Monthly Archives: August 2018

Hasty and Careless Termination Decisions Can Put Medicare/caid Providers Out of Business

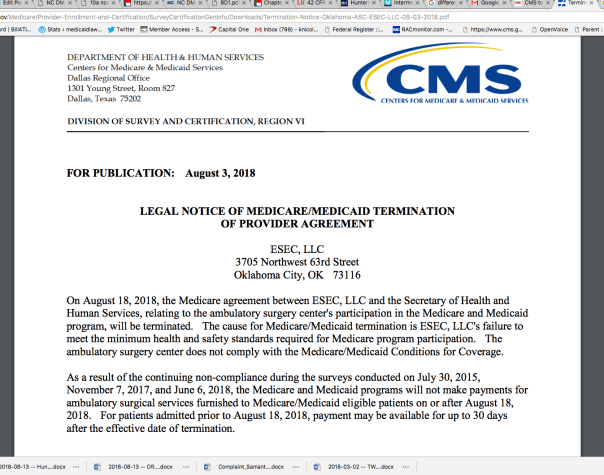

When action happens in the Medicare/caid world, it happens quickly. Sometimes you do not receive adequate notice to coordinate continuity of care for your consumers or patients. For example, on August 3, 2018, the Center for Medicare and Medicaid Services announced that at midnight on August 18, 2018, it would be terminating the contract between CMS and ESEC, LLC, an Oklahoma-based surgery center.

CMS provided ESEC 15 days notice of complete termination of Medicare and Medicaid reimbursements. Now I do not know the details of ESEC’s financial reliance on Medicare or Medicaid, but, these days, few providers are solely third-party pay or cash-only. I can only assume that ESEC is scrambling to initiate a lawsuit to remain afloat and open for business. Or ESEC is praying for a “rescind” by correcting whatever issues it purportedly had. Personally, I would not count on a possible rescind. I would be proactively seeking legal intervention.

Here are some examples of recent terminations and the notice received by the providers:

- Baylor St. Luke’s Medical Center’s heart transplant program lost federal funding August 17, 2018. The hospital will no longer be able to bill Medicare and Medicaid for heart transplants.

- Effective August 9, 2018, Brookwood Baptist Medical Center’s Medicare contract was terminated. The notice was published July 25, 2018.

- As of August 12, 2018, The Grandview Nursing & Rehabilitation Facility’s Medicare contract was terminated. Notice of the termination was published August 1, 2018.

- As of September 1, 2018, Compassus-Kansas City, a hospice company, will lose its Medicare contract. Notice was provided August 17, 2018.

- On August 3, 2018, CMS announced that it was terminating Deligent Health Services Inc.’s Medicare and Medicaid contact, effective December 5, 2017. (That is quite a retroactive timeframe).

Can Careless Judy put a healthcare provider out of business?

This happens all the time. Sure, ESEC probably had knowledge that CMS was investigating it. However, CMS has the authority to issue these public notices of termination without holding a hearing to determine whether CMS’ actions are accurate. What if Careless Judy in Program Integrity made a human error and ESEC actually does meet the standards of care. But you see, Careless Judy accidentally used the minimum standards of care from 2008 instead of 2018. It’s an honest mistake. She had no malice against ESEC. But, my point is – where is the mechanism that prevents a surgical ambulatory center from going out of business – just because Careless Judy made a mistake?

To look into whether any legal mechanism exists to prevent Careless Judy from putting the ambulatory center out of business, I turn to the legal rules.

42 CFR 488.456 governs terminations of provider agreements. Subsection (a) state that termination “ends – (1) Payment to the facility; and (2) Any alternative remedy.”

Subsection (b) states that CMS or the State may terminate the contract with the provider if the provider “Is not in substantial compliance with the requirements of participation, regardless whether immediate jeopardy is present.” On the bright side, if no immediate jeopardy exists then CMS or the State must give 15 days notice. If there is found to be immediate jeopardy, the provider get 2 days. But who determines what is “substantial compliance?” Careless Judy?

42 CFR 489.53 lists the reasons on which CMS may rely to terminate a provider. Although, please note, that the regulations use the word “may” and not “must.” So we have some additional guidance as to when a provider’s contract may be terminated, but it still seems subjective. Here are the reasons:

- The provider is not complying with the provisions of title XVIII and the applicable regulations of this chapter or with the provisions of the agreement.

