Virginia behavioral health care providers that accept Medicaid are under statewide blanket fire.

Without warning or provocation, the Managed Care Organizations (MCOs) recently began a mass firing, terminating all Medicaid behavioral health care providers “without cause.” Since the terminations involved multiple MCOs that were not ostensibly connected by business organization, involving providers across the state, it became immediately clear that the MCOs may have planned the terminations together.

Why are the MCOs doing this, you might ask? If you were charged with managing a firehose of Medicaid dollars, would you rather deal with 100 small providers or two large providers? This appears to be discrimination based on size.

Thankfully, for the behavioral healthcare providers of Virginia, they had an association, which is run by a tenacious woman with energy like the Energizer Bunny and passion like a tsunami. Caliber Virginia is the association heading the defense.

This is not my first rodeo with large-scale litigation regarding Medicare or Medicaid. I represented four behavioral healthcare providers in the New Mexico debacle through the administrative process. I have brought class-action lawsuits based on the computer software program implemented by the state to manage Medicaid funds. I have been successful in federal courts in obtaining federal injunctions staying terminations of Medicaid provider contracts.

Since I was contacted by Caliber Virginia, I have reviewed multiple contracts between providers and MCOs, termination letters, and federal and state law, listened to the stories of the providers that are facing imminent closure, and brainstormed legal theories to protect the providers.

I came up with this – these MCOs cannot terminate these providers “without cause.” In fact, these MCOs cannot terminate these providers without good reason.

Under numerous Supreme Court holdings, most notably the Court’s holding in Board of Regents v. Roth, the right to due process under the law only arises when a person has a property or liberty interest at stake.

In determining whether a property interest exists, a Court must first determine that there is an entitlement to that property. Unlike liberty interests, property interests and entitlements are not created by the Constitution. Instead, property interests are created by federal or state law, and can arise from statute, administrative regulations, or contract.

Specifically, the Fourth Circuit Court of Appeals has determined that North Carolina Medicaid providers have a property interest in continued provider status. In Bowens v. N.C. Dept. of Human Res., the Fourth Circuit recognized that the North Carolina provider appeals process created a due-process property interest in a Medicaid provider’s continued provision of services, and could not be terminated “at the will of the state.” The Court determined that these due process safeguards, which included a hearing and standards for review, indicated that the provider’s participation was not “terminable at will.” The Court held that these safeguards created an entitlement for the provider, because it limits the grounds for termination, only for cause, and that such cause was reviewable. The Fourth Circuit reached the same result in Ram v. Heckler two years later. I foresee the same results in other appellate jurisdictions, but definitely again within the Fourth Circuit.

Since Ram, North Carolina Medicaid providers’ rights to continued participation has been strengthened through the passage of Chapter 108C. Chapter 108C expressly creates a right for existing Medicaid providers to challenge a decision to terminate participation in the Medicaid program in the Office of Administrative Hearings (OAH). It also makes such reviews subject to the standards of Article 3 of the Administrative Procedure Act (APA). Therefore, North Carolina law now contains a statutory process that confers an entitlement to Medicaid providers. Chapter 108C sets forth the procedure and substantive standards for which OAH is to operate, and gives rise to the property right recognized in Bowens and Ram. Similarly, the Virginia law provides an appeal process for providers to follow in accordance with the Virginia Administrative Process Act. See VA Code § 32.1-325 and 12 VAC 30-121-230.

In another particular case, a Medicare Administrative Contractor (MAC) terminated a provider’s ability to deliver four CPT® codes, which comprised of over 80 percent of the provider’s bailiwick, severely decreasing the provider’s funding source, not to mention costing Medicare recipients’ access to care and choice of provider.

The MAC’s contention was that the provider was not really terminated, since they could still participate in the network in ways. But the company was being terminated from providing certain services.

The Court found that the MAC’s contention that providers have no right to challenge a termination was without merit. And, rightfully so, the Court stated that if the MAC’s position were correct, the appeals process provided by law would be meaningless. This was certainly not the case.

