Blog Archives

Instead of Orange, Medicare Advantage Audits Are the New Black

In case you didn’t know, instead of orange, Medicare Advantage is the new black. Since MA plans are paid more for sicker patients, there are huge incentives to fabricate co-morbidities that may or may not exist.

Medicare Advantage will be the next most audited arena. Home health, BH, and the two-midnight rule had held the gold medal for highest number of audits, but MA will soon prevail.

As an example, last week- a New York health insurance plan for seniors, along with amedical analytics company the insurer is affiliated with, was accused by the Justice Department of committing health care fraud to the tune of tens of millions of dollars. The dollar amounts are exceedingly high, which also attracts auditors, especially the auditors who are paid on contingency fee, which is almost all the auditors.

CMS pays Medicare Advantage plans using a complex formula called a “risk score,” which is intended to render higher rates for sicker patients and less for those in good health. The data mining company combed electronic medical records to identify missed diagnoses — pocketing up to 20% of new revenue it generated for the health plan. But the Department of Justice alleges that DxID’s reviews triggered “tens of millions” of dollars in overcharges when those missing diagnoses were filled in with exaggerations of how sick patients were or with charges for medical conditions the patients did not have. “All problems are boring until they’re your own.” – Red

MA plans have grown to now cover more than 40% of all Medicare beneficiaries, so too has fraud and abuse. A 2020 OIG report found that MA paid $2.6 billion a year for diagnoses unrelated to any clinical services.

Diagnoses fraud is the main issue that auditors are focusing on. Juxtapose the other alphabet soup auditors – MACs, SMRCs, UPICs, ZPICs, MCOs, TPEs, RACs – they concentrate on documentation nitpicking. I had a client accused of FWA for using purple ink. “Yeah I said stupid twice, only to emphasize how stupid that is!” – Pennsatucky. Other examples include purported failing of writing the times “in or out” when the CPT code definition includes the amount of time.

Audits will be ramping up, especially since HHS has reduced the Medicare appeals backlog at the Administrative Judge Level by 79 percent, which puts the department on track to clear the backlog by the end of the 2022 fiscal year.

As of June 30, 2021, the end of the third quarter of FY 2021, HHS had 86,063 pending appeals remaining at OMHA, according to the latest status report, acquired by the American Hospital Association. The department started with 426,594 appeals. This is progress!!

FACT SHEET: EXPANSION OF THE ACCELERATED AND ADVANCE PAYMENTS PROGRAM FOR PROVIDERS AND SUPPLIERS DURING COVID-19 EMERGENCY

CMS published the below fact sheet for providers yesterday (March 28, 2020).

In order to increase cash flow to providers of services and suppliers impacted by the 2019 Novel Coronavirus (COVID-19) pandemic, the Centers for Medicare & Medicaid Services (CMS) has expanded our current Accelerated and Advance Payment Program to a broader group of Medicare Part A providers and Part B suppliers. The expansion of this program is only for the duration of the public health emergency. Details on the eligibility, and the request process are outlined below.

The information below reflects the passage of the CARES Act (P.L. 116-136).

Accelerated/Advance Payments

An accelerated/advance payment is a payment intended to provide necessary funds when there is a disruption in claims submission and/or claims processing. These expedited payments can also be offered in circumstances such as national emergencies, or natural disasters in order to accelerate cash flow to the impacted health care providers and suppliers.

CMS is authorized to provide accelerated or advance payments during the period of the public health emergency to any Medicare provider/supplier who submits a request to the appropriate Medicare Administrative Contractor (MAC) and meets the required qualifications.

Eligibility & Process

Eligibility: To qualify for advance/accelerated payments the provider/supplier must:

1. Have billed Medicare for claims within 180 days immediately prior to the date of signature on the provider’s/supplier’s request form

2. Not be in bankruptcy,

3. Not be under active medical review or program integrity investigation, and

4. Not have any outstanding delinquent Medicare overpayments.

Amount of Payment: Qualified providers/suppliers will be asked to request a specific amount using an Accelerated or Advance Payment Request form provided on each MAC’s website. Most providers and suppliers will be able to request up to 100% of the Medicare payment amount for a three-month period. Inpatient acute care hospitals, children’s hospitals, and certain cancer hospitals are able to request up to 100% of the Medicare payment amount for a six-month period. Critical access hospitals (CAH) can request up to 125% of their payment amount for a six-month period.

Processing Time: Each MAC will work to review and issue payments within seven (7) calendar days of receiving the request.

Repayment: CMS has extended the repayment of these accelerated/advance payments to begin 120 days after the date of issuance of the payment. The repayment timeline is broken out by provider type below:

o Inpatient acute care hospitals, children’s hospitals, certain cancer hospitals, and Critical Access Hospitals (CAH) have up to one year from the date the accelerated payment was made to repay the balance.

o All other Part A providers and Part B suppliers will have 210 days from the date of the accelerated or advance payment was made to repay the balance. The payments will be recovered according to the process described in number 7 below. •

Recoupment and Reconciliation: o The provider/supplier can continue to submit claims as usual after the issuance of the accelerated or advance payment; however, recoupment will not begin for 120 days. Providers/ suppliers will receive full payments for their claims during the 120-day delay period. At the end of the 120-day period, the recoupment process will begin and every claim submitted by the provider/supplier will be offset from the new claims to repay the accelerated/advanced payment. Thus, instead of receiving payment for newly submitted claims, the provider’s/supplier’s outstanding accelerated/advance payment balance is reduced by the claim payment amount. This process is automatic. o The majority of hospitals including inpatient acute care hospitals, children’s hospitals, certain cancer hospitals, and critical access hospitals will have up to one year from the date the accelerated payment was made to repay the balance. That means after one year from the accelerated payment, the MACs will perform a manual check to determine if there is a balance remaining, and if so, the MACs will send a request for repayment of the remaining balance, which is collected by direct payment. All other Part A providers not listed above and Part B suppliers will have up to 210 days for the reconciliation process to begin. o For the small subset of Part A providers who receive Period Interim Payment (PIP), the accelerated payment reconciliation process will happen at the final cost report process (180 days after the fiscal year closes). A step by step application guide can be found below. More information on this process will also be available on your MAC’s website.

