Category Archives: Office of Medicare Hearings and Appeals

Federal Court Vacates Two, Medicare ALJ Decisions with Extrapolations

Today is April Fool’s Day, but the story I am going to tell you today is no prank. On 03/25/2024, the U.S. District Court of the Southern District of Florida rendered its Decision on MedEnvios Healthcare, Inc. v. Xavier Becerra, in his official capacity as Secretary USDHHS. 2024 WL 1252264. The federal Court vacated two, ALJ Decisions upholding two, separate, extrapolated audits. This example highlights the importance of appealing ALJ Decisions to federal court, which will uphold the law versus CMS Rules.

MedEnvios is a durable medical equipment provider (DME). It was the target of two Medicare audits and both audits were extrapolated. MedEnvios’ argument is two-fold: (1) that its due process rights were violated because HHS failed to comply with the procedures set forth in statute, regulation, and “sub-regulatory guidance” that mandate “certain due process minimum protections be provided to health care suppliers in the statistical sampling and extrapolation process.” (Pl.’s Resp. at 9.) Specifically, MedEnvios objects to the Defendant’s exclusion of claims for which the Department never made a payment to MedEnvios from the sampling frame. Obviously if the zero-claims are not removed the number will be inflated or maybe even surpass what was actually paid to the provider during the specific timeframe. And (2) MedEnvios argues that the Defendant failed to provide sufficient documentation to support overpayments recalculated following partially favorable appellate decisions, allegedly depriving MedEnvios of notice. Following partially favorable decisions on appeal, the relevant contractor must “effectuate” the decision by recalculating the extrapolated overpayment amount to be recouped from the supplier based upon the revised decisions on individual sampled Medicare claims. The contractor then sends the supplier a revised demand letter reflecting the new overpayment amount. Without the underlying documentation showing how the contractor arrived at the new amount, MedEnvios claims that it lacked “the information necessary to mount a meaningful challenge to those recalculations.”

I bet that many readers today have felt the pain of having to defend themselves from an audit and knew the auditor was withholding data or documents, yet felt powerless. This Decision says it is not ok to not give all the information. The Court held that MedEnvios was and is prejudiced by the unavailability of the recalculation worksheets because MedEnvios did not receive three of the four relevant recalculation worksheets within enough time to satisfy its procedural due process rights by recreating the recalculations to verify the revised extrapolated amounts.

The Court held that the prejudice to MedEnvios in having to mount appeals without reviewing the contractors’ effectuation work easily outweighs any administrative difficulty of timely providing the worksheets. Provision of this information should be a negligible burden on the Department and its contractors. The MPIM already instructs that “[d]ocumentation shall be kept in sufficient detail so that the sampling frame can be re-created should the methodology be challenged. The contractor shall keep an electronic copy of the sampling frame.” MPIM § 8.4.4.4.1. Thus, contractors are already required to maintain this information, and the added burden of providing the information on request would be minimal. The Court therefore concludes that the Department has run afoul of MedEnvios’s procedural due process rights by failing to provide the documentation supporting the recalculated overpayment amounts.

So, what is the remedy for the Department’s failure to timely provide documents showing how the revised overpayment demands were calculated?

This Court vacated both ALJ Decisions upholding the two extrapolated amounts. This is a perfect example of why providers MUST appeal ALJ Decisions to federal court. The difference in the law and CMS’ Rules is vast. Not enough providers continue their appeal to federal court because of money. Litigation is expensive. However, in this case, attorneys’ fees were, most likely, much less than what CMS was alleging MedEnvios owed.

Have a great April Fool’s Day. Play a prank on a colleague. At the office, put tape under a coworker’s computer mouse, and watch them try to figure out why it’s not working!

Laboratories Are Under Scrutiny by OIG and State Medicaid!

Laboratories are under scrutiny by the OIG and State Medicaid Departments. Labs get urine samples from behavioral health care companies, substance abuse companies, hospitals, and primary care facilities, who don’t have their own labs. Owners of labs entrust their lab executives to follow procedure on a federal and/or state level for Medicare or Medicaid. Well, what if they don’t. For example, one client paid a urine collector/courier by the mile. That courier service collected urine from Medicaid consumers in NC, sometimes in excess of 90 times a year, when Medicaid only allows 24 per year. I have about 10-15 laboratory clients at the present.

Another laboratory’s urine collector collected the urine, but never brought the urine back to get tested. To which I ponder, where did all those urine specimens go?

Another laboratory had a standing order for over 6 years to test presumptive and definitive testing on 100% of urine samples.

OIG has smelled fraud within laboratories and is widening its search for fraudsters. Several laboratories are undergoing the most serious audits in existence. Not RAC, MAC, or UPIC audits, but audits of even more importance. They received CIDs or civil investigative demands from their State Medicaid Divisions. These requests, like RAC, MAC, or UPIC audits, request lots of documents. In fact, CIDs are legally allowed to request documents for a much longer period of time than RACs, which can only request 3 years back. Most CIDs are fishing for false claims under the False Claims Act (FCA). Stark and Anti-Kickback violations are also included in these investigations. While civil penalties can result in high monetary penalties, criminal violations result in jail time.

