Monthly Archives: March 2016

Pac-Man Is Gobbling Up the Health Care World: Know Who To Call!

As many of you know, the health care provider world in North Carolina, and throughout the USA, is changing rapidly. Smaller providers are getting absorbed by bigger providers at an increasingly rapid pace. Some of those small providers cannot survive alone without the financial backing of a larger provider.

It reminds me of the Atari game of my childhood, “Pac-Man.” I am sure that all my readers remember playing Pac-Man as a youth or their children playing Pac-Man. If not, you are surely too young to understand this blog.

Pac-Man (or Ms. Pac-Man, in 1982, two years after Pac-Man was released) would gobble, gobble, gobble, gobble up pellets and try to avoid the super scary ghosts, which tried to eat Ms./Mr. Pac-Man. Once Pac-Man consumed all the pellets, you advanced to the next level.

While this analogy is wildly simplistic as an analogy for the current situation in health care in North Carolina and throughout the USA, I find the analogy fitting. Think of the super scary ghosts (Inky, Blinky, Pinky, and Clyde) as…well…certain providers that you should avoid absorbing…or, hence, get eaten alive.

The point of the health care market today is to eat as many pellets as possible without being eaten by Inky, Pinky, Blinky, or Clyde.

I have blogged about this “Brave New World” of health care providers merging, selling, and consolidating previously (you have to love Aldous Huxley). See blog. And blog.

However, I have never provided you with an actual contact with whom you may correspond to explore merger, acquisition, and partnership ventures.

But guess what…for those of you who have continued to read, despite my simplistic analogy, here comes the contact information.

First, the required law disclosure: This is a personal endorsement. There is no guarantee of outcome. My recommendation is not being made on behalf of my law firm, Gordon & Rees, although Mr. Rodgers’ company, see below, is a client of the firm.

So when you are contemplating who to call, my recommendation is Gene Rodgers! ‘Cause he ain’t afraid of no ghosts!!

Meet Gene Rodgers. His company, Community Based Care, is interested in acquiring health care providers in North Carolina, as well as the rest of country. See below:

Gene Rodgers, Community Based Care

grodgers@cbcarellc.com

New Federal Legislation Proposed to Increase Due Process for Health Care Providers!

Every once in a blue moon, I am actually happy with the actions of our government. One of these rare occasions occurred on March 17, 2016. Happy St. Patty’s Day!

On March 17, 2016, Senior Senator John Thune from South Dakota introduced S.2736: A bill to require consideration of the impact on beneficiary access to care and to enhance due process protections in procedures for suspending payments to Medicaid providers.

How many times have I blogged about the nonexistence of due process for Medicaid providers??? I cannot even count. (Well,I probably could count, but it take quite some time). My readers know that I have been complaining for years that the federal regulations consider Medicaid provider guilty until proven innocent. See blog. And blog.

Well, finally, someone in Congress has taken notice.What is really cool is that my team at my law firm Gordon & Rees was asked to provide some input for this bill…pretty cool! Although I have to say, everything that we proposed is not included in the proposed bill. Apparently, some of our suggestions were too “pro provider” and “didn’t stand a chance to be passed.” Who would have thought? Baby steps, I was informed.

The bill, if enacted, would require the Secretary of Health and Human Services (HHS) to revise the Code of Federal Regulations, specifically the Title 42 of the CFR.

Currently, 42 CFR 455.23 reads: “the State Medicaid agency must suspend all Medicaid payments to a provider after the agency determines there is a credible allegation of fraud for which an investigation is pending under the Medicaid program against an individual or entity unless the agency has good cause to not suspend payments or to suspend payment only in part.” (emphasis added). Rarely has a state agency found “good cause” to not suspend payments. In fact, quite the opposite. I have seen state agencies use this regulation harshly and with intent to put providers out of business.

S.2736 would revise the above-mentioned language and require that a state agency take certain steps to ensure due process for the provider prior to implementing a suspension in payments.