Step-by-Step Guide on How to Request Accelerated or Advance Payment

1. Complete and submit a request form: Accelerated/Advance Payment Request forms vary by contractor and can be found on each individual MAC’s website. Complete an Accelerated/Advance Payment Request form and submit it to your servicing MAC via mail or email. CMS has established COVID-19 hotlines at each MAC that are operational Monday – Friday to assist you with accelerated payment requests. You can contact the MAC that services your geographic area.

To locate your designated MAC, refer to https://www.cms.gov/Medicare/Medicare-Contracting/Medicare-AdministrativeContractors/Downloads/MACs-by-State-June-2019.pdf.

CGS Administrators, LLC (CGS) – Jurisdiction 15 (KY, OH, and home health and hospice claims for the following states: DE, DC, CO, IA, KS, MD, MO, MT, NE, ND, PA, SD, UT, VA, WV, and WY) The toll-free Hotline Telephone Number: 1-855-769-9920 Hours of Operation: 7:00 am – 4:00 pm CT The toll-free Hotline Telephone Number for Home Health and Hospice Claims: 1-877-299- 4500 Hours of Operation: 8:00 am – 4:30 pm CT for main customer service and 7:00 am – 4:00 pm CT for the Electronic Data Interchange (EDI) Department

First Coast Service Options Inc. (FCSO) – Jurisdiction N (FL, PR, US VI) The toll-free Hotline Telephone Number: 1-855-247-8428 Hours of Operation: 8:30 AM – 4:00 PM ET

National Government Services (NGS) – Jurisdiction 6 & Jurisdiction K (CT, IL, ME, MA, MN, NY, NH, RI, VT, WI, and home health and hospice claims for the following states: AK, AS, AZ, CA, CT, GU, HI, ID, MA, ME, MI, MN, NH, NV, NJ, NY, MP, OR, PR, RI, US VI, VT, WI, and WA) The toll-free Hotline Telephone Number: 1-888-802-3898 Hours of Operation: 8:00 am – 4:00 pm CT

Novitas Solutions, Inc. – Jurisdiction H & Jurisdiction L (AR, CO, DE, DC, LA, MS, MD, NJ, NM, OK, PA, TX, (includes Part B for counties of Arlington and Fairfax in VA and the city of Alexandria in VA)) The toll-free Hotline Telephone Number: 1-855-247-8428 Hours of Operation: 8:30 AM – 4:00 PM ET

Noridian Healthcare Solutions – Jurisdiction E & Jurisdiction F (AK, AZ, CA, HI, ID, MT, ND, NV, OR, SD, UT, WA, WY, AS, GU, MP) The toll-free Hotline Telephone Number: 1-866-575-4067 Hours of Operation: 8:00 am – 6:00 pm CT

Palmetto GBA – Jurisdiction J & Jurisdiction M (AL, GA, NC, SC, TN, VA (excludes Part B for the counties of Arlington and Fairfax in VA and the city of Alexandria in VA), WV, and home health and hospice claims for the following states: AL, AR, FL, GA, IL, IN, KY, LA, MS, NM, NC, OH, OK, SC, TN, and TX) The toll-free Hotline Telephone Number: 1-833-820-6138 Hours of Operation: 8:30 am – 5:00 pm ET

Wisconsin Physician Services (WPS) – Jurisdiction 5 & Jurisdiction 8 (IN, MI, IA, KS, MO, NE) The toll-free Hotline Telephone Number: 1-844-209-2567 Hours of Operation: 7:00 am – 4:00 pm CT 4 | Page Noridian Healthcare Solutions, LLC – DME A & D (CT, DE, DC, ME, MD, MA, NH, NJ, NY, PA, RI, VT, AK, AZ, CA, HI, ID, IA, KS, MO, MT, NE, NV, ND, OR, SD, UT, WA, WY, AS, GU, MP) The toll-free Hotline Telephone Numbers: A: 1-866-419-9458; D: 1-877-320-0390 Hours of Operation: 8:00 am – 6:00 pm CT CGS Administrators, LLC – DME B & C (AL, AR, CO, FL, GA, IL, IN, KY, LA, MI, MN, MS, NM, NC, OH, OK, SC, TN, TX, VA, WI, WV, PR, US VI) The toll-free Hotline Telephone Numbers: B: 866-590-6727; C: 866-270-4909 Hours of Operation: 7:00 am – 4:00 pm CT

2. What to include in the request form: Incomplete forms cannot be reviewed or processed, so it is vital that all required information is included with the initial submission. The provider/supplier must complete the entire form, including the following:

- Provider/supplier identification information:

- Legal Business Name/ Legal Name;

- Correspondence Address;

- National Provider Identifier (NPI);

- Other information as required by the MAC.

- Amount requested based on your need.

Most providers and suppliers will be able to request up to 100% of the Medicare payment amount for a three-month period. However, inpatient acute care hospitals, children’s hospitals, and certain cancer hospitals are able to request up to 100% of the Medicare payment amount for a six-month period. Critical access hospitals (CAH) can now request up to 125% of their payment amount for a six-month period.