As everyone knows, labs must follow CLIA or be CLIA certified, which is the federal standard for which labs. The Clinical Laboratory Improvement Amendments (CLIA) of 1988 (42 USC 263a) and the associated regulations (42 CFR 493) provide the authority for certification and oversight of clinical laboratories and laboratory testing. Under the CLIA program, clinical laboratories are required to have the appropriate certificate before they can accept human samples for testing. There are different types of CLIA certificates, as well as different regulatory requirements, based on the types and complexity of clinical laboratory tests a laboratory conducts. CLIA, like CMS, has its own set of rules. When entities like CLIA or CMS have their own rules, sometimes those rules juxtapose law, which creates a conundrum for providers. If you own a lab, do you follow CLIA rules or CMS rules or the law? Let me give you an example. According to CLIA, you must maintain documentation regarding samples and testing for two years. So, if CLIA audits a laboratory, the audits requests will only go back for two years. Well, that’s all fine and dandy. Except according to the law, you have to maintain medical documents for 5 or 6 years, depending on the service type.

Recently, one of my labs received a CID for records going back to 2017. That is a 6-year lookback. Had the lab followed CLIA’s rules, the lab would only have documentation going back to 2021. Had the lab followed CLIA’s rules, when OIG knocked on its door, it would have NOT had four years of OIG’s request. Now I do not know, because I have never been in the position that my lab client only retained records for two years…thank goodness. If I were in the position, I would argue that the lab was following CLIA’s rules. But that’s the thing, rules are not laws. When in doubt, follow laws, not rules.

However, that takes me to Medicare provider appeals of RAC, MAC, and UPIC audits. Everything under the umbrella of CMS must follow CMS rules. Remember how I said that rules are not laws? CMS rules, sometimes, contradict law. Yet when a Medicare provider appeals an overpayment or termination, the first four levels of appeal are mandated to follow CMS rules. It is not until the 5th level, which is the federal district court that law prevails. In other words, the RAC, MAC, or UPIC, the 2nd level QIC, the 3rd level ALJ, and the 4th level Medicare Appeal Council, all must follow CMS rules. It is not until you appear before the federal district judge that law prevails.

Receiving a CID does not mean that your investigation will remain civil. Most investigations begin civilly. If the evidence uncovered demonstrates any criminal activity, your civil investigation can quickly turn criminal. I co-defend with a federal criminal attorney if the case has a chance to turn criminal. Believe me, there is a huge difference between federal and state criminal lawyers! Even with the best federal criminal lawyers, you want a Medicare and Medicaid expert lawyer on the team to dispute the regulatory accusations that a criminal attorney may not be as well-versed. I am so thankful that I moved my practice to Nelson Mullins, because we have a huge, yet highly-specialized health care practice. While we have a large number of lawyers, each partner specializes in slightly different aspects of health care. So, when I need a federal criminal attorney to partner-up with me, I just walk down the hall.

Laboratories: Beware! Be ready! Be prepared! Be lawyered up!

RAC Report: PET Scans, Helicopter Transportation, and Hospice, Oh My!

The RACs are on attack! The “COVID Pause Button” on RAC audits has been lifted. The COVID Pause Button has been lifted since August 2020. But never have I ever seen CMS spew out so many new RAC topics in one month of a new year. Happy 2021.

Recovery audit contractors (“RACs”) will soon be auditing positron emission tomography (PET) scans for initial treatment strategy in oncologic conditions for compliance with medical necessity and documentation requirements.

Positron emission tomography (“PET”) scans detect early signs of cancer, heart disease and brain disorders. An injectable radioactive tracer detects diseased cells. A combination PET-CT scan produces 3D images for a more accurate diagnosis.

According to CMS’ RAC audit topics, “(PET) for Initial Treatment Strategy in Oncologic Conditions: Medical Necessity and Documentation Requirements,” will be reviewed as of January 5, 2021. The PET scan audits will be for outpatient hospital and professional service reviews. CMS added additional 2021 audit targets to the approved list:

- Air Ambulance: Medical Necessity and Documentation Requirements,[1]. This complex review will be examining rotatory wing (helicopter) aircraft claims to determine if air ambulance transport was reasonable and medically necessary as well as whether or not documentation requirements have been met.

- Hospice Continuous Home Care: Medical Necessity and Documentation Requirements,[2] and

- Ambulance Transport Subject to SNF Consolidated Billing.[3]

Upcoming HHS secretary Xavier Becerra plans to get his new tenure underway quickly.

In False Claims Act (“FCA”) news, Medicare audits of P-Stim have ramped up across the country. A Spinal Clinic in Texas agreed to pay $330,898 to settle FCA allegations for allegedly billing Medicare improperly for electro-acupuncture device neurostimulators. CMS claims that “Medicare does not reimburse for acupuncture or for acupuncture devices such as P-Stim, nor does Medicare reimburse for P-Stim as a neurostimulator or as implantation of neurostimulator electrodes.”

Finally, is your staff getting medical records to consumers requesting their records quickly enough? Right to access to health records is yet another potential risk for all providers, especially hospitals due to their size. A hospital system agreed to pay $200,000 to settle potential violations of the HIPAA Privacy Rule’s right of access standard. This is HHS Office for Civil Rights’ 14th settlement under its Right of Access Initiative. The first person alleged that she requested medical records in December 2017 and did not receive them until May 2018. In the second complaint, the person asked for an electronic copy of his records in September 2019, and they were not sent until February 2020.