Prior to implementing a payment suspension, this proposed bill would require the state agency to:

- Consult with the Medicaid fraud unit for the state and receive written confirmation of such a consultation; and

- Certify that the agency considered whether beneficiary access would be jeopardized or whether good cause exists, in whole or in part (according to the new, proposed manner of determining good cause)

We all know that the above bullet points supply more protection than we have now.

Furthermore, there are protections on the back end.

After a suspension is implemented, at the beginning of each fiscal quarter, the state Medicaid agency must:

- certify to the Secretary that it has considered whether the suspension of payments should be terminated or modified due to good cause (as modified by S.2736); and

- if no good cause is found, furnish to the provider the reasons for such determination.

S.2736 allow requires the agency to disclose the specific allegations of fraud that is being investigated (after a reasonable amount of time) and to evaluate every 180 days whether good cause exists to lift the suspension. Regardless, good cause not to continue the suspension will be deemed to exist after 18 months (with some other qualifying details).

According to a government track website, this bill has a 8% chance of getting past committee. And a 3% chance of being enacted.

The stats on all bills’ “pass-ability,” is that only 15% of bills made it past committee and only about 3% were enacted in 2013–2015.

So call your Congressman or woman! Support S.2736! It’s not perfect, but it’s better!!!

The Merger of the MCOs!

Breaking News: From DHHS

Raleigh, NC

State health officials announced today that the state- and Medicaid-funded Local Management Entities/Managed Care Organizations providing mental health, intellectual and developmental disability and substance use services to North Carolina citizens will be consolidating into four service regions across the state.

Further consolidation will improve quality of services, accessibility, accountability and long-term sustainability.

“I’m a strong believer in LME/MCOs,” said Rick Brajer, Secretary of the Department of Health and Human Services. “These populations deserve dedicated management.”

The newly consolidated service areas are:

- North Central Region: CenterPoint Human Services and Cardinal Innovations Healthcare Solutions will be merging

- South Central Region: Sandhills Center and Alliance Behavioral Healthcare will be merging

- Eastern Region: Eastpointe and Trillium Health Resources will be merging

- Western Region: Partners Behavioral Health Management and Smoky Mountain LME/MCO will be merging

Medicare Appeal Backlog: Tough Tooties!…Unless…[Think Outside the Box!]

When you are accused of a $12 million dollar overpayment by Medicare, obviously, you appeal it.But do you expect that appeal to take ten years or longer? Are such long, wait periods allowed by law? That is what Cumberland Community Hospital System, Inc. (Cape Fear) discovered in a 4th Circuit Court of Appeals Decision, on March 7, 2016, denying a Writ of Mandamus from the Court and refusing to order the Secretary of Health and Human Services (HHS) Burwell to immediately adjudicate Cape Fear’s Medicare appeals to be heard within the Congressional requirement that appeals be heard and decided by Administrative Law Judges (ALJs) within 90 days.

According to the Center for Medicare and Medicaid Services‘ (CMS) website, an “ALJ will generally issue a decision within 90 days of receipt of the hearing request. Again, according to CMS’ website, this time frame may be extended for a variety of reasons including, but not limited to:

- The case being escalated from the reconsideration level

- The submission of additional evidence not included with the hearing request

- The request for an in-person hearing

- The appellant’s failure to send a notice of the hearing request to other parties

- The initiation of discovery if CMS is a party.”

In Cape Fear’s case, the Secretary admitted that the Medicare appeal backlog equates to more than 800,000 claims and would, likely, take over 10 years to adjudicate all the claims. Even the 4th Circuit Court, which, ultimately, dismissed Cape Fear’s complaint, agrees with Cape Fear and calls the Medicare appeal backlog “incontrovertibly grotesque.”