7. Reason for request: i. Please check box 2 (“Delay in provider/supplier billing process of an isolated temporary nature beyond the provider’s/supplier’s normal billing cycle and not attributable to other third party payers or private patients.”); and ii. State that the request is for an accelerated/advance payment due to the COVID19 pandemic.

3. Who must sign the request form? The form must be signed by an authorized representative of the provider/supplier.

4. How to submit the request form: While electronic submission will significantly reduce the processing time, requests can be submitted to the appropriate MAC by fax, email, or mail. You can also contact the MAC provider/supplier helplines listed above.

5. What review does the MAC perform? Requests for accelerated/advance payments will be reviewed by the provider or supplier’s servicing MAC. The MAC will perform a validation of the following eligibility criteria:

- Has billed Medicare for claims within 180 days immediately prior to the date of signature on the provider’s or supplier’s request form,

- Is not in bankruptcy,

- Is not under active medical review or program integrity investigation,

- Does not have any outstanding delinquent Medicare overpayments.

6. When should you expect payment? The MAC will notify the provider/supplier as to whether the request is approved or denied via email or mail (based on the provider’s/supplier’s preference). If the request is approved, the payment will be issued by the MAC within 7 calendar days from the request.

7. When will the provider/supplier be required to begin repayment of the accelerated/ advanced payments? Accelerated/advance payments will be recovered from the receiving provider or supplier by one of two methods:

- For the small subset of Part A providers who receive Period Interim Payment (PIP), the accelerated payment will be included in the reconciliation and settlement of the final cost report.

- All other providers and suppliers will begin repayment of the accelerated/advance payment 120 calendar days after payment is issued.

8. Do provider/suppliers have any appeal rights? Providers/suppliers do not have administrative appeal rights related to these payments. However, administrative appeal rights would apply to the extent CMS issued overpayment determinations to recover any unpaid balances on accelerated or advance payments.

State Agencies Must Follow the State Medicare Plan! Or Else!

Accused of an alleged overpayment? Scrutinize the Department’s procedure to determine that alleged overpayment. One step out of line (in violation of any pertinent rule) by the Department and the overpayment is dismissed.

Ask yourself: Did the State follow Medicare State Plan Agreement? (The Plan germane in your State).

In a Mississippi Supreme Court case, the Mississippi Department of Medicaid (“DOM”) alleged that a hospital owed $1.2226 million in overpayments. However, the Court found that DOM failed to follow proper procedure in assessing the alleged overpayment. Since the DOM failed to follow the rules, the $1.2226 million alleged overpayment was thrown out.

The Court determined that the DOM, the single state agency charged with managing Medicare and Medicaid, must follow all pertinent rules otherwise an alleged overpayment will be thrown out.

Two cases premised on the notion that the DOM must follow all pertinent rules were decided in MS – with polar opposite endings.

- Crossgates River Oaks Hosp. v. Mississippi Div. of Medicaid, 240 So. 3d 385, 388 (Miss. 2018); and

- Cent. Mississippi Med. Ctr. v. Mississippi Div. of Medicaid, No. 2018-SA-01410-SCT, 2020 WL 728806, at *2–3 (Miss. Feb. 13, 2020).

In Crossgates, the hospitals prevailed because the DOM had failed to adhere to the Medicare State Plan Agreement. Applying the same legal principles in Cent. MS Med. Ctr, the DOM prevailed because the DOM adhered to the Medicaid State Plan.

It is as simple as the childhood game, “Simon Says.” Do what Simon (State Plan) says or you will be eliminated.

Crossgates

In the 2018 MS Supreme Court case, the Court found that the MS Department failed to follow the Medicare State Plan Agreement in determining an overpayment for a provider, which meant that the overpayment alleged was arbitrary. The thinking is as follows: had the Department followed the rules, then there may not be an overpayment or the alleged overpayment would be a different amount. Since the Department messed up procedurally, the provider got the whole alleged overpayment dismissed from Court. It is the “fruit of the poisonous tree” theory. See Crossgates River Oaks Hosp. v. Miss. Div. of Medicaid, 240 So. 3d 385 (Miss. 2018).

While Courts generally afford great deference to an agency’s interpretation of its regulations, once the agency violates a procedural rule, it is not entitled to that deference. The Court found that the DOM’s interpretation of Attachment 4.19–B of the State Plan was inconsistent with the relevant regulation. Crossgates River Oaks Hosp. v. Mississippi Div. of Medicaid, 240 So. 3d 385, 388 (Miss. 2018).

Throughout these proceedings, the DOM never articulated an explanation for its failure to exclude the radiology and laboratory charges or for its use of a blended rate in place of actual costs, absent altering or amending the State Plan. The clear language of the State Plan establishes that DOM’s choice to reduce payments to the Hospitals was arbitrary, capricious, and not supported by substantial evidence.

Central MS Medical Center

Juxtapose the Central Mississippi Medical Center case, which, by the way has not been released for publication. Atop the header for the case is the following warning:

With that caveat, the MS Supreme Court held that Medicaid State Plans that are accepted by CMS reign supreme and must be followed. In this case, the MS State Plan required the DOM to use the Medicare Notice of Program Reimbursement (NPR) to establish the final reimbursement.

According to the Supreme Court, the agency followed the rules. Thus, the agency’s adverse determination was upheld. It does not matter what the adverse determination was – you can insert any adverse determination into the equation. But the equation remains stedfast. The State must follow the State Plan in order to validate any adverse decision.

CMS Revises and Details Extrapolation Rules: Part II

Biggest RACs Changes Are Here: Learn to Avoid Denied Claims

See Part I: Medicare Audits: Huge Overhaul on Extrapolation Rules

Part II continues to explain the nuances in the changes made by CMS to its statistical sampling methodology. Originally published on RACMonitor.

