 that indicated it should review codes and delete the invalid codes, but, allegedly, failed to do so.

How do you self disclose?

According to CMS:

“Beginning June 1, 2017, providers of services and suppliers must use the forms included in the OMB-approved collection instrument entitled CMS Voluntary Self-Referral Disclosure Protocol (SRDP) in order to utilize the SRDP. For disclosures of noncompliant financial relationships with more than one physician, the disclosing entity must submit a separate Physician Information Form for each physician. The CMS Voluntary Self-Referral Disclosure Protocol document contains one Physician Information Form.”

Medicare Fraud: Do MCOs Have Accountability Too?

Dr. Isaac Kojo Anakwah Thompson, a Florida primary care physician, was sentenced in July 2016 to 4 years in prison and a subsequent two years of supervised release. Dr. Thompson pled guilty to health care fraud. He was further ordered to pay restitution in the amount of $2,114,332.33. Ouch!! What did he do?

According to the Department of Justice, Dr. Thompson falsely reported that 387 of his clients suffered from ankylosing spondylitis when they did not.

Question: How does faking a patient’s disease make a physician money???

Answer: Hierarchal condition category (HCC) coding. Wait, what?

Basically, Medicare Advantage assigns HCC coding to each patient depending on the severity of their illnesses. Higher HCC scores equals substantially higher monthly capitation payments from Medicare to the managed care organization (MCO). In turn, the MCO will pay physicians more who have more extremely sick patients (higher HCC codes).

Ankylosing spondylitis is a form of arthritis that causes inflammation and damage at the joints; eventually, the inflamed spinal joints can become fused, or joined together so they can’t move independently. It’s a rare disease, affecting 1 in 1000 people. And, importantly, it sports a high HCC code.

In this case, the Office of Inspector General (OIG) found it odd that, between 2006-2010, Dr. Thompson diagnosed 387 Medicare Advantage beneficiaries with ankylosing spondylitis and treated them with such rare disease. To which, I say, if you’re going to defraud the Medicare system, choose common, fabricated diseases (kidding – it’s called sarcasm – I always have to add a disclaimer for people with no humor).

According to the Department of Justice, none or very few of Dr. Thompson’s 387 consumers actually had ankylosing spondylitis.

My issue is as follows: Doesn’t the managed care organization (MCO) share in some of the punishment? Shouldn’t the MCO have to repay the financial benefit it reaped from Dr. Thompson?? Shouldn’t the MCO have a duty to report such oddities?

Let me explain:

In Florida, Humana acted as the MCO. Every dollar that Dr. Thompson received was funneled through Humana. Humana would pay Dr. Thompson a monthly capitation fee from Medicare Advantage based on his patient’s hierarchal condition category (HCC) coding. Increasing even just one patient’s HCC code means more bucks for Dr. Thompson. Remember, according to the DOJ, he increased 387 patients’ HCC codes.

Dr. Thompson reported these diagnoses to Humana, which in turn reported them to Medicare. Consequently, Medicare paid approximately $2.1 million in excess capitation fees to Humana, approximately 80% of which went to Dr. Thompson.

In this case, it is reasonable to expect that Humana had knowledge that Dr. Thompson reported abnormally high HCCs for his patients. For comparison, ankylosing spondylitis has an HCC score of 0.364, which is more than an aortic aneurysm and three times as high as diabetes. Plus, look at the amount of money that the MCO paid Dr. Thompson. Surely, it appeared irregular.

What, if anything, is the MCO’s duty to report physicians with an abnormally high number of high HCC codes? If you have knowledge of someone committing a crime and you do nothing, isn’t that called aiding and abetting?

With the publication of the Yates memo, I expect to see CMS holding MCOs and other state agencies accountable for the actions of its providers. Not to say that the MCOs should actively, independently investigate Medicare/caid fraud, but to notify the Human Services Department (HSD) if abnormalities exist, especially if as blatant as one doctor with 387 patients suffering from ankylosing spondylitis.

Medicare/Caid Audits: Urine Testing Under Fire!!

I have blogged about peeing in a cup before…but we will not be talking about dentists in this blog. Instead we will be discussing pain management physicians and peeing in a cup.

Pain management physicians are under intense scrutiny on the federal and state level due to increased urine testing. But is it the pain management doctors’ fault?

When I was little, my dad and I would play catch with bouncy balls. He would always play a dirty little trick, and I fell for it every time. He would toss one ball high in the air. While I was concentrating on catching that ball, he would hurl another ball straight at me, which, every time, smacked into me – leaving me disoriented as to what was happening. He would laugh and laugh. I was his Charlie Brown, and he was my Lucy. (Yes, I have done this to my child).

The point is that it is difficult to concentrate on more than one thing. When the Affordable Care Act (ACA) came out, it was as if the federal government wielded 500, metaphoric, bouncy balls at every health care provider. You couldn’t comprehend it in its entirety. There were different deadlines for multiple changes, provider requirements, employer requirements, consumer requirements…it was a bloodbath! [If you haven’t seen the brothers who trick their sister into thinking it’s a zombie apocalypse, you have to watch it!!]

