Category Archives: Self-Audits

There Is No Law to Be Perfect in Medicare; Just Self-Disclose!

We all know that there is no law, regulation or statute that medical records supporting payment by Medicare or Medicaid must be perfect. There is no mandatory 100% compliant standard. Because humans err. In light of the ongoing financial strain brought about by the pandemic and the constraints imposed by Congress on Medicaid coverage disenrollments, State Medicaid agencies are poised to explore additional audits to manage increasing Medicaid expenditures. Recent developments, such as additional flexibilities granted by CMS, suggest a shifting landscape in how States respond to these challenges.

Anticipating a more assertive approach by States in dealing with service providers, potential measures could include rate cuts and enhanced scrutiny through service audits. This prompts a crucial examination of States’ and providers’ rights under federal Medicaid law to audit service provisions and recover overpayments, a legally intricate and noteworthy domain.

Medicaid RAC Audits are governed by 42 CFR 455 Subpart F—Medicaid Recovery Audit Contractors Program. Other Medicaid alleged overpayments are dictated by 42 CFR Chapter 433.

To establish a foundational understanding, it’s essential to consider the mandate imposed by Congress in section 1902(a)(30)(A) of the Social Security Act. States are required to incorporate provisions in their Medicaid plans to “safeguard against unnecessary utilization of … care and services.” This underscores the federal interest in ensuring responsible use of matching funds, given the federal government’s financial contribution to the program.

A landmark case illustrating the complexities of this mandate is the 1999 decision by the Supreme Judicial Court of Massachusetts in Massachusetts Eye and Ear Infirmary v. Commissioner of Medical Assistance. The court evaluated Massachusetts Medicaid’s retrospective utilization review policy, emphasizing the need for meaningful definitions of terms like “inpatient” and “outpatient” to avoid arbitrary penalties on providers.

Moving to the realm of overpayments, CMS regulations, specifically at 42 C.F.R. § 433.316, provide guidance on how States should proceed when identifying overpayments. The regulations recommend written notification to providers, with states having the discretion to choose whether to notify in cases of suspected fraud. Furthermore, States are required to take “reasonable actions” based on state collections law to recoup overpayments, with a one-year timeframe to return the federal share of identified overpayments to CMS.

Determining when a State “discovers” an overpayment is a critical aspect outlined in the regulations. The discovery is pegged to specific events, such as the state contacting the provider, the provider notifying the state, formal initiation of recoupment, or a federal official identifying the overpayment. Significantly, the regulations focus more on CMS’s relationship with the state than on the state’s relationship with providers.

Recent legal precedents, such as the Wisconsin Supreme Court’s decision in Professional Home Care Providers v. Wisconsin Department of Health Services, underscore the need for states to operate within the bounds of their granted authority. In this case, the court rejected a Medicaid agency’s “perfection” policy, emphasizing that state law must align with CMS regulations in overseeing overpayment recovery.

As States grapple with revenue shortfalls exacerbated by the pandemic, the potential for increased efforts to recoup overpayments from providers looms large. Legal challenges, exemplified by recent decisions in Massachusetts and Wisconsin, underscore the delicate balance States must strike in these endeavors, emphasizing the limits within which they must operate as they navigate the complex terrain of Medicaid law and financial constraints.

Expect audits. Be ready to defend yourself. Self audits are so important. If you self audit and find a problem and self-disclose, you will not receive penalties. Self-disclosures are key. When I told a group of law students this key information, one asked, has you told a client to self-disclose and they refused? To which I said yes. One time. A female doctor informed me that she falsified 7 medical records, I said that she should disclose. She screamed at me in her language, fired me, and hired a new attorney and withheld the information about falsifying records.

She is jail currently.

“Reverse RAC Audits”: Increase Revenue by Protecting Your Consumers

Today I want to talk about two ways to increase revenue merely by ensuring that your patients’ rights are met. We talk about providers being audited for their claims being regulatory compliant, but how about self-audits to increase your revenue? I like these kind of audits! I am calling these audits “Reverse RAC audits”. Let’s bring money in instead of reimbursements recouped.

You can protect yourself as a provider and increase revenue by remembering and litigating on behalf of your consumers’ rights. Plus, your patients will be eternally grateful for your advocacy. It is a win/win. The following are two, distinct ways to increase revenue and protect your consumers’ rights:

- Ensuring freedom of choice of provider; and

- Appealing denials on behalf of your consumers.