The Centers for Medicare & Medicaid Services (CMS) recently made significant changes in its statistical sampling methodology for overpayment estimation. Effective Jan. 2, 2019, CMS radically changed its guidance on the use of extrapolation in audits by Recovery Audit Contractors (RACs), Medicare Administrative Contractors (MACs), Unified Program Integrity Contractors (UPICs), and the Supplemental Medical Review Contractor (SMRC).

The RAC program was created through the Medicare Modernization Act of 2003 (MMA) to identify and recover improper Medicare payments paid to healthcare providers under fee-for-service (FFS) Medicare plans. The RAC auditors review a small sample of claims, usually 150, and determine an error rate. That error rate is attributed to the universe, which is normally three years, and extrapolated to that universe. Extrapolation is similar to political polls – in that a Gallup poll will ask the opinions of 1-2 percent of the U.S. population, yet will extrapolate those opinions to the entire country.

First, I would like to address a listener’s question regarding the dollar amount’s factor in extrapolation cases. I recently wrote, “for example, if 500 claims are reviewed and one is found to be noncompliant for a total of $100, then the error rate is set at 20 percent.”

I need to explain that the math here is not “straight math.” The dollar amount of the alleged noncompliant claims factors into the extrapolation amount. If the dollar amount did not factor into the extrapolation, then a review of 500 claims with one non-compliant claim is 0.2 percent. The fact that, in my hypothetical, the one claim’s dollar amount equals $100 changes the error rate from 0.2 percent to 20 percent.

Secondly, the new rule includes provisions implementing the additional Medicare Advantage telehealth benefit added by the Bipartisan Budget Act of 2018. Prior to the new rule, audits were limited in the telehealth services they could include in their basic benefit packages because they could only cover the telehealth services available under the FFS Medicare program. Under the new rule, telehealth becomes more prominent in basic services. Telehealth is now able to be included in the basic benefit packages for any Part B benefit that the plan identifies as “clinically appropriate,” to be furnished electronically by a remote physician or practitioner.

The pre-Jan. 2, 2019 approach to extrapolation employed by RACs was inconsistent, and often statistically invalid. This often resulted in drastically overstated overpayment findings that could bankrupt a physician practice. The method of extrapolation is often a major issue in appeals, and the, new rules address many providers’ frustrations and complaints about the extrapolation process. This is not to say that the post-Jan. 2, 2019 extrapolation approach is perfect…far from it. But the more detailed guidance by CMS just provides more ways to defend against an extrapolation if the RAC auditor veers from instruction.

Thirdly, hiring an expert is a key component in debunking an extrapolation. Your attorney should have a relationship with a statistical expert. Keep in mind the following factors when choosing an expert:

- Price (more expensive is not always better, but expect the hourly rate to increase for trial testimony).

- Intelligence (his/her CV should tout a prestigious educational background).

- Report (even though he/she drafts a report, the report is not a substitute for testimony).

- Clusters (watch out for a sample that has a significant number of higher reimbursed claims. For example, if you generally use three CPT codes at an equal rate and the sample has an abnormal amount of the higher reimbursed claim, then you have an argument that the sample is an invalid example of your claims.

- Sample (the sample must be random and must not contain claims not paid by Medicaid).

- Oral skills (can he/she make statistics understandable to the average person?)

Fourthly, the new revised rule redefines the universe. In the past, suppliers have argued that some of the claims (or claim lines) included in the universe were improperly used for purposes of extrapolation. However, the pre-Jan. 2, 2019 Medicare Manual provided little to no additional guidance regarding the inclusion or exclusion of claims when conducting the statistical analysis. By contrast, the revised Medicare Manual specifically states:

“The universe includes all claim lines that meet the selection criteria. The sampling frame is the listing of sample units, derived from the universe, from which the sample is selected. However, in some cases, the universe may include items that are not utilized in the construction of the sample frame. This can happen for a number of reasons, including but not limited to:

- Some claims/claim lines are discovered to have been subject to a prior review;

- The definitions of the sample unit necessitate eliminating some claims/claim lines; or

- Some claims/claim lines are attributed to sample units for which there was no payment.”

By providing detailed criteria with which contractors should exclude certain claims from the universe or sample frame, the revised Medicare Manual will also provide suppliers another means to argue against the validity of the extrapolation.

Lastly, the revised rules explicitly instruct the auditors to retain an expert statistician when changes occur due to appeals and legal arguments.

As a challenge to an extrapolated overpayment determination works its way through the administrative appeals process, often, a certain number of claims may be reversed from the initial claim determination. When this happens, the statistical extrapolation must be revised, and the extrapolated overpayment amount must be adjusted. This requirement remains unchanged in the revised PIM; however, the Medicare contractors will now be required to consult with a statistical expert in reviewing the methodology and adjusting the extrapolated overpayment amount.

Between my first article on extrapolation, “CMS Revises and Details Extrapolation Rules,” and this follow-up, you should have a decent understanding of the revised extrapolation rules that became effective Jan. 2, 2019. But my two articles are not exhaustive. Please, click here for Change Request 10067 for the full and comprehensive revisions.

The Courts Order Medicare to Stop Recouping Alleged Overpayments Without Due Process!

New case law supports due process for Medicare providers. As first seen on RACMonitor.

Due process is one of the cornerstones of our society. Due process is the universal guarantee and found in the Fifth Amendment to the United States Constitution, which provides “No person shall…be deprived of life, liberty, or property, without due process of law,” and is applied to all states by the 14th Amendment. From this basic principle flows many legal decisions determining both procedural and substantive rights.