A similar “metaphoric ball frenzy” is occurring now with urine testing, and pain management physicians make up the bulk of prescribed urine testing. The urine testing industry has boomed in the past 4-5 years. This could be caused by a number of factors:

- increase use of drugs (especially heroine and opioids),

- the tightening of regulations requiring physicians to monitor whether patients are abusing drugs,

- increase of pain management doctors purchasing mass-spectrometry machines and becoming their own lab,

- simply more people are complaining of pain, and

- the pharmaceutical industry’s direct-to-consumer advertising (DTCA).

Medicare’s spending on 22 high-tech tests for drugs of abuse hit $445 million in 2012, up 1,423% in five years. “In 2012, 259 million prescriptions were written for opioids, which is more than enough to give every American adult their own bottle of pills.” See article.

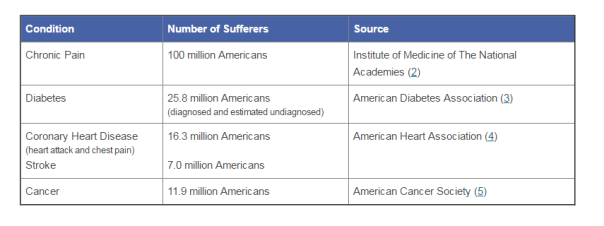

According to the American Association of Pain Management, pain affects more Americans than diabetes, heart disease and cancer combined. The chart below depicts the number of chronic pain sufferers compared to other major health conditions.

In the world of Medicare and Medicaid, where there is profit being made, the government comes a-knockin’.

But should we blame the pain management doctors if recent years brought more patients due to increase of drug use? The flip side is that we do not want doctors ordering urine tests unnecessarily. But aren’t the doctors supposed to the experts on medical necessity??? How can an auditor, who is not a physician and never seen the patient opine to medical necessity of a urine test?

The metaphoric ball frenzy:

There are so many investigations into urine testing going on right now.

Ball #1: The machine manufacturers. A couple of years ago, Carolina Liquid Chemistries (CLC) was raided by the federal government. See article. One of the allegations was that CLC was misrepresenting their product, a urinalysis machine, which caused doctors to overbill Medicare and Medicaid. According to a source, the federal government is still investigating CLC and all the physicians who purchased the urinalysis machine from CLC.

Ball #2: The federal government. Concurrently, the federal government is investigating urine testing billed to Medicare. In 2015, Millennium Health paid $256 million to resolve alleged violations of the False Claims Act for billing Medicare and Medicaid for medically unnecessary urine drug and genetic testing. I wonder if Millennium bought a urinalysis machine from CLC…

Ball #3: The state governments. Many state governments are investigating urine testing billed to Medicaid. Here are a few examples:

New Jersey: July 12, 2016, a couple and their diagnostic imaging companies were ordered to pay more than $7.75 million for knowingly submitting false claims to Medicare for thousands of falsified diagnostic test reports and the underlying tests.

Oklahoma: July 10, 2016, the Oklahoma attorney general’s office announced that it is investigating a group of laboratories involved in the state’s booming urine testing industry.

Tennessee: April 2016, two lab professionals from Bristol, Tenn., were convicted of health care fraud in a scheme involving urine tests for substance abuse treatments.

If you are a pain management physician, here are a few recommendations to, not necessarily avoid an audit (because that may be impossible), but recommendations on how to “win” an audit:

- Document, document, document. Explain why the urine test is medically necessary in your documents. An auditor is less likely to question something you wrote at the time of the testing, instead of well after the fact.

- Double check the CPT codes. These change often.

- Check your urinalysis machine. Who manufactured it? Is it performing accurately?

- Self-audit

- Have an experienced, knowledgeable, health care attorney. Do not wait for the results of the audit to contact an attorney.

And, perhaps, the most important – Do NOT just accept the results of an audit. Especially with allegations involving medical necessity…there are so many legal defenses built into regulations!! You turn around and throw a bouncy ball really high – and then…wallop them!!

The Yates Memo: It May Be the Second Coming for Individual Executives

The Yates memo? Sadly, we aren’t talking about William Butler Yates, who is one of my favorite poets:

TURNING and turning in the widening gyre

The falcon cannot hear the falconer;

Things fall apart; the centre cannot hold;

Mere anarchy is loosed upon the world,

The blood-dimmed tide is loosed, and everywhere

The ceremony of innocence is drowned;

The best lack all conviction, while the worst

Are full of passionate intensity.

Surely some revelation is at hand;

Surely the Second Coming is at hand…Part of The Second Coming

Ok, so maybe it is a little melodramatic to compare the Yates memo from the Office of the Deputy Attorney General to the end of the world, the drowning of innocence, and The Second Coming, but I made analogies in past blogs that had stretched and, dare I say, hyberbolized the situation.

What is the Yates memo?

The Yates memo is a memorandum written by Sally Quillian Yates, Deputy Attorney General for the U.S. Dept. of Justice, dated September 9, 2015.