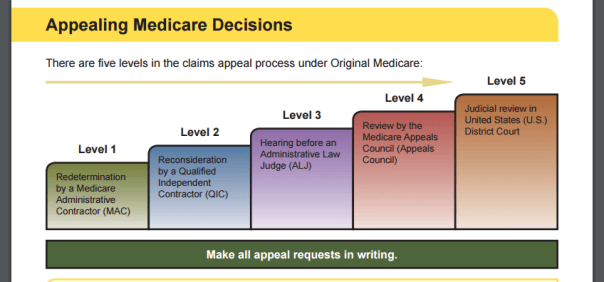

Generally, the rule is that if the ALJ does not render a decision after 180 days of the filing of the case, then the provider has the right to escalate the case to the Medicare Appeals Council, which is the 4th step of a Medicare appeal. See blog for more details on the appeal process.

What about after 3,650 days? Get a big pie in the face?

The United States Code is even less vague than CMS’ website. Without question 42 U.S.C. states that for a:

“(1)Hearing by administrative law judge; (A)In general

Except as provided in subparagraph (B), an administrative law judge shall conduct and conclude a hearing on a decision of a qualified independent contractor under subsection (c) of this section and render a decision on such hearing by not later than the end of the 90-day period beginning on the date a request for hearing has been timely filed.”

(emphasis added). And, BTW, subsection (B) is irrelevant here. It contemplates when a party moves for or stipulates to an extension past the 90-day period.

So why did Cape Fear lose? How could the hospital lose when federal administrative code specifically spells out mandatory 90-day limit for a decision by an ALJ? Ever heard of a statute with no teeth? [i.e., HIPAA].

No one will be surprised to read that I have my opinions. First, a writ of mandamus was not the legal weapon to wield. It is an antiquated legal theory that rarely makes itself useful in modern law. I remember the one and only time I filed a writ of mandamus in state court in an attempt to hold a State Agency liable for willfully violating a Court’s Order. I appeared before the judge, who asked me, “Do you know how long I have been on this bench?” To which I responded, “Yes, Your Honor, you have been on the bench for X number of years.” He said, “Do you know how many times I have granted a writ of mandamus?” I said, “No, Your Honor.” “Zero,” he said, “Zero.” The point is that writs of mandamus are rare. A party must prove to the court that he/she has a clear and indisputable right to what is being asked of the court.

Secondly, in my mind, Cape Fear made a disastrous mistake in arguing that it has a clear right for its Medicare appeals to be adjudicated immediately. Think about it…there are 800,000+ Medicare appeals pending before the ALJs. What judge would ever order the administrative court to immediately drop all other 799,250 pended claims (Cape Fear had 750 claims pending) and to adjudicate only Cape Fear’s claims? It is the classic slippery slope…if you do this for Cape Fear, then you need to order the same for the rest of the pended claims.

In this instance, it appears that Cape Fear requested too drastic a measure for a federal judge to order. The claims were doomed from the beginning.

However, I cannot fault Cape Fear for trying since the code is crystal clear in requiring a 90-day turnaround time. The question becomes…what is the proper remedy for a gross disregard, even if unwillful, of the 90-day turnaround period?

This would have taken thinking outside the box.

Medicare providers have some rights. I discuss those rights frequently on this blog. But the population that the courts inevitably want to insulate from “David and Goliath situations” are the recipients. Unlike the perceived, “big, strong, and well-attorneyed” hospital, recipients often find themselves lacking legal representation to defend their statutorily-given right to choose their provider and exercise their right to access to care.

Had Cape Fear approached the same problem from a different perspective and argued violations of law on behalf of the beneficiaries of Cape Fear’s quality health care services, a different result may have occurred.

Another way Cape Fear could have approached the same problem, could have been a request for the Court to Cape Fear’s funds owed for service rendered to be released pending the litigation.

As always, there is more than one way to skin a cat. I humbly suggest that when you have such an important case to bring…BRING IT ALL!!

CMS Ramps Up Medicare Audits: A Pig and Pony Show?