- The provider or supplier places restrictions on the persons it will accept for treatment and it fails either to exempt Medicare beneficiaries from those restrictions or to apply them to Medicare beneficiaries the same as to all other persons seeking care.

- It no longer meets the appropriate conditions of participation or requirements (for SNFs and NFs) set forth elsewhere in this chapter. In the case of an RNHCI no longer meets the conditions for coverage, conditions of participation and requirements set forth elsewhere in this chapter.

- It fails to furnish information that CMS finds necessary for a determination as to whether payments are or were due under Medicare and the amounts due.

- It refuses to permit examination of its fiscal or other records by, or on behalf of CMS, as necessary for verification of information furnished as a basis for payment under Medicare.

- It failed to furnish information on business transactions as required in § 420.205 of this chapter.

- It failed at the time the agreement was entered into or renewed to disclose information on convicted individuals as required in § 420.204 of this chapter.

- It failed to furnish ownership information as required in § 420.206 of this chapter.

- It failed to comply with civil rights requirements set forth in 45 CFR parts 80, 84, and 90.

- In the case of a hospital or a critical access hospital as defined in section 1861(mm)(1) of the Act that has reason to believe it may have received an individual transferred by another hospital in violation of § 489.24(d), the hospital failed to report the incident to CMS or the State survey agency.

- In the case of a hospital requested to furnish inpatient services to CHAMPUS or CHAMPVA beneficiaries or to veterans, it failed to comply with § 489.25 or § 489.26, respectively.

- It failed to furnish the notice of discharge rights as required by § 489.27.

- The provider or supplier refuses to permit copying of any records or other information by, or on behalf of, CMS, as necessary to determine or verify compliance with participation requirements.

- The hospital knowingly and willfully fails to accept, on a repeated basis, an amount that approximates the Medicare rate established under the inpatient hospital prospective payment system, minus any enrollee deductibles or copayments, as payment in full from a fee-for-service FEHB plan for inpatient hospital services provided to a retired Federal enrollee of a fee-for-service FEHB plan, age 65 or older, who does not have Medicare Part A benefits.

- It had its enrollment in the Medicare program revoked in accordance to § 424.535 of this chapter.

- It has failed to pay a revisit user fee when and if assessed.

- In the case of an HHA, it failed to correct any deficiencies within the required time frame.

- The provider or supplier fails to grant immediate access upon a reasonable request to a state survey agency or other authorized entity for the purpose of determining, in accordance with § 488.3, whether the provider or supplier meets the applicable requirements, conditions of participation, conditions for coverage, or conditions for certification.

As you can see from the above list of possible termination reasons, many of which are subjective, it could be easy for Careless Judy to terminate a Medicare contract erroneously, based on inaccurate facts, or without proper investigation.

The same is true for Medicaid; your contract can be terminated on the federal or state level. The difference is that at the state level, Careless Judy is a state employee, not a federal.

42 CFR 498.5 governs appeal rights for providers contract terminations. Subsection (b) states that “Any provider dissatisfied with an initial determination to terminate its provider agreement is entitled to a hearing before an ALJ.”

42 CFR 498.20 states that an initial determination by CMS (like a contract termination) is binding unless it is reconsidered per 42 CFR 498.24.

A Stay of the termination should suspend the termination until the provider can obtain a hearing by an impartial tribunal until the appeal has been completed. The appeal process and supposed automatic Stay of the termination is the only protection for the provider from Careless Judy. Or filing an expensive injunction.

A Federal Regulation Violates the U.S. Constitution and Ruins Careers; Yet It Sits…Vaguely

There is a federal regulation that is putting health care providers out of business. It is my legal opinion that the regulation violates the U.S. Constitution. Yet, the regulation still exists and continues to put health care providers out of business.

Why?

Because so far, no one has litigated the validity of the regulation, and I believe it could be legally wiped from existence with the right legal arguments.

How is this important?

Currently, the state and federal government are legally authorized to immediately suspend your Medicare or Medicaid reimbursements upon a credible allegation of fraud. This immense authority has put many a provider out of business. Could you survive without any Medicare or Medicaid reimbursements?