It basically outlines how federal investigations for corporate fraud or misconduct should be conducted and what will be expected from the corporation getting investigated. It was not written specifically about health care providers; it is a general memo outlining the investigations of corporate wrongdoing across the board. But it is germane to health care providers.

By far the most scary and daunting item discussed within the Yates memo is the DOJ’s interest in indicting individuals within corporations as well as the corporate entities itself, i.e., the executives…the management. Individual accountability.

No more Lehman Brothers fallout with former CEO Dick Fuld leaving the catastrophe with a mansion in Greenwich, Conn., a 40+ acre ranch in Sun Valley, Idaho, as well as a five-bedroom home in Jupiter Island, Fla. Fuld may have or may not have been a player in the downfall of Lehman Brothers. But the Yates Memo was not published back in 2008.

The Yates Memo outlines 6 steps to strengthen audits for corporate compliance:

- To be eligible for any cooperation credit, corporations must provide to the DOJ all relevant facts about individuals involved in corporate misconduct.

- Both criminal and civil corporate investigations should focus on individuals from the inception of the investigation.

- Criminal and civil attorneys handling corporate investigations should be in routine communication with one another.

- Absent extraordinary circumstances, no corporate resolution will provide protection from criminal or civil liability for any individuals.

- Corporate cases should not be resolved without a clear plan to resolve related individual cases before the statute of limitations expires and declinations as to individuals in such cases must be memorialized.

- Civil attorneys should consistently focus on individuals as well as the company and evaluate whether to bring suit against an individual based on considerations beyond that individual’s ability to pay.

So why write about now – over 6 months after it was disseminated?

First, since its dissemination, a few points have been clarified that were otherwise in question.

About a month after its publication, U.S. Assistant Attorney General Leslie Caldwell emphasized the Yates memo’s requirement that corporations must disclose all relevant facts regarding misconduct to receive cooperation credit. Caldwell went so far to say that companies must affirmatively seek relevant facts regarding misconduct.

For example, Hospital X is accused of Medicare fraud, waste, and abuse (FWA) in the amount of $15 million. The Yates memo dictates that management at the hospital proactively investigate the allegations and report its findings to the federal government. The memo mandates that the hospital “show all its cards” and turn itself in prior to making any defense.

The problem here is that FWA is such a subjective determination.

What if a hospital bills Medicare for inplantable cardioverter defibrillator, or ICD, for patients that had coronary bypass surgery or angioplasty within 90 days or a heart attack within 40 days? What if the heart attack was never documented? What if the heart attack was so minor that it lasted under 100 milliseconds?

The Medicare National Coverage Determinations are so esoteric that your average Medicare auditor could very well cite a hospital for billing for an ICD even when the patient’s heart attack lasted under 100 milliseconds.

Yet, according to the Yates memo, the hospital is required to present all relevant facts before any defense. What if the hospital’s billing person is over zealous in detecting mis-billings? The hospital could very well have a legal defense as to why the alleged mis-billing is actually compliant. What about a company’s right to seek counsel and defend itself? The Yates memo may require the company to turn over attorney-client privilege.

The second point that has been clarified since the Yates’ memo’s publication came from Yates herself.

Yates remarks that there will be a presumption that the company has access to identify culpable individuals unless they can make an affirmative showing that the company does not have access to it or are legally prohibited from producing it.

Why should this matter? It’s only a memo, right?

Since its publication, the DOJ codified it into the revised U.S. Attorneys’ Manual, including the two clarifying remarks. Since its inception, the heads of companies have been targeted.

A case was brought against David Bostwick, the founder, owner and chief executive officer of Bostwick Laboratories for allegedly provided incentives to treating physicians in exchange for referrals of patients who would then be subjected to these tests.

When the pharmaceutical company Warner Chilcott was investigated for health care fraud prosecutors also went after W. Carl Reichel, the former president, for his alleged involvement in the company’s kickback scheme.

Prior to the Yates’ memo, it was uncommon for health care fraud investigations to involve criminal charges or civil resolutions against individual executives.

The Second Coming?

It may feel that way to executives of health care companies accused of fraud, waste, and abuse.

What is the Stark Law? And Why Is It Important to You?

It seems apropos that a US Congressman was named Pete Stark who first sponsored what came to be known as the Stark law, because the Stark law mandates stark penalties for financially driven physician referrals. Get it? Cheesy, I know.

The Stark law (42 U.S.C. 1395nn) prohibits physician referrals of designated health services (DHR) for Medicare and Medicaid if the physician has a financial interest with the “referred to” agency.

For example, Dr. Goneril is an internist. As an investment, he and his partner, Dr. Regan open a local laboratory “Gloucester” and hire Mr. Lear to run Gloucester. Drs. Goneril and Regan are silent partners. Dr. Goneril orders blood work on Patient Cordelia and refers her to Gloucester.

The above example would be a direct violation of the Stark law.

The penalties are severe. If caught, Dr. Goneril would have to repay all money received for services in which he referred Cordelia to Gloucester. In addition, he could be penalized $15,000 for every time he improperly referred Cordelia, plus three times the amount of improper payment he received from the Medicare/caid program, possible termination from the Medicare/caid program, and penalties of up to $100,000 for every time he tried to circumvent the Stark law.