Freedom of choice of provider.

In a federal case in Indiana, we won an injunction based on the patients’ rights to access to care.

42 CFR § 431.51 – Free choice of providers states that “(b) State plan requirements. A State plan must provide as follows…:

(1) A beneficiary may obtain Medicaid services from any institution, agency, pharmacy, person, or organization that is –

(i) Qualified to furnish the services; and

(ii) Willing to furnish them to that particular beneficiary.

In Bader v. Wernert, MD, we successfully obtained an injunction enjoining the State of Indiana from terminating a health care facility. We sued on behalf of a geneticist – Dr. Bader – whose facility’s contract was terminated from the Medicaid program for cause. We sued Dr. Wernert in his official capacity as Secretary of the Indiana Family and Social Services Administration. Through litigation, we saved the facility’s Medicaid contract from being terminated based on the rights of the consumers. The consumers’ rights can come to the aid of the provider.

Keep in mind that some States’ Waivers for Medicaid include exceptions and limitations to the qualified and willing provider standard. There are also limits to waiving the freedom of choice of provider, as well.

Appealing consumers’ denials.

This is kind of a reverse RAC Audit. This is an easy way to increase revenue.

Under 42 CFR § 405.910 – Appointed representatives, a provider of services may appeal on behalf of the consumers. If you appeal on behalf of your consumers, the obvious benefit is that you could get reimbursed for the services rendered that were denied. You cannot charge a fee for the service; however, so please keep this in mind.

One of my clients currently has hired my team appealing all denials that are still viable under the statute of limitations. There are literally hundreds of denials.

Over the past few years, they had hundreds of consumers’ coverage get denied for one reason or the other. Allegedly not medically necessary or provider’s trainings weren’t conveyed to the auditors. In other words, most of the denials are egregiously wrong. Others are closer to call. Regardless these funds were all a huge lump of accounts’ receivables that was weighing down the accounting books.

Now, with the help of my team, little by little, claim by claim, we are chipping away at that accounts’ receivables. The receivables are decreasing just by appealing the consumers’ denials.

Medicare/caid Fraud, Tattletails, and How To Self Disclose

On July 13, 2017, Attorney General Jeff Sessions and Department of Health and Human Services (HHS) Secretary Tom Price, M.D., announced the Department of Justice’s (DOJ) biggest-ever health care fraud takedown. 412 health care providers were charged with health care fraud. In total, allegedly, the 412 providers schemed and received $1.3 billion in false billings to Medicare, Medicaid, and TRICARE. Of the 412 defendants, 115 are physicians, nurses, and other licensed medical professionals. Additionally, HHS has begun the suspension process against 295 health care providers’ licenses.

The charges include allegations of billing for medically unnecessary treatments or services that were not really provided. The DOJ has evidence that many of the defendants had illegal kickback schemes set up. More than 120 of the defendants were charged with unlawfully or inappropriately prescribing and distributing opioids and other narcotics.

While this particular sting operation resulted from government investigations, not all health care fraud is discovered through government investigation. A great deal of fraud is uncovered through private citizens coming forward with incriminating information. These private citizens can file suit against the fraudulent parties on behalf of the government; these are known as qui tam suits.

Being a whistleblower goes against what most of us are taught as children. We are taught not to be a tattletail. I have vivid memories from elementary school of other kids acting out, but I would remain silent and not inform the teacher. But in the health care world, tattletails are becoming much more common – and they make money for blowing that metaphoric whistle.

What is a qui tam lawsuit?

Qui tam is Latin for “who as well.” Qui tam lawsuits are a type of civil lawsuit whistleblowers (tattletails) bring under the False Claims Act, a law that rewards whistleblowers if their qui tam cases recover funds for the government. Qui tam cases are a powerful weapon against Medicare and Medicaid fraud. In other words, if an employee at a health care facility witnesses any type of health care fraud, even if the alleged fraud is unknown to the provider, that employee can hire an attorney to file a qui tam lawsuit to recover money on behalf of the government. The government investigates the allegations of fraud and decides whether it will join the lawsuit. Health care entities found guilty in a qui tam lawsuit will be liable to government for three times the government’s losses, plus penalties.

The whistleblower is rewarded for bringing these lawsuits. If the government intervenes in the case and recovers funds through a settlement or a trial, the whistleblower is entitled to 15% – 25% of the recovery. If the government doesn’t intervene in the case and it is pursued by the whistleblower team, the whistleblower reward is between 25% – 30% of the recovery.