Beware of slow document production as slow document production can lead to penalties. And be on the lookout for the next RAC Report.

Remember, never accept the results of a Medicare or Medicaid audit. It is always too high. Believe me, after 21 years of my legal practice, I have yet to agree with the findings if a Tentative notice of Overpayment by any governmental contracted auditor, whether it is PCG, NGS, the MACs, MCOs, or Program Integrity – in any of our 50 States. That is quite a statement about the general, quality of work of auditors. Remember Teambuilders? How did $12 million become $896.35? See blog.

1 CMS, “0200-Air Ambulance: Medical Necessity and Documentation Requirements,” proposed RAC topic, January 5, 2021, http://go.cms.gov/35Jx1co.

2 CMS, “0201-Hospice Continuous Home Care: Medical Necessity and Documentation Requirements,” proposed RAC topic, January 5, 2021, http://go.cms.gov/3oRUyiY.

3 CMS, “0202- Ambulance Transport Subject to SNF Consolidated Billing,” proposed RAC topic, January 5, 2021, http://go.cms.gov/2LOMEbw.

Are ALJ Appointed Properly, per the Constitution?

A sneaky and under-publicized matter, which will affect every one of you reading this, slid into common law last year with a very recent case, dated Jan. 9, 2020, upholding and expanding the findings of a 2018 case, Lucia v. SEC, 138 S. Ct. 2044 (U.S. 2018). In Lucia, the Supreme Court upheld the plain language of the U.S. Constitution’s Appointments Clause.

The Appointments Clause prescribes the exclusive means of appointing “officers.” Only the President, a court of law, or a head of department can do so. See Art. II, § 2, cl. 2.

In Lucia, the sole issue was whether an administrative law judge (ALJ) can be appointed by someone other than the President or a department head under Article II, §2, cl. 2 of the U.S. Constitution, or whether ALJs simply federal employees. The Lucia court held that ALJs must be appointed by the President or the department head; this is a non-delegable duty. The most recent case, Sara White Dove-Ridgeway v. Nancy Berrryhill, 2020 WL 109034, (D.Ct.DE, Jan. 9, 2020), upheld and expanded Lucia.

ALJs are appointed. In many states, ALJs are direct employees of a single state agency. In other words, in many states, about half, the payroll check that an ALJ receives bears the emblem of the department of health for that state. I have litigated in administrative courts in approximately 33 states, and have seen my share of surprises. In one case, many years ago, LinkedIn informed me that my appointed ALJ was actually a professional photographer by trade.

Lucia, however, determined that ALJs at the Securities and Exchange Commission (SEC) were “officers of the United States,” subject to the Appointment Clause of the Constitution, which requires officers to be appointed by the president, the heads of departments, or the courts. The court’s decision raised concern at the U.S. Department of Health and Human Services (HHS) because its ALJs had not been appointed by the secretary, but rather by lower agency officials.

The court also held that relief should be granted to “one who makes a timely challenge to the constitutional validity of the appointment of an officer who adjudicates his case.” Whether that relief is monetary, in the form of attorneys’ fees reimbursed or out-of-pocket costs, it is unclear.

In July 2018, President Trump’s Executive Order 13843 excepted ALJs from the competitive service, so agency heads, like HHS Secretary Alex Azar, could directly select the best candidates through a process that would ensure the merit-based appointment of individuals with the specific experience and expertise needed by the selecting agencies.

The executive order also accepted all previously appointed ALJs. So there became a pre-July 16, 2018, challenge and a post-July 16, 2018, based on Trump’s Executive Order. Post-July 16, 2018, appointees had to be appointed by the President or department head. But the argument could be made that ALJs appointed pre-July 16, 2018, were grandfathered into the more lax standards. In Dove-Ridgway, Social Security benefits were at issue. On July 5, 2017, ALJ Jack S. Pena found a plaintiff not disabled. On Jan. 7, 2019, the plaintiff filed an appeal of the ALJ’s decision, seeking judicial review from the district court. In what seems to be the fastest decision ever to emerge from a court of law, two days later, a ruling was rendered. The District Court found that even though at the time of the administrative decision, Lucia and Trump’s Executive Order had not been issued, the court still held that the ALJ needed to have been appointed constitutionally. It ordered a remand for a rehearing before a different, constitutionally appointed ALJ, despite the fact that Trump had accepted all previously appointed ALJs.

In this firsthand, post-Jan. 9, 2020, era, we have an additional defense against Medicare or Medicaid audits or alleged overpayments in our arsenal: was the ALJ appointed properly, per the U.S. Constitution?

Programming Note: Listen to Knicole Emanuel’s live reports on Monitor Monday, 10-10:30 a.m. EST.

As seen on RACMonitor.

Medicare TPE Audits: A Wolf in Sheep’s Clothing (Part II)

Let’s talk targeted probe-and-educate (“TPE”) audits – again.

I received quite a bit of feedback on my RACMonitor article regarding Medicare TPE audits being a “Wolf in Sheep’s Clothing.” So, I decided to delve into more depth by contacting providers who reached out to me to discuss specific issues. My intent is to shed the sheep’s clothing and show the big, pointy ears, big, round eyes, and big, sharp teeth that the MACs will hear, see, and eat you through the Medicare TPE audits. So, call the Woodsman, arm yourself with a hatchet, and get ready to be prepared for TPE audits. I cannot stress enough the importance of being proactive.