The federal regulation to which I allude is 42 CFR 455.23. It is a federal regulation, and it applies to every single health care provider, despite the service type allowed by Medicare or Medicaid. Home care agencies are just as susceptible to an accusation of health care fraud as a hospital. Durable medical equipment agencies are as susceptible as dentists. Yet the standard for a “credible allegation of fraud” is low. The standard for which the government can implement an immediate withhold of Medicaid/care reimbursements is lower than for an accused murderer to be arrested. At least when you are accused of murder, you have the right to an attorney. When you are accused to health care fraud on the civil level, you do not receive the right to an attorney. You must pay 100% out of pocket, unless your insurance happens to cover the expense for attorneys. But, even if your insurance does cover legal fees, you can believe that you will be appointed a general litigator with little to no knowledge of Medicare or Medicaid regulatory compliance litigation.

42 USC 455.23 states that:

“The State Medicaid agency must suspend all Medicaid payments to a provider after the agency determines there is a credible allegation of fraud for which an investigation is pending under the Medicaid program against an individual or entity unless the agency has good cause to not suspend payments or to suspend payment only in part.

(2) The State Medicaid agency may suspend payments without first notifying the provider of its intention to suspend such payments.

(3) A provider may request, and must be granted, administrative review where State law so requires.”

In the very first sentence, which I highlighted in red, is the word “must.” Prior to the Affordable Care Act, this text read “may.” From my years of experience, every single state in America has used this revision from “may” to “must” for governmental advantage over providers. When asked for good cause, the state and or federal government protest that they have no authority to make a decision that good cause exists to suspend any reimbursement freeze during an investigation. But this protest is a pile of hooey.

In reality, if anyone could afford to litigate the constitutionality of the regulation, I believe that the regulation would be stricken an unconstitutional.

Here is one reason why: Due Process

The Fifth and Fourteenth Amendments to the Bill of Rights provide us our due process rights. Here is the 5th Amendment:

“No person shall be held to answer for a capital, or otherwise infamous crime, unless on a presentment or indictment of a Grand Jury, except in cases arising in the land or naval forces, or in the Militia, when in actual service in time of War or public danger; nor shall any person be subject for the same offense to be twice put in jeopardy of life or limb; nor shall be compelled in any criminal case to be a witness against himself, nor be deprived of life, liberty, or property, without due process of law; nor shall private property be taken for public use, without just compensation.”

There have been a long and rich history of interpretation of the due process clause. The Supreme Court has interpreted the due process clauses to provide four protections: (1) procedural due process (in civil and criminal proceedings), (2) substantive due process, (3) a prohibition against vague laws, and (4) as the vehicle for the incorporation of the Bill of Rights.

42 CFR 455.23 violates procedural due process.

Procedural due process requires that a person be allowed notice and an opportunity to be heard before a government official takes a person’s life, liberty, or property.

Yet, 42 CFR 455.23 allows the government to immediately withhold reimbursements for services rendered based on an allegation without due process and taking a provider’s property; i.e., money owed for services rendered. Isn’t this exactly what procedural due process was created to prevent???? Where is the fundamental fairness?

42 CFR 455.23 violates substantive due process.

The Court usually looks first to see if there is a fundamental right, by examining if the right can be found deeply rooted in American history and traditions.

Fundamental rights include the right to vote, right for protection from pirates on the high seas (seriously – you have that right), and the right to constitutional remedies. Courts have held that our right to property is a fundamental right, but to my knowledge, not in the context of Medicare/caid reimbursements owed; however, I see a strong argument.

If the court establishes that the right being violated is a fundamental right, it applies strict scrutiny. This test inquires into whether there is a compelling state interest being furthered by the violation of the right, and whether the law in question is narrowly tailored to address the state interest.

Where the right is not a fundamental right, the court applies a rational basis test: if the violation of the right can be rationally related to a legitimate government purpose, then the law is held valid.

Taking away property of a Medicare/caid provider without due process violates substantive due process. The great thing about writing your own blog is that no one can argue with you. Playing Devil’s advocate, I would anticipate that the government would argue that a suspension or withhold of reimbursements is not a “taking” because the withhold or suspension is temporary and the government has a compelling reason to deter health care fraud. To which, I would say, yes, catching health care fraud is important – I am in no way advocating for fraud. But important also is the right to be innocent until proven guilty, and in civil cases, our deeply-rooted belief in the presumption of innocence is upheld by the action at issue not taking place until a hearing is held.

For example, if I sue my neighbor and declare that he is encroaching on my property, the property line is not moved until a decision is in my favor.