These recoveries are not low numbers. On June 22, 2017, a physician and rehabilitative specialist agreed to pay $1.4 million to resolve allegations they violated the False Claims Act by billing federal health care programs for medically unreasonable and unnecessary ultrasound guidance used with routine lab blood draws, and with Botox and trigger point injections. If a whistleblower had brought this lawsuit, he/she would have been awarded $210,000 – 420,000.

On June 16, 2017, a Pennsylvania-based skilled nursing facility operator agreed to pay roughly $53.6 million to settle charges that it and its subsidiaries violated the False Claims Act by causing the submission of false claims to government health care programs for medically unnecessary therapy and hospice services. The allegations originated in a whistleblower lawsuit filed under the qui tam provisions of the False Claims Act by 7 former employees of the company. The whistleblower award – $8,040,000 – 16,080,000.

There are currently two, large qui tam cases against United Health Group (UHG) pending in the Central District of California. The cases are: U.S. ex rel. Benjamin Poehling v. UnitedHealth Group, Inc. and U.S. ex rel. Swoben v. Secure Horizons, et al. Both cases were brought by James Swoben, who was an employee and Benjamin Poehling, who was the former finance director of a UHG group that managed the insurer’s Medicare Advantage Plans. On May 2, 2027, the U.S. government joined the Poehling lawsuit.

The charges include allegations that UHG:

- Submitted invalid codes to the Center for Medicare and Medicaid Services (CMS) that it knew of or should have known that the codes were invalid – some of the dates of services at issue in the case are older than 2008.

- Intentionally avoided learning that some diagnoses codes or categories of codes submitted to their plans by providers were invalid, despite acknowledging in 2010 that it should evaluate the results of its blind chart reviews to find codes that need to be deleted.

- Failed to follow up on and prevent the submissions of invalid codes or submit deletion for invalid codes.

- Attested to CMS each year that the data they submitted was true and accurate while knowing it was not.

UHG would not be in this expensive, litigious pickle had it conducted a self audit and followed the mandatory disclosure requirements.

What are the mandatory disclosure requirements? Glad you asked…

Section 6402(a) of the Affordable Care Act (ACA) creates an express obligation for health care providers to report and return overpayments of Medicare and Medicaid. The disclosure must be made by 60 days days after the date that the overpayment was identified or the date any corresponding cost report is due, if applicable. Identification is defined as the point in which the provider has determined or should have determined through the exercise of due diligence that an overpayment exists. CMS expects the provider to proactively investigate any credible information of a potential overpayment. The consequences of failing to proactively investigate can be seen by the UHG lawsuits above-mentioned. Apparently, UHG had some documents dated in 2010 that indicated it should review codes and delete the invalid codes, but, allegedly, failed to do so.

How do you self disclose?

According to CMS:

“Beginning June 1, 2017, providers of services and suppliers must use the forms included in the OMB-approved collection instrument entitled CMS Voluntary Self-Referral Disclosure Protocol (SRDP) in order to utilize the SRDP. For disclosures of noncompliant financial relationships with more than one physician, the disclosing entity must submit a separate Physician Information Form for each physician. The CMS Voluntary Self-Referral Disclosure Protocol document contains one Physician Information Form.”

Class Action Lawsuit Alleges Right to Inpatient Hospital Stays: Hospitals Are Damned If They Do…and Don’t!

Hospitals – “Lend me your ears; I come to warn you, not to praise RACs. The evil that RACs do lives after them; The good is oft interred with their appeals; So let it be with lawsuits.” – Julius Caesar, with modifications by me.

A class action lawsuit is pending against U.S. Health and Human Services (HHS) alleging that the Center for Medicare and Medicaid Services (CMS) encourages (or bullies) hospitals to place patients in observation status (covered by Medicare Part B), rather than admitting them as patients (covered by Medicare Part A). The Complaint alleges that the treatments while in observation status are consistent with the treatments if the patients were admitted as inpatients; however, Medicare Part B reimbursements are lower, forcing the patient to pay more out-of-pocket expenses without recourse.

The United States District Court for the District of Connecticut refused to dismiss the class action case on February 8, 2017, giving the legal arguments within the Complaint some legal standing, at least, holding that the material facts alleged warrant investigation.