The very first way to rebut a TPE audit is to challenge the reason you were selected, which includes challenging the data supporting the reason that you were chosen. A poor TPE audit can easily result in termination of your Medicare contract, so it is imperative that you are prepared and appeal adverse results. 42 C.F.R. § 424.535, “Revocation of enrollment in the Medicare program” outlines the reasons for termination. Failing the audit process – even if the results are incorrect – can result in termination of your Medicare contract. Be prepared and appeal.

In 2014, the Center for Medicare and Medicaid Services (“CMS”) began the TPE program that combines a review of a sample of claims with “education” to allegedly reduce errors in the Medicare claims submission process; however, it took years to get the program off the ground. But off the ground it is. It seems, however, that CMS pushed the TPE program off the ground and then allowed the MACs to dictate the terms. CMS claims that the results of the TPE program are favorable, basing its determination of success on the decrease in the number of claim errors after providers receive education. But providers undergoing the TPE audit process face tedious and burdensome deadlines to submit documents and to undergo the “education” process. These 45-day deadlines to submit documents are not supported by federal law or regulation; they are arbitrary deadlines. Yet, these deadlines must be met by the providers or the MACs will aver a 0% accuracy. Private payors may create and enforce arbitrary deadlines; they don’t have to follow federal Medicare regulations. But Medicare and Medicaid auditors must obey federal regulations. A quick search on Westlaw confirms that no provider has challenged the MACs’ TPE rules, at least, litigiously.

The TPE process begins by the MAC selecting a CPT/HCPC code and a provider. This selection process is a mystery. How the MACs decide to audit sleep studies versus chemotherapy administration or a 93675 versus a 93674 remains to be seen. According to one health care provider, which has undergone multiple TPE audits and has Noridian Healthcare Solutions as its MAC informed me that, at times, they may have 4 -5 TPE audits ongoing at the same time. CMS has touted that TPE audits do not overlap claims or cause the providers to undergo redundant audits. But if a provider bills numerous CPT codes, the provider can undergo multiple TPE audits concurrently, which is clearly not the intent of the TPE audits, in general. The provider has questioned ad nauseam the data analysis that alerted Noridian to assign the TPE to them in the first place. Supposedly, MACs target providers with claim activity that contractors deem as unusual. The usual TPE notification letter contains a six-month comparison table purportedly demonstrating the paid amount and number of claims for a particular CPT/HCPC code, but its accuracy is questionable. See below.

This particular provider ran its own internal reports, and regardless of how many different ways this provider re-calculated the numbers, the provider could not figure out the numbers the TPE letter was alleging they were billing. But, because of the short turnaround deadlines and harsh penalties for failing to adhere to these deadlines, this provider has been unable to challenge the MAC’s comparison table. The MACs have yet to share its algorithm or computer program used to govern (a) which provider to target; (b) what CPT code to target; and (c) how it determines the paid amount and number of claims.

Pushing back on the original data on which the MACs supposedly relied upon to initially target you is an important way to defend yourself against a TPE audit. Unmask the wolf from the beginning. If you can debunk the reason for the TPE audit in the first place, the rest of the findings of the TPE audit cannot be valid. It is the classic “fruit of the poisonous tree” argument. Yet according to a quick search on Westlaw, no provider has appealed the reason for selection yet. For example, in the above image, the MAC compared one CPT code (78452) for this particular provider for dates of services January 1, 2017, through June 30, 2017, and then compared those claims to dates July 1, 2017, through December 31, 2017. Why? How is a comparison of the first half of a year to a second end of a year even relevant to your billing compliance? Before an independent tribunal, this chart, as supposed evidence of wrongdoing, would be thrown out as ridiculous. The point is – the MACs are using similar, yet irrelevant charts as proof of alleged, aberrant billing practices.

Another way to defend yourself is to contest the auditors/surveyors background knowledge. Challenging the knowledge of the nurse reviewer(s) and questioning the denial rate in relation to your TPE denials can also be successful. I had a dentist-client who was audited by a dental hygienist. Not to undermine the intelligence of a dental hygienist, but you can understand the awkwardness of a dental hygienist questioning a dentist’s opinion of the medical necessity of a service. If the auditor/surveyor lacks the same level of education of the health care provider, an independent tribunal will defer to the more educated and experienced decisions. This same provider kept a detailed timeline of their interactions with the hygienist reviewer(s), which included a summary of the conversations. Significantly, notes of conversations with the auditor/surveyor would normally not be allowed as evidence in a Court of law due to the hearsay rules. However, contemporaneous notes of conversations written in close time proximity of the conversation fall within a hearsay exception and can be admitted.

Pushing back on the MACs and/or formally appealing the MAC’s decisions are/is extremely important in getting the correct denial rate. If your appeal is favorable, the MACs will take into your appeal results into account and will factor the appeal decision into the denial rate.

The upshot is – do not accept the sheep’s clothing. Understand that you are under target during this TPE “educational” audit. Understand how to defend yourself and do so. Call the Woodsman. Get the hatchet.

Medicare TPE Audits: A Wolf in Sheep’s Clothing

Let’s talk targeted probe-and-educate (TPE) audits. See on RACMonitor as well.