Another example, if I sue my business partner for breach of contract because she embezzled $1 million from me, I do not get the $1 million from her until it is decided that she actually took $1 million from me.

So to should be – if a provider is accused of fraud, property legally owned by said provider cannot just be taken away. That is a violation of substantive due process.

42 CFR 455.23 violates the prohibition against vague laws

A law is void for vagueness if an average citizen cannot understand it. The vagueness doctrine is my favorite. According to census data, there are 209.3 million people in the US who are over 24-years. Of those over 24-years-old, 66.9 million have a college degree. 68% do not.

Although here is a quick anecdote: Not so sure that a college degree is indicative of intelligence. A recent poll of law students at Columbia University showed that over 60% of the students, who were polled, could not name what rights are protected by the 1st Amendment. Once they responded “speech,” many forgot the others. In case you need a refresher for the off-chance that you are asked this question in an impromptu interview, see here.

My point is – who is to determine what the average person may or may not understand?

Back to why 42 CFR 455.23 violates the vagueness doctrine…

Remember the language of the regulations: “The State Medicaid agency must suspend all Medicaid payments to a provider after the agency determines there is a credible allegation of fraud…”

“Credible allegation of fraud” is defined as an allegation, which has been verified by the State, from any source, including but not limited to the following:

- Fraud hotline complaints.

- Claims data mining.

- Patterns identified through provider audits, civil false claims cases, and law enforcement investigations. Allegations are considered to be credible when they have indicia of reliability and the State Medicaid agency has reviewed all allegations, facts, and evidence carefully and acts judiciously on a case-by-case basis.”

With a bit of research, I was able to find a written podcast published by CMS. It appears to be a Q and A between two workers at CMS discussing whether they should suspend a home health care agency’s reimbursements, similar to a playbook. I assume that it was an internal workshop to educate the CMS employees considering that the beginning of the screenplay begins with a “canned narrator” saying “This is a Medicaid program integrity podcast.”

The weird thing is that when you pull up the website – here – you get a glimpse of the podcast, but, at least on my computer, the image disappears in seconds and does not allow you to read it. I encourage you to determine whether this happens you as well.

While the podcast shimmered for a few seconds, I hit print and was able to read the disappearing podcast. As you can see, it is a staged conversation between “Patrick” and “Jim” regarding suspicion of a home health agency falsifying certificates of medical necessity.

On page 3, “Jim” says, “Remember the provider has the right to know why we are taking such serious action.”

But if your Medicare/caid reimbursements were suddenly suspended and you were told the suspension was based upon “credible allegations of fraud,” wouldn’t you find that reasoning vague?

42 CFR 455.23 violates the right to apply the Bill of Rights to me, as a citizen

This esoteric doctrine only means that the Bill of Rights apply to State governments. [Why do lawyers make everything so hard to understand?]

Medicaid Reform: As Addictive as Fortnite

Do you have a kid addicted to Fortnite? The numbers are rising…

For those of you who have been living under a rock for the past year, this is how Fortnite is explained on the internet:

“In short, it’s a mass online brawl where 100 players leap out of a plane on to a small island and then fight each other until only one is left. Hidden around the island are weapons and items, including rifles, traps and grenade launchers, and players must arm themselves while exploring the landscape and buildings. It’s also possible to collect resources that allow you to build structures where you can hide or defend yourself. As the match progresses, the playable area of land is continually reduced, so participants are forced closer and closer together. The last survivor is the winner.”

More than 40 million people play Fortnite. According to the May 2018 Medicaid Enrollment Report, 73,633,050 Americans are enrolled in Medicaid or CHIP, so government-assisted health insurance definitely trumps Fortnite on participation.

Recently, the General Assembly passed and the Governor signed two Bills into law pertaining to Medicaid reform: (1) HB 403 (Session Law 2018-48); and (2) HB 156 (Session Law 2018-49). Notice that the Session Laws are one digit separate from each other. That is because Governor Cooper signed these two bills consecutively and on the same day. But did he read them? I do not know the answer, but I do know this: Medicaid reform in NC has become a Fortnite. The MCOs, provider-led entities, ACOs, auditors, DHHS…everyone is vying for a piece of the very large Medicaid budget, approximately $3.6 billion – or 16% of NC’s total budget. It is literally a firehose of money if you can manage to be a player in the Medicaid Fortnite – a fight to eliminate everyone but you. Unlike Fortnite, the pay-off for winning Medicaid Fortnite is financially lucrative. But it is a fight with few winners.