On the federal level, the Department of Justice, the Center for Medicare and Medicaid Services (CMS), and the Department of Health and Human Services (DHHS) are tasked with enforcing the Stark law.

Recent years have seen the most Stark law violations since its inception and it is only being enforced more and more.

On June 9, 2015, the Office of Inspector General (OIG) issued a fraud alert regarding the Stark law. Investigations since June 2015 has risen significantly.

Here are some recent Stark settlements (for you to understand the severity):

- Adventist Health System agreed to pay $118.7 million to the federal government and to multiple states.

- Columbus Regional Healthcare System is paying $25 million.

- Citizens Medical Center in Victoria, Texas, agreed to pay $21.75 million.

“O, reason not the need! Our basest beggars / Are in the poorest thing superfluous. / Allow not nature more than nature needs, / Man’s life’s as cheap as beast’s.” (King Lear, II, iv).

How do you defend yourself if you are accused of a Stark violation?

First and foremost, hire a qualified health care attorney. There are exceptions to the Stark law which, hopefully, you fall within. Furthermore, there are multiple legal arguments that can abate penalties. You do not always want to settle.There have been a number of agencies, that recently, decided to never settle. Oddly enough, the number of their audits decreased. Maybe the government targets easy money.

The Feds Criminally Investigating DHHS! Is Its Scope Too Narrow and What Are Possible Consequences?

DHHS is under criminal investigation by the federal government for allegedly overpaying employees without a bid process, and, simply, mismanaging and overspending our Medicaid tax dollars. See blog.

When I first started writing this blog, I opined that the federal investigation should be broadened. While I still believe so, the results of broadening the scope of a federal investigation could be catastrophic for our Medicaid providers and recipients. So I am metaphorically torn between wanting to shine light on tax payer waste and wanting to shield NC Medicaid providers and recipients from the consequences of penalties and sanctions on NC DHHS. Because, think about it, who would be harmed if NC lost federal funding for Medicaid?

[BTW, of note: These subpoenas were received July 28, 2015. Aldona Wos announced her resignation on August 5, 2015, after receipt of subpoenas. The Subpoenas demand an appearance on August 18, 2015, which, obviously, has already passed, yet we have no intel as to the occurrences on August 18, 2015. If anyone has information, let me know.]

Let’s explore:

Does this criminal investigation go far enough? Should the feds investigate more Medicaid mismanagement over and above the salaries of DHHS employees? What are the potential consequences if NC is sanctioned for violating Medicaid regulations? How could a sanction affect providers and recipients?

DHHS’ employees are not the only highly compensated parties when it comes to our Medicaid dollars! It is without question that the contracts with vendors with whom DHHS contracts contain astronomically high figures. For example, DHHS hired Computer Sciences Corporation (CSC) to implement the NCTracks software for $265 million. Furthermore, there is no mention of the lack of supervision of the managed care organizations (MCOs) and the compensation for executives of MCOs being equal to that of the President of the United States in the Subpoenas.

The subpoenas are limited in scope as to documents related to hiring and the employment terms surrounding DHHS employees. As I just said, there is no mention of violations of bid processes for vendors or contractors, except as to Alvarez & Marsal, and nothing as to the MCOs.

Specifically, the subpoena is requesting documents germane to the following:

- Les Merritt, a former state auditor who stepped down from the North Carolina State Ethics Commission after WRAL News raised questions about potential conflicts of interest created by his service contract with DHHS;

- Thomas Adams, a former chief of staff who received more than $37,000 as “severance” after he served just one month on the job;

- Angie Sligh, the former director of the state’s upgraded Medicaid payment system who faced allegations of nepotism and the waste of $1.6 million in payments to under-qualified workers for wages, unjustified overtime and holiday pay in a 2015 state audit;

- Joe Hauck, an employee of Wos’ husband who landed a lucrative contract that put him among the highest-paid workers at DHHS;

- Alvarez & Marsal, a consulting firm overseeing agency budget forecasting under a no-bid contract that has nearly tripled in value, to at least $8 million;

See WRAL.com.

Possible penalties:

Most likely, the penalties imposed would be more civil in nature and encompass suspensions, recoupments, and/or reductions to the federal matching. Possibly a complete termination of all federal matching funds, at the worst.

42 CFR Part 430, Subpart C – of the Code of Federal Regulations (CFR) covers “Grants; Reviews and Audits; Withholding for Failure To Comply; Deferral and Disallowance of Claims; Reduction of Federal Medicaid Payments”

The Center for Medicare and Medicaid Services (CMS) is charged with the oversight of all 50 states’ management of Medicaid, which makes CMS very busy and with solid job security.

CMS may withhold federal funding, although reasonable notice and opportunity for a hearing is required (unlike the reimbursement suspensions from providers upon “credible” (or not) allegations of fraud).