For Medicare and Medicaid providers, however, due process, in the past, has been nonexistent. Imagine that you are accused of owing $5 million to the government. Perhaps it was a CPT® code error. You disagree. You believe that your documentation was proper and that you filed for reimbursement correctly. You appeal the decision that you owe $5 million. You continue conducting business as normal. Suddenly, you realize the government is recouping the $5 million now. Prior to any hearing before a judge. You haven’t been found guilty. What happened to innocent until proven guilty? What happened to due process?

For Medicare appeals there is a five-step appeal process. The law requires the government not to recoup during the first and second levels of appeal. But the first and second levels are jumping through hoops and are not normally successful. It is at the third level – the appeal to an impartial administrative judge – that the alleged recoupments are overturned.

After the second level, according to the black letter of the law, the government can begin recouping the alleged overpayment.

Sadly, in the past, the courts have held that it is proper for the government to recoup reimbursements after the second level. Even though, no hearing has been held before an impartial judge and you haven’t been found guilty of owing the money.

On Sept. 27, 2018, another U.S. District Court in South Carolina has agreed with courts in Texas by granting a provider’s request for a Temporary Restraining Order (TRO) to prevent the Centers for Medicare and Medicaid Services (CMS) from recouping monies until after Administrative Law Judge (ALJ) hearings have been held (Accident, Injury and Rehabilitation, PC, c/a No. 4:18-cv-02173, September 27, 2018).

A new trend in favor of providers seems to be arising. This is fantastic news for providers across the country!

Accident, Injury & Rehab, PC found that the ALJ stage of the appellate process is the most important for providers, as it provides the first opportunity for plaintiff to cross examine defendant’s witnesses and examine the evidence used to formulate the statistical sample. According to the American Hospital Association (AHA), 66 percent of Recovery Audit Contractor (RAC) denials are reversed by an ALJ (I actually believe the percentage is higher). The court found that plaintiff’s procedural due process rights were violated by premature recoupment. The court granted Accident, Injury & Rehab, PC’s preliminary injunction restraining and enjoining the government from withholding Medicare payments during the appeal process.

When the government starts recouping filing a preliminary injunction has been shown it to be the best course.

In the past, most preliminary injunctions asking the court to order the government to stop recoupments until a hearing was held was dismissed based on jurisdiction. In other words, the courts held that the courts did not have the authority to render an opinion as to recoupments prior to a hearing. Now, however, the trend is turning, and courts are starting to rule in favor of the provider, finding a violation of procedural due process based on a collateral claim exception.

There are four criteria in order to win a preliminary injunction. A party seeking a preliminary injunction must establish all for the following criteria: (1) that the party is likely to succeed on the merits; (2) that the party is likely to suffer irreparable harm in the absence of preliminary injunction; (3) that the balance of the equity tips in the party’s favor; and (4) that injunction is in the public interest.

There is an esoteric legal theory called exhaustion of administrative remedies. So jurisdiction is the question. There are exceptions to the judicial bar. The Supreme Court of United States articulated a collateral claim exception. The Supreme Court permitted a plaintiff to bring a procedural due process claim requesting an evidentiary area hearing before the termination of disability benefits. There are nonwaivable and waivable jurisdictional elements the nonwaivable requirement is that a claim must be presented to the administrative agency. The waivable requirement is that administrative remedies be exhausted.

The Collateral claim exception is when a party brings a claim in federal court when that “constitutional challenge is entirely collateral to its substantive claim of entitlement.”

The new trend in case law is that the courts are finding that the provider’s right to not undergo recoupment during the appeal process is a collateral issue as to the substantive issue of whether the provider owes the money. Therefore, the courts have found jurisdiction as to the collateral issue.

The proverbial ship has sailed. According to courts in Texas and now South Carolina, CMS cannot recoup monies prior to hearings before ALJs. Providers facing large recoupments should file TROs to prevent premature recoupments and to obtain due process.

Medicare and Medicaid Regulations Suspended During Natural Disasters

My blog (below) was published on RACMonitor.

CMS provides Medicare waivers for providers dealing with natural disasters.

I live in North Carolina, and as most of you have seen on the news, we just underwent a natural disaster. Its name is Hurricane Florence. Our Governor has declared a state of emergency, and this declaration is extremely important to healthcare providers that accept Medicare and Medicaid and are located within the state of emergency. Once a state of emergency is implemented, the 1135 Waiver is activated for Medicare and Medicaid providers, and it remains activated for the duration of the state of emergency. The 1135 Waiver allows for exceptions to normal regulatory compliance regulations during a disaster. It is important to note that, during the disaster, a state of emergency must be officially “declared” in order to activate the 1135 Waiver.

About a year ago, the Centers for Medicare & Medicaid Services (CMS) finalized the 1135 Waiver to establish consistent emergency preparedness requirements for healthcare providers participating in Medicare and Medicaid, to increase patient safety during emergencies, and to establish a more coordinated response to natural and manmade disasters. The final rule requires certain participating providers and suppliers to plan for disasters and coordinate with federal, state, tribal, regional, and local emergency preparedness systems to ensure that facilities are adequately prepared to meet the needs of their patients during disasters and emergency situations.

The final rule states that Medicare and Medicaid participating providers and suppliers must do the following prior to a natural disaster capable of being foreseen:

- Conduct a risk assessment and develop an emergency plan using an all-hazards approach, focusing on capacities and capabilities that are critical to preparedness for a full spectrum of emergencies or disasters specific to the location of a provider or supplier;

- Develop and implement policies and procedures, based on the plan and risk assessment;

- Develop and maintain a communication plan that complies with both federal and state law, and ensures that patient care will be well-coordinated within the facility, across healthcare providers, and with state and local public health departments and emergency systems; and

- Develop and maintain training and testing programs, including initial and annual trainings, and conduct drills and exercises or participate in an actual incident that tests the plan.