Session Law 2018-48 is entitled, “An Act to Modify the Medicaid Transformation Legislation.”

Session Law 2018-49 is entitled, “An Act to Require Medicaid Prepaid Health Plans to Obtain a License from the Department of Insurance and to Make Other Changes Pertaining to Medicaid Transformation and the Department of Insurance.”

Don’t you like how the House decided to use the term “transformation” instead of “reform?” The term “reform” had been over-utilized.

Recently, the North Carolina Medical Society announced that it is throwing its metaphoric hat in the ring to become “Carolina Complete Health,” a provider-led patient-care center.

The New Laws

Session Law 2018-48

Session Law 2018-48 defines provider-led entity (PLE) as an entity that meets the following criteria: (1) A majority of the entity’s ownership is held by an individual or entity that has its primary business purpose the operation of a capitated contract for Medicaid; (2) A majority of the entity’s governing body is composed of licensed physicians, physician assistants, nurse practitioners, or psychologist and have experience treating Medicaid beneficiaries; (3) Holds a PHP license issued by the Department of Insurance (see Session Law 2018-49).

Services covered by PHP’s will include physical health services, prescription drugs, long-term services and supports, and behavioral health care services for North Carolina Health Choice recipients. The PHP’s will not cover services currently covered by the managed care organizations (MCOs).

Session Law 2018-48 allows for 4 contracts with PHPs to provide services for Medicaid and NC Health Choice (statewide contracts). Plus, it allows up to 12 regional contracts.

What is the future of behavioral health and the MCO system?

For now, they will still exist. The double negative wording of the new Session Law makes it seem like the MCOs will have less authority, but the MCOs will continue to cover for services described in subdivisions a, d, e, f, g, j, k, and l of this subdivision.

Session Law 2018-48 also creates new entities called BH IDD Tailored Plans. Session Law 2018-48 carves out developmentally disabled services (or IDD). It mandates that DHHS create a detailed plan for implementation of a new IDD program under the 1115 Waiver. Services provided by the new Tailored Plans shall pay for and manage services currently offered under the 1915(b)(c) Waiver.

Here’s the catch for providers: “Entities operating BH IDD Tailored Plans shall maintain closed provider networks for behavioral health, intellectual and developmental disability, and traumatic brain injury services and shall ensure network adequacy.” (emphasis added). Fortnite continues with providers jockeying to be included in the networks.

For the next four years only an MCO may operate a BH IDD Tailored Plan. This tells me that the MCOs have sufficiently lawyered up with lobbyists. After the term of the initial contracts, the Tailored Plans will be the result of RFPs issued by DHHS and the submission of competitive bids from nonprofit PHPs.

DHHS was to report to the Joint Legislative Oversight Committee with a plan for the implementation of the Tailored Plans by June 22, 2018. – Sure would’ve loved to be a fly on that wall.

Starting August 31, 2018, DHHS is authorized to take any actions necessary to implement the BH IDD Tailored Plans in accordance with all the requirements in this Act.

Session Law 2018-49

A provider-led entity must meet all the following criteria: (1) A majority of the entity’s ownership is held by an individual or entity that has as its primary business purpose operating a capitated contract with with Medicaid providers; and (2) A majority of the governing body is composed of individuals who are licensed as physicians, physician assistants, nurse practitioners, or psychologists and all of whom have experienced treating Medicaid beneficiaries.

Session Law 2018-49 requires that all PHPs apply for a license with the Commissioner of Insurance. With the application, all entities would need to provide proof of financial stability and other corporate documents. This new law definitely increases the authority of the Commissioner of Insurance (Mike Causey).

The remaining portion of the law pertains to protection against insolvency, continuation of healthcare services in case of insolvency, suspension or revocation of licenses, administrative procedures, penalties and enforcement, confidentiality of information, and that sort.

Session Law 2018-49 also applies to the current opioid crisis. It allows a “lock-in programs” for those consumers who use multiple pharmacies and multiple doctors to “lock them in” to one pharmacy and one doctor.

Besides the “lock-in” program, Session Law 2018-49 is basically a law that brings the Department of Insurance into the Medicaid arena.

Let Fortnite begin!