The issue of admitting patients versus keeping them in observation has been a hot topic for hospitals for years. If you recall, Recovery Audit Contractors (RACs) specifically target patient admissions. See blog and blog. RAC audits of hospital short-stays is now one of the most RAC-reviewed issues. In fiscal year 2014, RACs “recouped” from hospitals $1.2 billion in allegedly improper inpatient claims. RACs do not, however, review outpatient claims to determine whether they should have been paid as inpatient.

On May 4, 2016, CMS paused its reviews of inpatient stays to determine the appropriateness of Medicare Part A payment. On September 12, 2016, CMS resumed them, but with more stringent rules on the auditors’ part. For example, auditors cannot audit claims more than the six-month look-back period from the date of admission.

Prior to September 2016, hospitals would often have no recourse when a claim is denied because the timely filing limits will have passed. The exception was if the hospital joined the Medicare Part A/Part B rebilling demonstration project. But to join the program, hospitals would forfeit their right to appeal – leaving them with no option but to re-file the claim as an outpatient claim.

With increased scrutiny, including RAC audits, on hospital inpatient stays, the class action lawsuit, Alexander et al. v. Cochran, alleges that HHS pressures hospitals to place patients in observation rather than admitting them. The decision states that “Identical services provided to patients on observation status are covered under Medicare Part B, instead of Part A, and are therefore reimbursed at a lower rate. Allegedly, the plaintiffs lost thousands of dollars in coverage—of both hospital services and subsequent skilled nursing care—as a result of being placed on observation status during their hospital stays.” In other words, the decision to place on observation status rather than admit as an inpatient has significant financial consequences for the patient. But that decision does not affect what treatment or medical services the hospital can provide.

While official Medicare policy allows the physicians to determine the inpatient v. observation status, RAC audits come behind and question that discretion. The Medicare Policy states that “the decision to admit a patient is a complex medical judgment.” Ch. 1 § 10. By contrast, CMS considers the determination as to whether services are properly billed and paid as inpatient or outpatient to be a regulatory matter. In an effort to avoid claim denials and recoupments, plaintiffs allege that hospitals automatically place the patients in observation and rely on computer algorithms or “commercial screening tools.”

In a deposition, a RAC official admitted that if the claim being reviewed meets the “commercial screening tool” requirements, then the RAC would find the inpatient status is appropriate, as long as there is a technically valid order. No wonder hospitals are relying on these commercial screening tools more and more! It is only logical and self-preserving!

This case was originally filed in 2011, and the Court of Appeals overturned the district court’s dismissal and remanded it back to the district court for consideration of the due process claims. In this case, the Court of Appeals held that the plaintiffs could establish a protected property interest if they proved their allegation “that the Secretary—acting through CMS—has effectively established fixed and objective criteria for when to admit Medicare beneficiaries as ‘inpatients,’ and that, notwithstanding the Medicare Policy Manual’s guidance, hospitals apply these criteria when making admissions decisions, rather than relying on the judgment of their treating physicians.”

HHS argues that that the undisputed fact that a physician makes the initial patient status determination on the basis of clinical judgment is enough to demonstrate that there is no due process property interest at stake.

The court disagreed and found too many material facts in dispute to dismiss the case.

Going forward:

Significant discovery will be explored as to the extent to which hospitals rely on commercial screening tools. Also whether the commercial screening tools are applied equally to private insureds versus Medicare patients.

Significant discovery will be explored on whether the hospital’s physicians challenge changing a patient from inpatient to observation.

Significant discovery will be explored as to the extent that CMS policy influences hospital decision-making.

Hospitals need to follow this case closely. If, in fact, RAC audits and CMS policy is influencing hospitals to issue patients as observation status instead of inpatient, expect changes to come – regardless the outcome of the case.

As for inpatient hospital stays, could this lawsuit give Medicare patients the right to appeal a hospital’s decision to place the patient in observation status? A possible, future scenario is a physician places a patient in observation. The patient appeals and gets admitted. Then hospital’s claim is denied because the RAC determines that the patient should have been in observation, not inpatient. Will the hospitals be damned if they do, damned if they don’t?

In the meantime:

Hospitals and physicians at hospitals: Review your policy regarding determining inpatient versus observation status. Review specific patient files that were admitted as inpatient. Was a commercial screening tool used? Is there adequate documentation that the physician made an independent decision to admit the patient? Hold educational seminars for your physicians. Educate! And have an attorney on retainer – this issue will be litigated.