If the Administrator of a hearing finds North Carolina non compliant with federal regulations, CMS may withhold, in whole or in part, our reimbursements until we remedy such deficiency. Similar to health care providers’ appeals, if the State of North Carolina is dissatisfied with the result of the hearing, NC may file for Judicial Review. Theoretically, NC could go all the way to the U.S. Supreme Court.

Other penalties could include reductions of (1) the Federal Medical Assistance Percentage; (2) the amount of State expenditures subject to FFP; (3) the rates of FFP; and/or (4) the amount otherwise payable to the state.

As a reminder, the penalties listed above are civil penalties, and NC is under criminal investigation; however, I could not fathom that the criminal penalties would differ far from the civil allowable penalties. What are the feds going to do? Throw Wos in jail? Highly unlikely.

The subpoena was addressed to:

NC DHHS, attention the Custodian of Records. In NC, public records requests go to Kevin V. Howell, Legal Communications Coordinator, DHHS.

But is the federal government’s criminal investigation of DHHS too narrow in scope?

If we are investigating DHHS employees’ salaries and bid processes, should we not also look into the salaries of DHHS’ agents, such as the salaries for employees of MCOs? And the contracts’ price tags for DHHS vendors?

Turning to the MCOs, who are the managers of a fire hose of Medicaid funds with little to no supervision, I liken the MCOs’ current stance on the tax dollars provided to the MCOs as the Lion, who hunted with the Fox and the Jackal from Aesop’s Fables.

The Lion went once a-hunting along with the Fox, the Jackal, and the Wolf. They hunted and they hunted till at last they surprised a Stag, and soon took its life. Then came the question how the spoil should be divided. “Quarter me this Stag,” roared the Lion; so the other animals skinned it and cut it into four parts. Then the Lion took his stand in front of the carcass and pronounced judgment: The first quarter is for me in my capacity as King of Beasts; the second is mine as arbiter; another share comes to me for my part in the chase; and as for the fourth quarter, well, as for that, I should like to see which of you will dare to lay a paw upon it.”

“Humph,” grumbled the Fox as he walked away with his tail between his legs; but he spoke in a low growl:

Moral of Aesop’s Fable: “You may share the labours of the great, but you will not share the spoil.”

At least as to DHHS employees’ salaries, the federal government is investigating any potential mismanagement of Medicaid funds due to exorbitant salaries, which were compensated with tax dollars.

Maybe this investigation is only the beginning of more forced accountability as to mismanaging tax dollars with Medicaid administrative costs.

One can hope…(but you do not always want what you wish for…because the consequences to our state could be dire if the investigation were broadened and non compliance found).

Possible Ramifications:

Let us quickly contemplate the possible consequences of any of the above-mentioned penalties, whether civil or criminal in nature, on Medicaid recipients.

To the extent that you believe that the reimbursement rates are already too low, that medically necessary services are not being authorized, that limitations to the amount services are being unduly enforced…Imagine that NC lost our federal funding completely. We would lose approximately 60% of our Medicaid budget.

All our “voluntary” Medicaid-covered services would, most likely, be terminated. Personal care services (PCS) is an optional Medicaid-covered service.

With only 40% of our Medicaid budget, I could not imagine that we would have much money left to pay providers for services rendered to Medicaid recipients after paying our hefty administrative costs, including overhead,payroll, vendor contracts, MCO disbursements, etc. We may even be forced to breach our contracts with our vendors for lack of funds, which would cause us to incur additional expenses.

All Medicaid providers could not be paid. Without payments to providers, Medicaid recipients would not receive medically necessary services.

Basically, it would be the next episode of “Fear the Walking Dead.”

Hopefully, because the ramifications of such penalties would be so drastic, the federal government will not impose such sanctions lightly. Sanctions of such magnitude would be a last resort if we simply refused to remedy whatever deficiencies are found.

Otherwise, it could be the zombie apocalypse, but the Lion’s would be forced to share.

Is Health Care Fraud on the Rise? Or Just the Accusations??

Recent stories in the news seem to suggest that health care fraud is running rampant. We’ve got stories about Eric Leak‘s Medicaid agency, Nature’s Reflections, funneling money to pay athletes, a seizure of property in Greensboro for alleged Medicaid fraud, and, in Charlotte, a man was charged with Medicaid fraud and sentenced to three years under court supervision and ordered to pay $3,153,074. And these examples are local.

Health care fraud with even larger amounts of money at stake has been prosecuted in other states. A nonprofit up in NY is accused of defrauding the Medicaid system for over $27 million. Overall, the federal government opened 924 criminal health care fraud investigations last year.

What is going on? Are more people getting into the health care fraud business? Has the government become better at detecting possible health care fraud?

I believe that the answer is that the federal and state governments have determined that it “pays” high dividends to invest in health care fraud investigations. More and more money is being allocated to the fraud investigative divisions. More money, in turn, yields more health care fraud allegations…which yields more convictions….and more money to the government.