Monday, February 22, 2016, The Centers for Medicare and Medicaid Services (CMS) announced that it plans to increase onsite visits and monitoring of health care providers. One of the top priorities for CMS is to verify that provider enrollment and address are correct…

Because, as you know, providers with correct addresses on file are less likely to commit Medicare fraud. Medicare Fraud 101 – Give CMS the wrong address. Really? (While I applaud their valiant effort, the fraud that I have witnessed has not been a health care provider using a fake address to provide fake services…that is too Ponzi, too shallow in thought…too easily detected. Oh no, the fraud I have encountered were providers with actual practices with correct addresses, but embellishing on the amount of services provided to an actual Medicare enrollee to cushion their pockets. This is much more difficult to detect.

But CMS has its reasons for sniffing out fake addresses. CMS’ address hunt-down comes on the heels of a report from June 2015 out of the Government Accountability Office (GAO), which determined that approximately 22% of Medicare provider addresses are “potentially ineligible.” Additionally, last March (2015) CMS decreased the amount of audits conducted by Medicare Administrative Contractors (MACs), which are one of the entities that investigate Medicare provider eligibility.

Whenever the GAO finds potential errors, CMS usually puts on the whole dog and pony show…or, maybe, for a change, a pig and pony show…

With all these political talks about donkeys and elephants, I would like to take a moment and blog about a pig. Some of you know that I own a pet pig. She is 4 1/2 years old and about 30 pounds. See below.

Isn’t she cute?! Some of you will remember my last blog about Oink was “Our Medicaid Budget: Are We Just Putting Lipstick on a Pig?”

The reason I bring up Oink is that she is the smartest, most animated animal I have ever encountered. She is also the best “sniffer-outer” I have ever encountered. Her keen sense of smell is well beyond any human’s sense of smell. If you liken Oink to CMS and Medicare fraud to a Skittle, the Skittle would have no chance.

These upcoming and increased number of audits is CMS’ way of sniffing out fraud. However, CMS’ sense of smell is not up to snuff like Oink’s sense of smell.

Searching for erroneous addresses in order to detect fraud, waste, and abuse (FWA) will, inevitably, be over-inclusive. Meaning, many of the erroneous addresses will not be committing Medicare fraud. Some erroneous addresses exist because providers simply moved to another location and either failed to inform CMS or CMS’ database was not updated with the new address. Other erroneous addresses exist because health care providers went out of business and never informed CMS. A new company leases the property and it appears to CMS that fraudulent billing was occurring a couple years ago out of, for example, what is now a Jimmy John’s.

Searching for erroneous addresses in order to detect FWA will, inevitably, be under-inclusive. Meaning, that many providers committing Medicare fraud do so with accurate office addresses.

My contention is that if you want to find FWA, you need to dig deeper than an incorrect address. Sniffing out Medicare fraud is a bit more in depth than finding improper addresses. That would be like tossing handfuls of Skittles on the ground and expecting Oink to only find the green ones.

In fiscal year 2014, Medicare paid $554 billion for health care and related services. CMS estimates that $60 billion (about 10 percent) of that total was paid improperly (not only because of incorrect addresses).

CMS is responsible for developing provider and supplier enrollment procedures to help safeguard the program from FWA. CMS contracts with Medicare Administrative Contractors (MACs) and the National Supplier Clearinghouse (NSCs) to manage the enrollment process. MACs are responsible for verifying provider and supplier application information in Provider Enrollment, Chain and Ownership System (PECOS) before the providers and suppliers are permitted to enroll into Medicare. CMS currently contracts with 12 MACs, each of which is responsible for its own geographic region, known as a “jurisdiction.

As you can see, we live in Jurisdiction 11. These MACs act as the “sniffer-outers” for CMS.

According to the GAO June 2015 report, about 23,400 (22 percent) of the 105,234 addresses that GAO initially identified as a Commercial Mail Receiving Agency (CMRA), vacant, or invalid address are potentially ineligible for Medicare providers and suppliers. “About 300 of the addresses were CMRAs, 3,200 were vacant properties, and 19,900 were invalid. Of the 23,400 potentially ineligible addresses, [GAO] estimates that, from 2005 to 2013, about 17,900 had no claims associated with the address, 2,900 were associated with providers that had claims that were less than $500,000, and 2,600 were associated with providers that had claims that were $500,000 or more per address.”