Medicare/Caid Audits: Urine Testing Under Fire!!

I have blogged about peeing in a cup before…but we will not be talking about dentists in this blog. Instead we will be discussing pain management physicians and peeing in a cup.

Pain management physicians are under intense scrutiny on the federal and state level due to increased urine testing. But is it the pain management doctors’ fault?

When I was little, my dad and I would play catch with bouncy balls. He would always play a dirty little trick, and I fell for it every time. He would toss one ball high in the air. While I was concentrating on catching that ball, he would hurl another ball straight at me, which, every time, smacked into me – leaving me disoriented as to what was happening. He would laugh and laugh. I was his Charlie Brown, and he was my Lucy. (Yes, I have done this to my child).

The point is that it is difficult to concentrate on more than one thing. When the Affordable Care Act (ACA) came out, it was as if the federal government wielded 500, metaphoric, bouncy balls at every health care provider. You couldn’t comprehend it in its entirety. There were different deadlines for multiple changes, provider requirements, employer requirements, consumer requirements…it was a bloodbath! [If you haven’t seen the brothers who trick their sister into thinking it’s a zombie apocalypse, you have to watch it!!]

A similar “metaphoric ball frenzy” is occurring now with urine testing, and pain management physicians make up the bulk of prescribed urine testing. The urine testing industry has boomed in the past 4-5 years. This could be caused by a number of factors:

- increase use of drugs (especially heroine and opioids),

- the tightening of regulations requiring physicians to monitor whether patients are abusing drugs,

- increase of pain management doctors purchasing mass-spectrometry machines and becoming their own lab,

- simply more people are complaining of pain, and

- the pharmaceutical industry’s direct-to-consumer advertising (DTCA).

Medicare’s spending on 22 high-tech tests for drugs of abuse hit $445 million in 2012, up 1,423% in five years. “In 2012, 259 million prescriptions were written for opioids, which is more than enough to give every American adult their own bottle of pills.” See article.

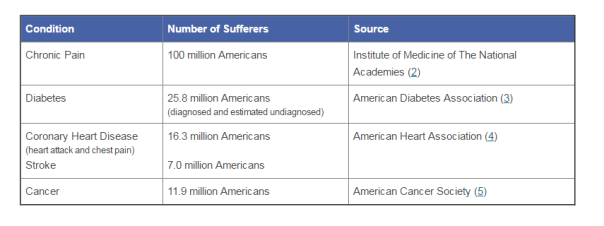

According to the American Association of Pain Management, pain affects more Americans than diabetes, heart disease and cancer combined. The chart below depicts the number of chronic pain sufferers compared to other major health conditions.

In the world of Medicare and Medicaid, where there is profit being made, the government comes a-knockin’.

But should we blame the pain management doctors if recent years brought more patients due to increase of drug use? The flip side is that we do not want doctors ordering urine tests unnecessarily. But aren’t the doctors supposed to the experts on medical necessity??? How can an auditor, who is not a physician and never seen the patient opine to medical necessity of a urine test?

The metaphoric ball frenzy:

There are so many investigations into urine testing going on right now.

Ball #1: The machine manufacturers. A couple of years ago, Carolina Liquid Chemistries (CLC) was raided by the federal government. See article. One of the allegations was that CLC was misrepresenting their product, a urinalysis machine, which caused doctors to overbill Medicare and Medicaid. According to a source, the federal government is still investigating CLC and all the physicians who purchased the urinalysis machine from CLC.

Ball #2: The federal government. Concurrently, the federal government is investigating urine testing billed to Medicare. In 2015, Millennium Health paid $256 million to resolve alleged violations of the False Claims Act for billing Medicare and Medicaid for medically unnecessary urine drug and genetic testing. I wonder if Millennium bought a urinalysis machine from CLC…

Ball #3: The state governments. Many state governments are investigating urine testing billed to Medicaid. Here are a few examples:

New Jersey: July 12, 2016, a couple and their diagnostic imaging companies were ordered to pay more than $7.75 million for knowingly submitting false claims to Medicare for thousands of falsified diagnostic test reports and the underlying tests.

Oklahoma: July 10, 2016, the Oklahoma attorney general’s office announced that it is investigating a group of laboratories involved in the state’s booming urine testing industry.

Tennessee: April 2016, two lab professionals from Bristol, Tenn., were convicted of health care fraud in a scheme involving urine tests for substance abuse treatments.