TPE audits have turned out to be “wolf audits” in sheep’s clothing. The Centers for Medicare & Medicaid Services (CMS) asserted that the intent of TPE audits is to reduce provider burden and appeals by combining medical review with provider education.

But the “education” portion is getting overlooked. Instead, the Medicare Administrative Contractors (MACs) resort to referring healthcare providers to other agencies or contractors for “other possible action,” including audit by a Recovery Audit Contractor (RAC), which can include extrapolation or referral to the U.S. Department of Health and Human Services (HHS) Office of Inspector General (OIG) for investigation of fraud. A TPE audit involves up to three rounds of review, conducted by a MAC. Once Congress was instructed that RAC audits are not fair, and providers complained that RAC auditors did not help with education, CMS came up with TPE audits – which, supposedly, had more of an educational aspect, and a more fair approach. But in reality, the TPE audits have created an expensive, burdensome, cyclical pattern that, again, can result in RAC audits. The implementation of TPE audits has been just as draconian and subjective as RAC audits. The penalties can be actually worse than those resulting from RAC audits, including termination from the Medicare program. In this article, I want to discuss the appeal process and why it is important to appeal at the first level of audit.

Chapter Three, Section 3.2.5 of the Medicare Program Integrity Manual (MPIM) outlines the requirements for the TPE process, which leaves much of the details within the discretion of the MAC conducting the review. The MACs are afforded too much discretion. Often, they make erroneous decisions, but providers are not pushing back. A recent one-time notification transmittal provides additional instructions to MACs on the TPE process: CMS Transmittal 2239 (Jan. 24, 2019).

Providers are selected for TPE audit based on data analysis, with CMS instructing MACs to target providers with high denial rates or claim activity that the contractor deems unusual, in comparison to peers. These audits are generally performed as a prepayment review of claims for a specific item or service, though relevant CMS instructions also allow for post-payment TPE audits.

A TPE round typically involves a review of a probe sample of between 20 and 40 claims. Providers first receive notice that they have been targeted by their MAC, followed by additional documentation requests (ADRs) for the specific claims included in the audit.

The MACs have sole discretion as to which providers to target, whether claims meet coverage requirements, what error rate is considered compliant, and when a provider should be removed from TPE. Health care providers can be exposed to future audits and penalties based merely on the MAC’s resolve, and before the provider has received due process through their right to challenge claim denials in an independent appeals process. In this way, the MACs’ misinterpretation of the rules and misapplication of coverage requirements can lead to further audits or disciplinary actions, based on an erroneous determination that is later overturned. Similarly, while the educational activities are supposedly meant to assist providers in achieving compliance, in reality, this “education” can force providers to appear to acknowledge error findings with which they may disagree – and which may ultimately be determined to be wrong. Often times, the MACs – for “educational purposes” – require the provider to sign documentation that admits alleged wrongdoing, and the provider signs these documents without legal counsel, and without the understanding that these documents can adversely affect any appeal or future audits.

The MACs have the power, based on CMS directive, to revoke billing privileges based on a determination that “the provider or supplier has a pattern or practice of submitting claims that fail to meet Medicare requirements.” 42 C.F.R. § 424.535(a)(8)(ii). This language shows that TPE audit findings can be used as a basis for a finding of abuse of billing privileges, warranting removal from participation in the Medicare program. CMS guidance also gives the MACs authority to refer providers for potential fraud investigation, based on TPE review findings. It is therefore vital that providers submit documentation in a timely fashion and build a clear record to support their claims and compliance with Medicare requirements.

TPE audits promise further education and training for an unsuccessful audit (unsuccessful according to the MAC, which may constitute a flawed opinion), but most of the training is broad in nature and offered remotely – either over the phone, via web conference, or through the mail, with documentation shared on Google Docs. Only on atypical occasions is there an on-site visit.

Why appeal? It’s expensive, tedious, time-consuming, and emotionally draining. Not only that, but many providers are complaining that the MACs inform them that the TPE audit results are not appealable (TPE audits ARE appealable).

TPE reviews and TPE audit overpayment determinations may be appealed through the Medicare appeals process. The first stage of appeal will be to request a redetermination of the overpayment by the MAC. If the redetermination decision is unfavorable, Medicare providers and suppliers may request an independent review by filing a request for reconsideration with the applicable Qualified Independent Contractor (QIC). If the reconsideration decision is unfavorable, Medicare providers and suppliers are granted the opportunity to present their case in a hearing before an administrative law judge (ALJ). While providers or suppliers who disagree with an ALJ decision may appeal to the Medicare Appeals Council and then seek judicial review in federal district court, it is crucial to obtain experienced healthcare counsel to overturn the overpayment determination during the first three levels of review.

Appealing unfavorable TPE audits results sends a message. Right now, the MACs hold the metaphoric conch shell. The Medicare appeals process allows the provider or supplier to overturn the TPE audit overpayment, and reduces the likelihood of future TPE reviews, other Medicare audits, and disciplinary actions such as suspension of Medicare payments, revocation of Medicare billing privileges, or exclusion from the Medicare program. In instances when a TPE audit identifies potential civil or criminal fraud, it is essential that the Medicare provider or supplier engage experienced healthcare counsel to appeal the Medicare overpayment as the first step in defending its billing practices, and thus mitigating the likelihood of fraud allegations (e.g., False Claims Act actions).