In other words, out of 105,234 addresses, only 2,600 actively billed Medicare for over $500,000 from 2005 through 2013 (8 years). Had CMS narrowed the scope and looked at practices that billed over $500,000 since 2010, I fancy the the number would have been much lower, because, as discussed above, many of these providers either moved or went out-of-business.

Now, 2,600 is not a nominal number. I am in no way undermining CMS’ efforts to determine the accuracy of providers’ addresses; I am not insinuating that these efforts are unnecessary or a complete waste of time. I think verification of health care providers’ addresses is an important aspect of detecting FWA. Instead, I believe that, as discussed above, verifying providers’ addresses is a poor, under and over-inclusive attempt at searching for FWA. Because, as I stated at the beginning of this blog, the people who are intentionally trying to defraud the system, are not going to intentionally give an erroneous address. It is just too easy for the government to discover the error. No, the people who are intentionally defrauding the state will have a legitimate office.

For example, in my opinion, it is unlikely that anyone intentionally trying to defraud the system will inform the government that they provide health care services from the following places:

Again, if I liken CMS’ search for FWA by detecting inaccurate addresses to Oink, it would be like tossing a handful of Skittles on the ground and expecting Oink to only find the green ones.

If CMS audits are to Oink as fraud is to Skittles, then I think there is a less intrusive, less inclusive way to detect FWA rather than throwing out packets of Skittles for Oink. All that does is make Oink eat too much.

If you are one of the Medicare providers that get caught into CMS’ widely thrown net, be sure to know your rights! Know the appeal steps!

When is sales tax due on your DME-related sales and services? The North Carolina Business Court Weighs In.

Feeling Great, Inc. v. North Carolina Department of Revenue

By Robert Shaw, Partner at Gordon & Rees

Sales tax compliance may not be the reason you are in business, but consequences can be very serious if you fail to collect and remit sales taxes on a taxable transaction. Durable medical equipment suppliers (DME) should take note of a recent decision by the North Carolina Business Court in which the DME supplier (at least according to the Court) erroneously thought that certain DME sales were exempt from use tax.

In Feeling Great, Inc. v. North Carolina Department of Revenue, 2015 NCBC 81 (N.C. Business Ct. Aug. 20, 2015), the DME suppliers did not collect and remit use tax to the Department of Revenue on the basis that the purchases at issue (medical supplies used in sleep study testing) were exempt from sales and use tax under N.C. Gen. Stat. 105-164.13(12)d. That statute provides that sales of “[d]urable medical supplies sold on prescription” are exempt from sales tax. Seems straightforward, right?

The Department of Revenue, however, issued a tax assessment for sales of supplies used in sleep study testing in connection with a diagnostic sleep system machine. The sleep studies were covered by Medicare or Medicaid and were not part of the tax assessment. It was the supplies used with the sleep studies, such as cleaner, sensors, gauze tape, Q-Tips, and the like, that the Department took issue with because the physicians’ prescriptions did not specifically mention the supplies as having been prescribed, only the sleep studies!

Feeling Great’s problem was that the prescriptions did not specifically refer to “supplies” associated with the sleep studies. Instead, the physician only “prescribed sleep study testing for the patient.” Had the prescription included “all supplies as needed” in the description, the court implied that the result would have been different: sales of such supplies would have been “on prescription” and therefore exempt from sales tax.

Feeling Great’s many arguments to the contrary, including that “Medicaid routinely authorizes the purchase of durable medical equipment and associated ‘supplies’ under a single prescription” (which the administrative law judge had found), were not accepted by the Business Court.

It may seem odd to distinguish between a prescription that prescribes sleep study testing and a prescription that prescribes sleep study testing as well as needed supplies for the machine, but it is the distinction that caused a significant sales tax assessment for the taxpayer in this case. DME suppliers should carefully review the prescriptions and be mindful of the Department’s position when collecting sales and use tax.