If you are a pain management physician, here are a few recommendations to, not necessarily avoid an audit (because that may be impossible), but recommendations on how to “win” an audit:

- Document, document, document. Explain why the urine test is medically necessary in your documents. An auditor is less likely to question something you wrote at the time of the testing, instead of well after the fact.

- Double check the CPT codes. These change often.

- Check your urinalysis machine. Who manufactured it? Is it performing accurately?

- Self-audit

- Have an experienced, knowledgeable, health care attorney. Do not wait for the results of the audit to contact an attorney.

And, perhaps, the most important – Do NOT just accept the results of an audit. Especially with allegations involving medical necessity…there are so many legal defenses built into regulations!! You turn around and throw a bouncy ball really high – and then…wallop them!!

NC Medicaid: Ready or Not, the Onsite Reviews Have Started; Are You Ready?

Planning for the inevitable is smart. And it is inevitable if you are a provider and you accept Medicaid that you will undergo some sort of review, whether it is onsite or database checks, in the near future. And only two outcomes can result from this upcoming review:

Are YOU ready for that test???

Are YOU ready for that test???

So, it is imperative to arm yourself with knowledge of your rights, a liability insurance policy that covers attorneys’ fees (and lets you pick your attorney), and confidence that your billing practices comply with rules and regulations. If you do not know whether your billing practices comply, do a self-audit or hire a knowledgeable billing expert to audit you.

Read or not here they come…

Beginning June 9, 2014, Public Consulting Group (PCG) began scheduling post-enrollment site visits to fulfill federal regulations 42 CFR 455.410 and 455.450, which require all participating providers to be screened according to their categorical risk level: high, moderate, or limited.

What does being high, moderate, or limited risk mean?

If you are limited risk, the state will check your licenses, ensure that you, as a provider, meet criteria for applicable federal and state statutes, conduct license verifications, and conduct database checks on a pre- and post-enrollment basis to ensure that providers continue to meet the enrollment criteria for their provider type. This is the only category that does not need an onsite review.

If you are moderate risk, the state does everything for you as if you are a limited risk plus perform on-site reviews. (Enter PCG).

If you are high risk, the state will perform all reviews as if you are a moderate risk but also will conduct a criminal background check, and require the submission of a set of fingerprints in accordance with §455.434. (And you thought fingerprints for only for the accused.)

Let’s discuss in which level risk you fall. NC Gen. Stat §108C-3 spells out the risk levels. Are you a new personal care service (PCS) provider getting ready to start your own business? You are high risk. Are you a directly-enrolled behavioral health care provider rendering outpatient behavioral health care services? You are high risk. Do you provide HIV Management services? You are high risk.

Here is a list of high risk providers:

- Prospective (newly enrolling) adult care homes delivering Medicaid-reimbursed services.

- Agencies providing behavioral health services, excluding Critical Access Behavioral Health Agencies

- Directly enrolled outpatient behavioral health services providers.

- Prospective (newly enrolling) agencies providing durable medical equipment, including, but not limited to, orthotics and prosthetics.

- Agencies providing HIV case management.

- Prospective (newly enrolling) agencies providing home or community-based services pursuant to waivers authorized by the federal Centers for Medicare and Medicaid Services under 42 U.S.C. § 1396n(c).

- Prospective (newly enrolling) agencies providing personal care services or in-home care services.

- Prospective (newly enrolling) agencies providing private duty nursing, home health, or home infusion.

- Providers against whom the Department has imposed a payment suspension based upon a credible allegation of fraud in accordance with 42 C.F.R. § 455.23 within the previous 12-month period. The Department shall return the provider to its original risk category not later than 12 months after the cessation of the payment suspension.

- Providers that were excluded, or whose owners, operators, or managing employees were excluded, by the U.S. Department of Health and Human Services Office of Inspector General or another state’s Medicaid program within the previous 10 years.

- Providers who have incurred a Medicaid or Health Choice final overpayment, assessment, or fine to the Department in excess of twenty percent (20%) of the provider’s payments received from Medicaid and Health Choice in the previous 12-month period. The Department shall return the provider to its original risk category not later than 12 months after the completion of the provider’s repayment of the final overpayment, assessment, or fine.

- Providers whose owners, operators, or managing employees were convicted of a disqualifying offense pursuant to G.S. 108C-4 but were granted an exemption by the Department within the previous 10 years.