CMS and the MACs maintain that TPEs are in the providers’ best interest because education is included. In actuality, TPEs are wolves in sheep’s clothing, masking true repercussions in a cloak of “education.” The Medicare appeal process is a provider’s best weapon.

Non-Profit Going For-Profit: Merger Mania Manifests

According to the American Hospital Association, America has 4,840 general hospitals that aren’t run by the federal government: 2,849 are nonprofit, 1,035 are for-profit and 956 are owned by state or local governments.

What is the distinction between a for-profit and not-for-profit hospital… besides the obvious? The obvious difference is that one is “for-profit” and one is “not-for-profit” – but any reader of the English language would be able to tell you that. Unknown to some is that the not-for-profit status does not mean that the hospital will not make money; the status has nothing to do with a hospitals bottom line. Just ask any charity that brings in millions of dollars.

The most significant variation between non-profit and for-profit hospitals is tax status. Not-for-profit hospitals are exempt from state and local taxes. Some say that for-profit hospitals have to be more cost-effective because they have sales taxes and property taxes. I can understand that sentiment. Sales taxes and property taxes are nothing to sneeze at.

The organizational structure and culture also varies at for-profit hospitals rather than not-for-profit hospitals. For-profit hospitals have to answer to shareholders and/or investors. Those that are publicly traded may have a high attrition rate at the top executive level because when poor performance occurs heads tend to roll.

Bargaining power is another big difference between for-profit and non-profit. For-profit has it while non-profit, generally, do not. The imbalance of bargaining power comes into play when the government negotiates its managed care contracts. I also believe that bargaining power is a strong catalyst in the push for mergers. Being a minnow means that you have insect larvae and fish eggs to consume. Being a whale, however, allows you to feed on sea lion, squid, and other larger fish.

Merger Mania

A report conducted by the Health Research Institute showed 255 healthcare merger and acquisition (M&A) deals in the second quarter of 2018. Just the second quarter! According to the report, deal volume is up 9.4% since last year.

The most active sub-sector in the second quarter of 2018 is long-term care, with 104 announced healthcare M&A deals representing almost 41% of deal volume.

The trend today is that for-profit hospitals are buying up smaller, for-profit hospitals and, any and all, not-for-profit hospitals. The upshot is that hospitals are growing larger, more massive, more “corporate-like,” and less community-based. Is this trend positive or negative? I will have to research whether the prices of services increase at hospitals that are for-profit rather than not-for-profit, but I have a gut feeling that they do. Not that prices are the only variable to determine whether the merger trend is positive or negative. From the hospital’s perspective, I would much rather be the whale, not the minnow. I would feel much more comfortable swimming around.

My opinion is that, as our health care system veers toward value-based reimbursement and this metamorphous places financial pressure on providers, health care providers are struggling for more efficient means of cost control. The logical solution is to merge and buy up the smaller fish until your entity is a whale. Whales have more bargaining power and more budget.

In 2017, 29 for-profit companies bought 18 for-profit hospitals and 11 not-for-profits, according to an analysis for Kaiser Health News.

10 hospital M&A transactions involved health care organizations with net revenues of $1 billion or more in 2017.

Here, in NC, Mission Health, a former, not-for-profit hospital in Asheville, announced in March 2018 that HCA Healthcare, the largest, for-profit, hospital chain would buy it for $1.5 billion. The NC Attorney General had to sign off on the deal since the deal involved a non-profit turning for-profit, and he did ultimately did sign off on it.

Regardless your opinion on the matter, merger mania has manifested. Providers need to determine whether they want to be a whale or a minnow.

The Courts Order Medicare to Stop Recouping Alleged Overpayments Without Due Process!

New case law supports due process for Medicare providers. As first seen on RACMonitor.

Due process is one of the cornerstones of our society. Due process is the universal guarantee and found in the Fifth Amendment to the United States Constitution, which provides “No person shall…be deprived of life, liberty, or property, without due process of law,” and is applied to all states by the 14th Amendment. From this basic principle flows many legal decisions determining both procedural and substantive rights.

For Medicare and Medicaid providers, however, due process, in the past, has been nonexistent. Imagine that you are accused of owing $5 million to the government. Perhaps it was a CPT® code error. You disagree. You believe that your documentation was proper and that you filed for reimbursement correctly. You appeal the decision that you owe $5 million. You continue conducting business as normal. Suddenly, you realize the government is recouping the $5 million now. Prior to any hearing before a judge. You haven’t been found guilty. What happened to innocent until proven guilty? What happened to due process?

For Medicare appeals there is a five-step appeal process. The law requires the government not to recoup during the first and second levels of appeal. But the first and second levels are jumping through hoops and are not normally successful. It is at the third level – the appeal to an impartial administrative judge – that the alleged recoupments are overturned.

After the second level, according to the black letter of the law, the government can begin recouping the alleged overpayment.

Sadly, in the past, the courts have held that it is proper for the government to recoup reimbursements after the second level. Even though, no hearing has been held before an impartial judge and you haven’t been found guilty of owing the money.