Obviously, the minutiae of this final rule deviates depending on the type of provider. The waivers and modifications apply only to providers located in the declared “emergency area” (as defined in section 1135(g)(1) of the Social Security Act, or SSA) in which the Secretary of the U.S. Department of Health and Human Services (HHS) has declared a public health emergency, and only to the extent that the provider in question has been affected by the disaster or is treating evacuees.

Some examples of exceptions available for providers during a disaster situation under the 1135 Waiver are as follows:

- CMS may allow Critical Access Hospitals (CAHs) to exceed the 25-bed limit in order to accept evacuees.

- CMS can temporarily suspend a pending termination action or denial of payment sanction so as to enable a nursing home to accept evacuees.

- Normally, CAHs are expected to transfer out patients who require longer admissions to hospitals that are better equipped to provide complex services to those more acutely ill. The average length of stay is limited to 96 hours. However, during a natural disaster, the CAH may be granted a 1135 Waiver to the 96-hour limit.

- Certification for a special purpose dialysis facility can be immediate.

- Relocated transplant candidates who need to list at a different center can transfer their accumulated waiting time without losing any allocation priority.

- For home health services, normally, the patient must be confined to his or her home. During a state of emergency, the place of residence may include a temporary alternative site, such as a family member’s home, a shelter, a community, facility, a church, or a hotel. A hospital, SNF, or nursing facility would not be considered a temporary residence.

In rare circumstances, the 1135 Waiver flexibilities may be extended to areas beyond the declared emergency area. A limitation of the 1135 Waiver is that, during a state of emergency, an Inpatient Prospective Payment System- (IPPS)-excluded psychiatric or rehabilitation unit cannot be used for acute patients. A hospital can submit a request for relief under 1135 Waiver authority, and CMS will determine a course of action on a case-by-case basis. A hospital could also apply for certification of portions of its facility to act as a nursing facility. Hospitals with fewer than 100 beds, located in a non-urbanized area, may apply for swing bed status and receive payment for skilled nursing facility services.

If a provider’s building is devastated during a state of emergency, the 1135 Waiver allows the provider to maintain its Medicare and Medicaid contract, despite a change of location – under certain circumstances and on a case-by-case basis. Factors CMS will consider are as follows: (1) whether the provider remains in the same state with the same licensure requirements; (2) whether the provider remains the same type pf provider after relocation; (3) whether the provider maintains at least 75 percent of the same medical staff, nursing staff, and other employees, and whether they are contracted; (4) whether the provider retains the same governing body or person(s) legally responsible for the provider after the relocation; (5) whether the provider maintains essentially the same medical staff bylaws, policies, and procedures, as applicable; (6) whether at least 75 percent of the services offered by the provider during the last year at the original location continue to be offered at the new location; (7) the distance the provider moves from the original site; and (8) whether the provider continues to serve at least 75 percent of the original community at its new location.

The 1135 Waiver does not cover state-run services. For example, the 1135 Waiver does not apply to assisted living facilities. The federal government does not regulate assisted living facilities. Instead, assisted living is a state service under the Medicaid program. The same is true for clinical laboratory improvement amendment (CLIA) certification and all Medicaid provider rules. The 1135 Waiver also does not allow for the 60 percent rule to be suspended. The 60 percent Rule is a Medicare facility criterion that requires each Inpatient Rehabilitation Facility (IRF) to discharge at least 60 percent of its patients with one of 13 qualifying conditions.

In conclusion, when the governor of your state declares a state of emergency, the 1135 Waiver is activated for healthcare providers. The 1135 Waiver provides exceptions and exclusions to the normal regulatory requirements. It is important for healthcare providers to know and understand how the 1135 Waiver affects their particular types of services prior to a natural disaster ever occurring.

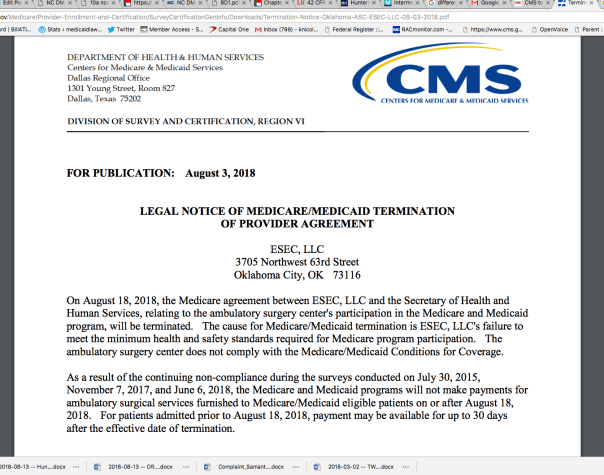

Hasty and Careless Termination Decisions Can Put Medicare/caid Providers Out of Business

When action happens in the Medicare/caid world, it happens quickly. Sometimes you do not receive adequate notice to coordinate continuity of care for your consumers or patients. For example, on August 3, 2018, the Center for Medicare and Medicaid Services announced that at midnight on August 18, 2018, it would be terminating the contract between CMS and ESEC, LLC, an Oklahoma-based surgery center.

CMS provided ESEC 15 days notice of complete termination of Medicare and Medicaid reimbursements. Now I do not know the details of ESEC’s financial reliance on Medicare or Medicaid, but, these days, few providers are solely third-party pay or cash-only. I can only assume that ESEC is scrambling to initiate a lawsuit to remain afloat and open for business. Or ESEC is praying for a “rescind” by correcting whatever issues it purportedly had. Personally, I would not count on a possible rescind. I would be proactively seeking legal intervention.

Here are some examples of recent terminations and the notice received by the providers:

- Baylor St. Luke’s Medical Center’s heart transplant program lost federal funding August 17, 2018. The hospital will no longer be able to bill Medicare and Medicaid for heart transplants.