Believe me, I understand the importance of detecting fraud. It sickens me that those who actually defraud our Medicaid and Medicare systems are taking medically necessary services away from those who need the services. However, sometimes the net is cast so wide…so far…that innocent providers get caught in the net. And being accused of health care fraud when you innocent is a gruesome, harrowing experience that (1) you hope never happens; and (2) you have to be prepared in case it does. I have seen it happen.

As previously stated, in fiscal year (FY) 2014, the federal government opened 924 new criminal health care fraud investigations. That’s 77 new fraud investigations a month!! This number does not include civil investigations.

In FY 2012, the Department of Justice (DOJ) opened 2,016 new health care fraud investigations (1,131 criminal, 885 civil).

The Justice Department launched 903 new health-care fraud prosecutions in the first eight months of FY 2011, more than all of FY 2010.

These numbers show:

- an 85% increase over FY 2010,

- a 157% increase over FY 2006

- and 822% over FY 1991.

And the 924 investigations opened in fiscal 2014 only represent federal investigations. Concurrently, all 50 states are conducting similar investigations.

What is being recovered? Are the increased efforts to detect health care fraud worth the effort and expenditures?

Heck, yes, it is worth it to both the state and federal governments!

Government teams recovered $4.3 billion in FY 2013 and $19.2 billion over the last five years. While still astronomically high, the numbers dropped slightly for FY 2014. In FY 2014, according to the Annual Report of the Departments of Health and Human Services and Justice, the federal government won or negotiated over $2.3 billion in health care fraud judgments and settlements. Due to these efforts, as well as efforts from preceding years, the federal government retrieved $3.3 billion from health care fraud investigations.

So the federal and state governments are putting more money into investigating health care fraud. Why?

The Affordable Care Act.

Obviously, the federal and state governments conducted health care fraud investigations prior to the ACA. But the implementation of the ACA set new mandates to increase fraud investigations. (Mandates, which were suggestions prior to the ACA).

In 2009, Barack Obama signed Executive Order 13520, which was targeted to reduce improper payments and to eliminate waste in federal programs.

On March 23, 2010, President Obama signed the ACA into law. A major part of the ACA is focused on cost containment methods. Theoretically, the ACA is supposed to be self-funding. Detecting fraud, waste and abuse in the Medicare/Medicaid system helps to fund the ACA.

Unlike many of the other ACA provisions, most of the fraud and abuse provisions went into effect in 2010 or 2011. The ACA increases funding to the Healthcare Fraud and Abuse Control Program by $350 million over the next decade. These funds can be used for fraud and abuse control and for the Medicare Integrity Program.

The ACA mandates states to conduct post payment and prepayment reviews, screen and audit providers, terminate certain providers, and create provider categories of risk.

While recent articles and media seem to indicate that health care fraud is running rampant, the substantial increase in accusations of health care fraud really may be caused by factors other than more fraud is occurring.

The ACA mandates have an impact.

And, quite frankly, the investigation units may be a bit overzealous to recover funds.

What will happen if you are a target of a criminal health care fraud investigation?

It depends whether the federal or state government is conducting the investigation.

If the federal government is investigating you, most likely, you will be unaware of the investigation. Then, one day, agents of the federal government will come to your office and seize all property deemed related to the alleged fraud. Your accounts will be frozen. Whether you are guilty or not will not matter. What will matter is you will need an experienced, knowledgeable health fraud attorney and the funds with which to compensate said attorney with frozen accounts.

If the state government is conducting the investigation, it is a little less hostile and CSI-ish. Your reimbursements will be suspended with or without your notice (obviously, you would notice the suspension once the suspension occurred). But the whole “raid on your office thing” is less likely.

There are legal remedies available, and the “defense” should begin immediately.

Most importantly, if you are a health care provider and you are not committing fraud, you are not safe from accusations of fraud.

Your insurance, most likely, will not cover attorneys’ fees for alleged intention fraud.

The attorney of your choice will not be able to accept funds that are “tainted” by alleged fraud, even if no fraud occurred.

Be aware that if, for whatever reason, you are accused, you will need to be prepared…for what you hope never happens.

The Medicaid Investigations Division: Facing the Department of Justice’s Fraud Unit

Blog post written by Camden Webb, guest blogger and partner at Williams Mullen. (He is also the attorney that filed the NCTracks lawsuit with me).

It’s a heart-stopping moment, but it happens regularly: A Medicaid provider, who never had any problems with the State of North Carolina, receives a letter from the North Carolina Attorney General’s Medicaid Investigations Division, or “MID”, informing her that she is the subject of an investigation of Medicaid billing practices. The MID’s core mission is to investigate and prosecute health care fraud committed by Medicaid providers. If you receive a letter from MID, it is an extremely serious matter and can instantly change everything you. You need to know what MID is, how you might become the subject of an investigation, and what to do if you are.

What is MID? MID is a subdivision of the North Carolina Department of Justice that is tasked primarily with investigating Medicaid fraud. MID has two main divisions, civil and criminal. The civil division investigates cases in which a provider may have made a false statement in order to obtain reimbursement payments. The civil division uses special powers granted by the North Carolina False Claims Act to investigate providers, determine if there is enough evidence to show a false statement resulting in reimbursement payments from Medicaid, and thereafter file a civil lawsuit to recover the money.