On Sept. 27, 2018, another U.S. District Court in South Carolina has agreed with courts in Texas by granting a provider’s request for a Temporary Restraining Order (TRO) to prevent the Centers for Medicare and Medicaid Services (CMS) from recouping monies until after Administrative Law Judge (ALJ) hearings have been held (Accident, Injury and Rehabilitation, PC, c/a No. 4:18-cv-02173, September 27, 2018).

A new trend in favor of providers seems to be arising. This is fantastic news for providers across the country!

Accident, Injury & Rehab, PC found that the ALJ stage of the appellate process is the most important for providers, as it provides the first opportunity for plaintiff to cross examine defendant’s witnesses and examine the evidence used to formulate the statistical sample. According to the American Hospital Association (AHA), 66 percent of Recovery Audit Contractor (RAC) denials are reversed by an ALJ (I actually believe the percentage is higher). The court found that plaintiff’s procedural due process rights were violated by premature recoupment. The court granted Accident, Injury & Rehab, PC’s preliminary injunction restraining and enjoining the government from withholding Medicare payments during the appeal process.

When the government starts recouping filing a preliminary injunction has been shown it to be the best course.

In the past, most preliminary injunctions asking the court to order the government to stop recoupments until a hearing was held was dismissed based on jurisdiction. In other words, the courts held that the courts did not have the authority to render an opinion as to recoupments prior to a hearing. Now, however, the trend is turning, and courts are starting to rule in favor of the provider, finding a violation of procedural due process based on a collateral claim exception.

There are four criteria in order to win a preliminary injunction. A party seeking a preliminary injunction must establish all for the following criteria: (1) that the party is likely to succeed on the merits; (2) that the party is likely to suffer irreparable harm in the absence of preliminary injunction; (3) that the balance of the equity tips in the party’s favor; and (4) that injunction is in the public interest.

There is an esoteric legal theory called exhaustion of administrative remedies. So jurisdiction is the question. There are exceptions to the judicial bar. The Supreme Court of United States articulated a collateral claim exception. The Supreme Court permitted a plaintiff to bring a procedural due process claim requesting an evidentiary area hearing before the termination of disability benefits. There are nonwaivable and waivable jurisdictional elements the nonwaivable requirement is that a claim must be presented to the administrative agency. The waivable requirement is that administrative remedies be exhausted.

The Collateral claim exception is when a party brings a claim in federal court when that “constitutional challenge is entirely collateral to its substantive claim of entitlement.”

The new trend in case law is that the courts are finding that the provider’s right to not undergo recoupment during the appeal process is a collateral issue as to the substantive issue of whether the provider owes the money. Therefore, the courts have found jurisdiction as to the collateral issue.

The proverbial ship has sailed. According to courts in Texas and now South Carolina, CMS cannot recoup monies prior to hearings before ALJs. Providers facing large recoupments should file TROs to prevent premature recoupments and to obtain due process.

Hasty and Careless Termination Decisions Can Put Medicare/caid Providers Out of Business

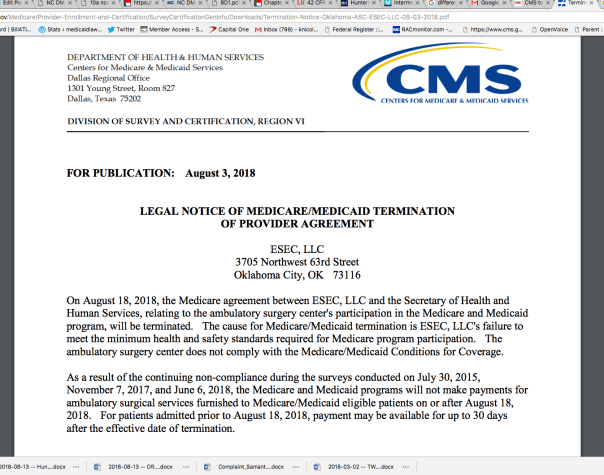

When action happens in the Medicare/caid world, it happens quickly. Sometimes you do not receive adequate notice to coordinate continuity of care for your consumers or patients. For example, on August 3, 2018, the Center for Medicare and Medicaid Services announced that at midnight on August 18, 2018, it would be terminating the contract between CMS and ESEC, LLC, an Oklahoma-based surgery center.

CMS provided ESEC 15 days notice of complete termination of Medicare and Medicaid reimbursements. Now I do not know the details of ESEC’s financial reliance on Medicare or Medicaid, but, these days, few providers are solely third-party pay or cash-only. I can only assume that ESEC is scrambling to initiate a lawsuit to remain afloat and open for business. Or ESEC is praying for a “rescind” by correcting whatever issues it purportedly had. Personally, I would not count on a possible rescind. I would be proactively seeking legal intervention.

Here are some examples of recent terminations and the notice received by the providers:

- Baylor St. Luke’s Medical Center’s heart transplant program lost federal funding August 17, 2018. The hospital will no longer be able to bill Medicare and Medicaid for heart transplants.

- Effective August 9, 2018, Brookwood Baptist Medical Center’s Medicare contract was terminated. The notice was published July 25, 2018.

- As of August 12, 2018, The Grandview Nursing & Rehabilitation Facility’s Medicare contract was terminated. Notice of the termination was published August 1, 2018.

- As of September 1, 2018, Compassus-Kansas City, a hospice company, will lose its Medicare contract. Notice was provided August 17, 2018.