- Effective August 9, 2018, Brookwood Baptist Medical Center’s Medicare contract was terminated. The notice was published July 25, 2018.

- As of August 12, 2018, The Grandview Nursing & Rehabilitation Facility’s Medicare contract was terminated. Notice of the termination was published August 1, 2018.

- As of September 1, 2018, Compassus-Kansas City, a hospice company, will lose its Medicare contract. Notice was provided August 17, 2018.

- On August 3, 2018, CMS announced that it was terminating Deligent Health Services Inc.’s Medicare and Medicaid contact, effective December 5, 2017. (That is quite a retroactive timeframe).

Can Careless Judy put a healthcare provider out of business?

This happens all the time. Sure, ESEC probably had knowledge that CMS was investigating it. However, CMS has the authority to issue these public notices of termination without holding a hearing to determine whether CMS’ actions are accurate. What if Careless Judy in Program Integrity made a human error and ESEC actually does meet the standards of care. But you see, Careless Judy accidentally used the minimum standards of care from 2008 instead of 2018. It’s an honest mistake. She had no malice against ESEC. But, my point is – where is the mechanism that prevents a surgical ambulatory center from going out of business – just because Careless Judy made a mistake?

To look into whether any legal mechanism exists to prevent Careless Judy from putting the ambulatory center out of business, I turn to the legal rules.

42 CFR 488.456 governs terminations of provider agreements. Subsection (a) state that termination “ends – (1) Payment to the facility; and (2) Any alternative remedy.”

Subsection (b) states that CMS or the State may terminate the contract with the provider if the provider “Is not in substantial compliance with the requirements of participation, regardless whether immediate jeopardy is present.” On the bright side, if no immediate jeopardy exists then CMS or the State must give 15 days notice. If there is found to be immediate jeopardy, the provider get 2 days. But who determines what is “substantial compliance?” Careless Judy?

42 CFR 489.53 lists the reasons on which CMS may rely to terminate a provider. Although, please note, that the regulations use the word “may” and not “must.” So we have some additional guidance as to when a provider’s contract may be terminated, but it still seems subjective. Here are the reasons:

- The provider is not complying with the provisions of title XVIII and the applicable regulations of this chapter or with the provisions of the agreement.

- The provider or supplier places restrictions on the persons it will accept for treatment and it fails either to exempt Medicare beneficiaries from those restrictions or to apply them to Medicare beneficiaries the same as to all other persons seeking care.

- It no longer meets the appropriate conditions of participation or requirements (for SNFs and NFs) set forth elsewhere in this chapter. In the case of an RNHCI no longer meets the conditions for coverage, conditions of participation and requirements set forth elsewhere in this chapter.

- It fails to furnish information that CMS finds necessary for a determination as to whether payments are or were due under Medicare and the amounts due.

- It refuses to permit examination of its fiscal or other records by, or on behalf of CMS, as necessary for verification of information furnished as a basis for payment under Medicare.

- It failed to furnish information on business transactions as required in § 420.205 of this chapter.

- It failed at the time the agreement was entered into or renewed to disclose information on convicted individuals as required in § 420.204 of this chapter.

- It failed to furnish ownership information as required in § 420.206 of this chapter.

- It failed to comply with civil rights requirements set forth in 45 CFR parts 80, 84, and 90.

- In the case of a hospital or a critical access hospital as defined in section 1861(mm)(1) of the Act that has reason to believe it may have received an individual transferred by another hospital in violation of § 489.24(d), the hospital failed to report the incident to CMS or the State survey agency.

- In the case of a hospital requested to furnish inpatient services to CHAMPUS or CHAMPVA beneficiaries or to veterans, it failed to comply with § 489.25 or § 489.26, respectively.

- It failed to furnish the notice of discharge rights as required by § 489.27.

- The provider or supplier refuses to permit copying of any records or other information by, or on behalf of, CMS, as necessary to determine or verify compliance with participation requirements.

- The hospital knowingly and willfully fails to accept, on a repeated basis, an amount that approximates the Medicare rate established under the inpatient hospital prospective payment system, minus any enrollee deductibles or copayments, as payment in full from a fee-for-service FEHB plan for inpatient hospital services provided to a retired Federal enrollee of a fee-for-service FEHB plan, age 65 or older, who does not have Medicare Part A benefits.

- It had its enrollment in the Medicare program revoked in accordance to § 424.535 of this chapter.

- It has failed to pay a revisit user fee when and if assessed.

- In the case of an HHA, it failed to correct any deficiencies within the required time frame.

- The provider or supplier fails to grant immediate access upon a reasonable request to a state survey agency or other authorized entity for the purpose of determining, in accordance with § 488.3, whether the provider or supplier meets the applicable requirements, conditions of participation, conditions for coverage, or conditions for certification.

As you can see from the above list of possible termination reasons, many of which are subjective, it could be easy for Careless Judy to terminate a Medicare contract erroneously, based on inaccurate facts, or without proper investigation.

The same is true for Medicaid; your contract can be terminated on the federal or state level. The difference is that at the state level, Careless Judy is a state employee, not a federal.

42 CFR 498.5 governs appeal rights for providers contract terminations. Subsection (b) states that “Any provider dissatisfied with an initial determination to terminate its provider agreement is entitled to a hearing before an ALJ.”

42 CFR 498.20 states that an initial determination by CMS (like a contract termination) is binding unless it is reconsidered per 42 CFR 498.24.

A Stay of the termination should suspend the termination until the provider can obtain a hearing by an impartial tribunal until the appeal has been completed. The appeal process and supposed automatic Stay of the termination is the only protection for the provider from Careless Judy. Or filing an expensive injunction.