MID’s criminal division employs prosecutors whose job is to investigate, file criminal charges against, and convict providers who have intentionally and willfully obtained reimbursement payments under false pretenses. The MID website itself describes Medicaid fraud to include circumstances in which providers intentionally bill Medicaid for services not actually provided, use an improper procedure code to bill for a higher priced service when a lower priced service was provided, bill for non-covered services by describing the services as covered services, misrepresent a patient’s diagnosis and symptoms and bill Medicaid for a service that is medically unnecessary, or falsifies medical records. Any such acts could result in criminal prosecution.

As a responsible Medicaid provider, you might conclude that you would never have to worry about an MID investigation. After all, MID is tasked with investigating fraud, and the vast majority of providers honestly and lawfully provide services and submit reimbursement requests for those services. However, the new reality in Medicaid is that many honest providers can and do find themselves dealing with an MID investigation. A prime example, which happens frequently, is when DHHS finds a “credible allegation of fraud” regarding the provider. One would conclude that a “credible allegation of fraud” would be limited to hard evidence that a provider intentionally obtained reimbursements based on false information or some other bad act. However, the Medicaid regulations define a “credible allegation of fraud” to include the results of claims data mining. In other words, a “credible allegation of fraud” can be based simply on a computer analysis of a provider’s billings to Medicaid, and this has indeed been the basis of DHHS’ referral of cases to MID for investigation. For this reason, a number of honest providers have indeed found themselves the subject of an MID investigation, having to contend with the difficulty that such an investigation brings.

There are several key things that providers must know about an MID investigation. If you find yourself the subject of such an investigation, keep the following in mind:

• The first and most important: get a lawyer. The stakes in an MID investigation are extremely high, to include the potential for conviction of a crime. Proceeding without advice of counsel is very risky. Everyone who is subject of an investigation has substantial and important rights, but it takes an expert in this area of the law (and not necessarily me or my firm) to competently advise someone who is the subject of an MID investigation.

• Always remember that the State’s investigators and lawyers only work for the State. MID is staffed with competent, dedicated investigators and attorneys, and my dealings with them show that they are straightforward people. However, their job is to investigate fraud, and if you are the subject of an investigation, they have received information indicating that you may have committed fraud. You therefore should exercise caution when speaking with them, you are under no obligation to answer questions, and you certainly are under no such obligation without first hiring an attorney.

• Ensure that all your records are properly preserved. Part of MID’s investigation will certainly be a request to inspect and copy your records related to Medicaid billing, such as patient files, employee timesheets, records relating to claims submissions, and contracts with service providers. Any loss of such records will have to be explained, and if a loss occurs after a provider has received notice of an investigation, the provider could be accused of having destroyed records. It is therefore crucial that you preserve your records, both the ones on paper and the electronic data containing relevant information.

• Do not discuss the investigation or your Medicaid billing practices with anyone except your lawyer. Because you are the subject of an investigation that is based on information that may indicate you committed fraud, you must be careful about what you say. If you discuss matters with anyone but your lawyer, those persons could be compelled to testify about what you said, and it is not uncommon for someone to misquote, misunderstand, or otherwise misreport what someone has said. Speaking only with your lawyer is the safest course.

• Finally, be patient with the process. Being the subject of an MID investigation is stressful and frustrating, but MID currently is backlogged with a huge number of cases. This means that it will take time for the investigation to conclude. Expert counsel can help you through this process, but recognize that it will take a long time for it to conclude.

Because of PCG Audit, New Mexico Freezes Mental Health Services!

Last week, I was busy working in my office when a woman named Shawn called me. The area code showing on my caller ID was definitely NOT from North Carolina. Turns out Shawn lives in New Mexico.

Pop Quiz: (For those of you who have been with me for a while): What is similar between New Mexico and North Carolina Medicaid? Answer: Public Consulting Group (PCG).

Remember my blog, “New Mexico and NC: Fraternal Twins?”

Seems that the bloopers surrounding PCG do not only lie within the state border of NC.

Oh, no! PCG is much more far-reaching than just NC.

Hence, Shawn calling me up to fly to New Mexico to speak to the New Mexico State legislature about PCG in NC. And, perhaps, how Medicaid providers can defend themselves (maybe without me since I do not have my NM law license, although I am sure I could pro hac in).

So what was I supposed to say to a bunch of state legislatures? Why would they even care what I have to say?

I ask Shawn this.

New Mexico has frozen mental health services for Medicaid recipients?

Can you imagine? What has happened to the New Mexico Medicaid recipients who need mental health services?

And this mental health services freeze is based on an audit conducted by Public Consulting Group? Are you kidding? The same company that stated that my client owed $706,000+ Medicaid reimbursement overpayment, yet, after legal arguments, DHHS held that my client only owed $336????

THAT COMPANY????

So, here I am, flying to New Mexico… I am on a plane (obviously, coach) squished into a window seat, unable to straighten my legs, typing this, thinking that allowing me only one cup of water over a 3 hour trip constitutes cruel and unusual punishment, all to explain to NM legislators the ineptness of PCG.