Here is a list of moderate risk providers:

- Ambulance services.

- Comprehensive outpatient rehabilitation facilities

- Critical Access Behavioral Health Agencies.

- Hospice organizations

- Independent clinical laboratories.

- Independent diagnostic testing facilities.

- Pharmacy Services.

- Physical therapists enrolling as individuals or as group practices.

- Revalidating adult care homes delivering Medicaid-reimbursed services.

- Revalidating agencies providing durable medical equipment, including, but not limited to, orthotics and prosthetics

- Revalidating agencies providing home or community-based services pursuant to waivers authorized by the federal Centers for Medicare and Medicaid Services under 42 U.S.C. § 1396n(c).

- Revalidating agencies providing private duty nursing, home health, personal care services or in-home care services, or home infusion.

- Nonemergency medical transportation.

Here are the limited risk providers:

- Ambulatory surgical centers.

- End-stage renal disease facilities.

- Federally qualified health centers.

- Health programs operated by an Indian Health Program (as defined in section 4(12) of the Indian Health Care Improvement Act) or an urban Indian organization (as defined in section 4(29) of the Indian Health Care Improvement Act) that receives funding from the Indian Health Service pursuant to Title V of the Indian Health Care Improvement Act.

- Histocompatibility laboratories.

- Hospitals, including critical access hospitals, Department of Veterans Affairs Hospitals, and other State or federally owned hospital facilities

- Local Education Agencies.

- Mammography screening centers.

- Mass immunization roster billers.

- Nursing facilities, including Intermediate Care Facilities for the Mentally Retarded.

- Organ procurement organizations.

- Physician or nonphysician practitioners (including nurse practitioners, CRNAs, physician assistants, physician extenders, occupational therapists, speech/language pathologists, chiropractors, and audiologists), optometrists, dentists and orthodontists, and medical groups

According to the June 2014 Medicaid Bulletin, the onsite reviews will last approximately two hours and PCG will send 2 representatives to conduct the review.

How to prepare for the onSite reviews

- Read and learn. (or re-learn, whichever the case may be).

“Providers will be expected to demonstrate a working knowledge of N.C. Medicaid through responses to a series of questions.” See June 2014 Medicaid Bulletin.

Knowledge is power. Brush up on your applicable DMA Clinical Coverage Policy. Review the NC Medicaid Billing Guide. Re-read your provider participation agreement. If you don’t understand a section, go to your attorney and ask for an explanation. Actually read the pertinent federal and state statutes quoted in your participation agreements because, whether you know what the laws say or not, you signed that agreement and you will be held to the standards spelled out in the federal and state statutes.

- Call your liability insurance.

Be proactive. Contact your liability insurance agent before you get the notice of an onsite review from PCG. Have a frank, open discussion about these upcoming onsite reviews. Explain that you want to know whether you policy covers attorneys’ fees and whether you can choose your attorney. If your policy does not cover attorneys’ fees or does not allow you to choose your own lawyer, beef up your liability insurance plan to include both. Believe me, the premiums will be cheaper than an attorney from your own pocket.

- Be confident.

Presentation matters. If you whisper and cower before the PCG reviewers, you will come across as weak and/or trying to hide something. Be polite and forthcoming, but provide the information that is asked of you; do not supply more information than the reviewers do not request.

I always tell my clients before their deposition or a cross examination by the other side, “Answer the question that is asked. No more. If you are asked if your favorite color is blue, and you favorite color is red, the correct response is “No,” not “No, my favorite color is red.” Do not over-answer.

If you do not believe that you can be confident, ask your attorney to be present. I had someone tell me one time that he did not want an attorney present because he felt that the auditors would think he was hiding something and he did not want to appear litigious. I say, this is your company, your career, and your life. If you need the support of an attorney, get one. Whenever I give this advice, I try to imagine that I am telling the same advice to my mother. My mother, bless her heart, does not have the confidence to stand her ground in high pressure situations. She would rather yield her position than be the least bit confrontational. If that also describes you, have your attorney present.

- Know your rights.

What if you fail the onsite review? Can you appeal? You need to know your rights. When you get a notice from PCG that an onsite review is scheduled, contact your attorney. Make sure that BEFORE the onsite review, you understand all the possible consequences. Knowing your rights will also help with #3, confidence. If you know the worst case scenario, then you stop creating worse case scenarios in your mind and become more confident.

Ready or not, the PCG reviews are coming, so get ready!