The MAC’s contention that it operates a “closed network” and thus can terminate a provider at its sole discretion was also not supported by the law. No MAC or MCO can cite to any statute, regulation, or contract provision that gives it such authority. The statutory definition of “closed network” simply delineates those providers that have contracted with the Local Management Entity (LME) MCOs to furnish services to Medicaid enrollees. The MAC was relying on its own definition of “closed network” to exercise complete and sole control and discretion, which is without foundation and/or any merit. Nothing in the definition of “closed network” indicates that MACs or MCOs have absolute discretion to determine which existing providers can remain in the closed network.

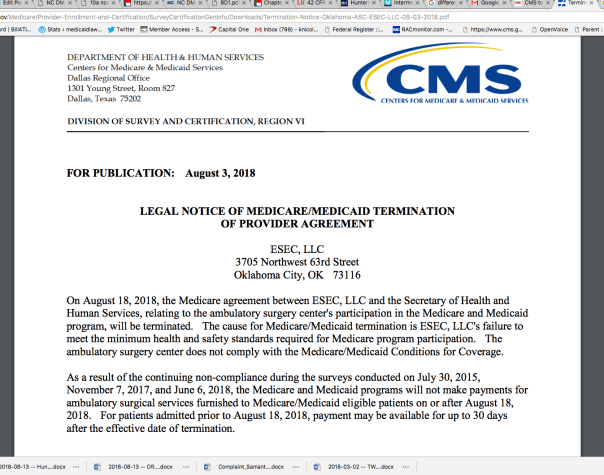

It is well-settled law that there is a single state agency responsible for Medicare and Medicaid: The Centers for Medicare & Medicaid Services (CMS). Case law dictates that the responsibility cannot be delegated away. A supervisory role, at the very least, must be maintained.

On the Medicaid level, 42 CFR § 438.214, titled “Provider Selection,” requires the state to ensure, through a contract, that each MCO PIHP (Prepaid Inpatient Health Plan) “implements written policies and procedures for selection and retention of providers.”) A plain reading of the law makes clear that MCOs that operate a PIHP are required to have written policies and procedures for retention of providers. Requiring policies and procedures would be pointless if they are not followed.

The Medicare Provider Manual and any the provisions of a request for proposal (RFP) must be adhered to, pursuant to the federal regulation and the state contracts. To the extent that Alliance’s policy states that it can decide not to retain a provider for any reason at its sole discretion, such a policy does not conform with federal law or the state requirements.

On the Medicare level, 42 U.S.C. § 405(h) spells out the judicial review available to providers, which is made applicable to Medicare by 42 U.S.C. § 1395ii. Section 405(h) aims to lay out the sole means by which a court may review decisions to terminate a provider agreement in compliance with the process available in § 405(g). Section 405(g) lays out the sole process of judicial review available in this type of dispute. The Supreme Court has endorsed the process, for nearly two decades, since its decision in Shalala v. Illinois Council on Long Term Care, Inc., holding that providers are required to abide by the provisions of § 405(g) providing for judicial review only after the administrative appeal process is complete.

The MACs and the MCOs cannot circumvent federal law and state requirements regarding provider retention by creating a policy that allows them to make the determination for any reason in its sole discretion. Such a provision is tantamount to having no policies and procedures at all.

If you or someone you know is being terminated in Virginia, please contact me – kemanuel@potomasclaw.com, or Caliber Virginia – calibervaed@gmail.com.

Caliber Virginia, formerly known as the Association for Community-Based Service Providers (ACBP), was established in 2006 to provide support, resources, and information with a united, well-informed and engaged voice among the community-based behavioral and mental health service providers of the Commonwealth. Caliber Virginia represents organizations that provide health and human services and supports for children, adults, and families in the areas of mental health, substance use disorders, developmental disabilities, child and family health and well-being, and other related issue areas. Its member providers deliver quality health and human services to over 500,000 of Virginia’s residents each year. Caliber Virginia promotes equal opportunity, economic empowerment, independent living, and political participation for people with disabilities, including mental health diagnoses.

Programming Note:

Listen to Knicole Emanuel’s live reporting on this story Monday, Sept. 23, 2019, on Monitor Monday, 10-10:30 a.m. EST.

First published on RACMonitor

Break Room

Break Room Conference Room

Conference Room