Worth it?

Heck, yes, if my message does not all on deaf ears. I will keep you posted.

“Dr. Fata and His Shadow:” Fata’s Attempt at Multiple Medicare Bones Results in Zero

Recently a Michigan physician was arrested for committing over $35 million in Medicare fraud. (Probably some Medicaid fraud too, but Medicaid payments have not been reviewed). I have always said in this blog that I am against fraud. When someone is committing Medicare or Medicaid fraud, I say, prosecute to the highest degree allowable by law!

Here is one of many articles: link.

Providers who commit fraud are making good providers undergo harassing audits, harsh recoupments, and needless attorneys’ fees to fight the injustices.

Dear DHHS, This (the below-referenced story) is what Medicare/caid fraud looks like. It is obvious. It is disgusting. Fraud is NOT forgetting to date a service note. Fraud is NOT inadvertently inserting the incorrect billing code. Stop focusing on documentation nit-picking and find the REAL fraud! From, Me.

But, this Michigan physician…of all the possible fraudulent Medicare/Medicaid schemes….this man takes the cake.

Dr. Farid Fata, an oncologist, falsely diagnosed people WITHOUT cancer (healthy adults) as having cancer, subjecting these healthy adults to chemotherapy, and reaping the monetary benefit of expensive procedures. In my mind, Dr. Farid Fata should spend the rest of his life behind bars. And, if possible, throw a little radiation in his cell every now and then.

If greed is the inordinate desire to possess wealth far beyond the dictates of basic survival and comfort and to the detriment of anyone else, Dr. Farat exemplifies greed.

Remember the moral: “It is not wise to be too greedy.” –Aesop.

This moral comes from “A Dog and its Shadow,” in which a dog crosses over a river with a bone in his mouth. He sees his own shadow in the water, but shadow’s bone is twice the size of the bone in his mouth. (Obviously, an optical illusion). In an effort to snatch the bigger bone, the dog lets go of his own bone, and attacks the other dog (shadow), to get the bigger bone. The dog loses both bones – the shadow-bone, because it is a shadow; and his own, because the stream sweeps it away.

Dr. Fata wanted his own bone, as well as any other bone he could possibly swipe.

In the meantime, Dr. Fata, in complete opposition of his Hippocratic Oath, injured hundreds of patients by subjecting them to unnecessary treatments.

In the end, Dr. Fata loses all bones.

What treatments did Dr. Farat perform?

- Chemotherapy treatments to healthy adults;

- Positron Emission Tomograph (PET) scans and a variety of cancer and hematology treatments for patients who did not need them;

- The administration of unnecessary chemotherapy to patients in remission;

- Deliberate misdiagnosis of patients as having cancer to justify unnecessary cancer treatment;

- Administration of chemotherapy to end-of-life patients who will not benefit from the treatment;

- Deliberate misdiagnosis of patients without cancer to justify expensive testing;

- Fabrication of other diagnoses such as anemia and fatigue to justify unnecessary hematology treatments; and

- Distribution of controlled substances to patients without medical necessity or are administered at dangerous levels.

Prosecutors say Fata was motivated by money, billing Medicare for false claims, all the while, living here:

That is quite a bone!!!!

Dr. Fata faced a federal magistrate. He was arraigned Monday on a federal health care fraud indictment. Dr. Fata is being held at Wayne County Jail on a $9 million bond.

Dr. Fata became a naturalized American citizen in 2009. He was a prominent oncologist. Dr. Fata could very well had done well in his life with his wife with his own bones that collected. Apparently, an oncologist-sized bone was not good enough for Dr. Fata. Oh no, he wanted his oncologist-sized bone SUPER-SIZED.

And super-sized he will get! He faces:

- 20 years in jail;

- Deportation (if any crimes occurred prior to 2009);

- Possible bankruptcy;

- Possible fines

- Loss of his medical license;

- Potential loss of family (If my husband intentionally committed these acts, I doubt I could ever stay with him…of course, my husband never would!!!)

- Inevitable civil suits (If Dr. Fata diagnosed my with cancer and I discovered he purposely diagnosed me with a terminal disease to benefit monetarily….a very, large civil lawsuit would be filed immediately. In fact, I am sure plaintiffs’ lawyers all over are salivating).

Yet, personally, I do not think the 20 years, even including all the incidental consequences, is enough punishment. Think of the people who believed they suffered from cancer, underwent chemo, became ill (when they would otherwise have been healthy)…

The Italian poet, Durante degli Alighieri, simply referred to as “Dante,” in “Purgatory,” reserved the fourth circle of Purgatory for the greedy. Also, some of the greedy were bound and laid face down on the ground for having concentrated too much on earthly thoughts.

In my mind, 20 years is not nearly long enough for Dr. Fata.

Maybe, as Dante wrote, Dr. Fata should be bound and laid face down for 20 years. Or, perhaps, he should be forced to undergo years of chemotherapy…one year for every healthy adult he forced to undergo unneccessary chemotherapy.