- On August 3, 2018, CMS announced that it was terminating Deligent Health Services Inc.’s Medicare and Medicaid contact, effective December 5, 2017. (That is quite a retroactive timeframe).

Can Careless Judy put a healthcare provider out of business?

This happens all the time. Sure, ESEC probably had knowledge that CMS was investigating it. However, CMS has the authority to issue these public notices of termination without holding a hearing to determine whether CMS’ actions are accurate. What if Careless Judy in Program Integrity made a human error and ESEC actually does meet the standards of care. But you see, Careless Judy accidentally used the minimum standards of care from 2008 instead of 2018. It’s an honest mistake. She had no malice against ESEC. But, my point is – where is the mechanism that prevents a surgical ambulatory center from going out of business – just because Careless Judy made a mistake?

To look into whether any legal mechanism exists to prevent Careless Judy from putting the ambulatory center out of business, I turn to the legal rules.

42 CFR 488.456 governs terminations of provider agreements. Subsection (a) state that termination “ends – (1) Payment to the facility; and (2) Any alternative remedy.”

Subsection (b) states that CMS or the State may terminate the contract with the provider if the provider “Is not in substantial compliance with the requirements of participation, regardless whether immediate jeopardy is present.” On the bright side, if no immediate jeopardy exists then CMS or the State must give 15 days notice. If there is found to be immediate jeopardy, the provider get 2 days. But who determines what is “substantial compliance?” Careless Judy?

42 CFR 489.53 lists the reasons on which CMS may rely to terminate a provider. Although, please note, that the regulations use the word “may” and not “must.” So we have some additional guidance as to when a provider’s contract may be terminated, but it still seems subjective. Here are the reasons:

- The provider is not complying with the provisions of title XVIII and the applicable regulations of this chapter or with the provisions of the agreement.

- The provider or supplier places restrictions on the persons it will accept for treatment and it fails either to exempt Medicare beneficiaries from those restrictions or to apply them to Medicare beneficiaries the same as to all other persons seeking care.

- It no longer meets the appropriate conditions of participation or requirements (for SNFs and NFs) set forth elsewhere in this chapter. In the case of an RNHCI no longer meets the conditions for coverage, conditions of participation and requirements set forth elsewhere in this chapter.

- It fails to furnish information that CMS finds necessary for a determination as to whether payments are or were due under Medicare and the amounts due.

- It refuses to permit examination of its fiscal or other records by, or on behalf of CMS, as necessary for verification of information furnished as a basis for payment under Medicare.

- It failed to furnish information on business transactions as required in § 420.205 of this chapter.

- It failed at the time the agreement was entered into or renewed to disclose information on convicted individuals as required in § 420.204 of this chapter.

- It failed to furnish ownership information as required in § 420.206 of this chapter.

- It failed to comply with civil rights requirements set forth in 45 CFR parts 80, 84, and 90.

- In the case of a hospital or a critical access hospital as defined in section 1861(mm)(1) of the Act that has reason to believe it may have received an individual transferred by another hospital in violation of § 489.24(d), the hospital failed to report the incident to CMS or the State survey agency.

- In the case of a hospital requested to furnish inpatient services to CHAMPUS or CHAMPVA beneficiaries or to veterans, it failed to comply with § 489.25 or § 489.26, respectively.

- It failed to furnish the notice of discharge rights as required by § 489.27.

- The provider or supplier refuses to permit copying of any records or other information by, or on behalf of, CMS, as necessary to determine or verify compliance with participation requirements.

- The hospital knowingly and willfully fails to accept, on a repeated basis, an amount that approximates the Medicare rate established under the inpatient hospital prospective payment system, minus any enrollee deductibles or copayments, as payment in full from a fee-for-service FEHB plan for inpatient hospital services provided to a retired Federal enrollee of a fee-for-service FEHB plan, age 65 or older, who does not have Medicare Part A benefits.

- It had its enrollment in the Medicare program revoked in accordance to § 424.535 of this chapter.

- It has failed to pay a revisit user fee when and if assessed.

- In the case of an HHA, it failed to correct any deficiencies within the required time frame.

- The provider or supplier fails to grant immediate access upon a reasonable request to a state survey agency or other authorized entity for the purpose of determining, in accordance with § 488.3, whether the provider or supplier meets the applicable requirements, conditions of participation, conditions for coverage, or conditions for certification.

As you can see from the above list of possible termination reasons, many of which are subjective, it could be easy for Careless Judy to terminate a Medicare contract erroneously, based on inaccurate facts, or without proper investigation.

The same is true for Medicaid; your contract can be terminated on the federal or state level. The difference is that at the state level, Careless Judy is a state employee, not a federal.

42 CFR 498.5 governs appeal rights for providers contract terminations. Subsection (b) states that “Any provider dissatisfied with an initial determination to terminate its provider agreement is entitled to a hearing before an ALJ.”

42 CFR 498.20 states that an initial determination by CMS (like a contract termination) is binding unless it is reconsidered per 42 CFR 498.24.

A Stay of the termination should suspend the termination until the provider can obtain a hearing by an impartial tribunal until the appeal has been completed. The appeal process and supposed automatic Stay of the termination is the only protection for the provider from Careless Judy. Or filing an expensive injunction.