CMS Initiates Process to Decrease the Medicare Appeal Backlog: But You May Have to Beg!

Last week, (May 22nd) the Center for Medicare and Medicaid Services (CMS) unveiled a new, streamlined appeal process aimed at decreasing the massive Medicare appeal backlog. CMS is hopeful that providers, like you, will choose to settle your Medicare appeal cases instead continuing the litigious dispute. Remember, currently, the backlog at the third level of Medicare appeals, the administrative law judge (ALJ) level, is approximately 5 – 8 years (I will use 8 years for the purpose of this blog). Recoupment can legally begin after level two, so many providers go out of business waiting to be heard at the third level. See blog.

The new “settlement conference facilitation” (SCF) process will allow CMS to make a settlement offer and providers have seven days to accept or proceed with the longer-lasting route. I have a strong sense that, if litigated, a judge would find forcing the decision between accepting a quick settlement versus enduring an 8-year waiting-period to present before an ALJ, coercion. But, for now, it is A choice other than the 8-year wait-period (as long as the provider met the eligibility requirements, see below).

To initiate said SCF process, a provider would have to submit a request in writing to CMS. CMS would then have 15 days to reply. If the agency chooses to take part, a settlement conference would occur within four weeks. Like that underlined part? I read the SCF process as saying, even if the provider qualifies for such process, CMS still has the authority to refuse to participate. Which begs the question, why have a process that does not have to be followed?

The SCF process is directed toward sizable providers with older and more substantial, alleged overpayments. In order to play, you must meet the criteria to enter the game. Here are the eligibility requirements:

The Backlog

In fiscal year (FY) 2016, more than 1.2 billion Medicare fee-for-service claims were processed. Over 119 million claims (or 9.7%) were denied. Of the denied claims, 3.5 million (2.9% of all Medicare denied claims) were appealed. That seems surprisingly low to me. But many claims are denied to Medicare recipients, who would be less inclined to appeal. For example, my grandma would not hire an attorney to appeal a denied claim; it would be fiscally illogical. However, a hospital that is accused of $10 million in alleged overpayments will hire an attorney.

In recent years, the Office of Medicare Hearings and Appeals (OMHA) and the Council have received more appeals than they can process within the statutorily-defined time frames. From FY 2010 through FY 2015, OMHA experienced an overall 442% increase in the number of appeals received annually. As a result, as of the end of FY 2016, 658,307 appeals were waiting to be adjudicated by OMHA. Under current resource levels (and without any additional appeals), it would take eight years for OMHA and ten years for the Council to process their respective backlogs.

The SCF “Fix”

While I do not believe that the creation of the SCF process is a fix, it is a concerted step in the right direction. Being that it was just enacted, we do not have any trial results. So many things on paper look good, but when implemented in real life end so poorly. For example, the Titanic.

Considering that there is a court case that found Health and Human Services (HHS) in violation of federal regulations that require level three Medicare appeals to be adjudicated in 90 days, instead of 8 years and HHS failed to follow the Order, claiming impossibility, at least HHS is making baby steps. See blog. At some point, Congress is going to have to increase funding to hire additional ALJs. I can only assume that the Hospital Association and American Medical Association are lobbying to get this action, but you know what they say about assuming…

As broached above, I do not like the fact that – if you do not accept whatever amount CMS proposes as settlement – BOOM – negotiation is over and you suffer the 8-year backlog time, undergo recoupments (that may not be appropriate), and incur tens of thousands of attorneys’ fees to continue litigation. Literally, CMS has no incentive to settle and you have every reason to settle. The only incentive for CMS to settle that I can fathom is that CMS wants this SCF program to be a success for the jury of public opinion, therefore, will try to get a high rate of success. But do not fool yourself.

You are the beggar and CMS is the King.

Medicare and Medicaid Providers: Administrative Law 101 and Hiring an Attorney from Out-of-State

What in the world is administrative law???? If you are a Medicare or Medicaid provider, you better know!

Most of my blogs are about Medicare and Medicaid providers and the tangled web of regulatory rules and regulations that they must abide by in order to continue providing medically necessary services to our most-needy and elderly populations. This time, however, I am going to blog about (1) administrative law 101 (which I am coming to the realization that few providers understand); and (2) out-of-state attorneys – and why you may need to seek out an attorney from another state from which you live (and why it is possible). Attorneys are licensed state-by-state and, lately, I’ve gotten a lot of questions about “how can you represent me in Nevada when you are in NC?” and when I Googled this topic – I found that there is very little information out there. I am here to teach and teach I will. Read on if you want to learn; close this browser if you do not. The other goal of this blog is to educate you on administrative law. Because administrative law is vastly different than normal law, yet it pertains to Medicare and Medicaid providers, such as you. My last goal with this blog is to educate you on the expense of hiring an attorney and why, in some instances, it may be more costly than others. Whew! We have a lot to go through!

Let’s get started…

A lot of potential clients often ask me how are you able to represent me in Nebraska when you live in North Carolina? Or Alaska? (yes, I have a client in Alaska). I figured I should clear up the confusion. (The “administrative law class” portion of this blog is interwoven throughout the blog – not my best blog, organizational-wise; but we cannot all be perfect).

There are three ways in which an attorney can represent an out-of-state client if that attorney does not have the State’s Bar license for the State in which you reside. Just in case you didn’t know, attorneys get licensed on a state-by-state basis. For example, I have my Bar licenses in North Carolina and Georgia. It is similar to how physicians have to get State licenses. However, I represent healthcare providers in approximately 30 states. I don’t have a client in Iowa yet, so any healthcare providers in Iowa – Hello!! Now we need to understand – how is this possible?

Let’s take a step back, in case there are those who are wondering what a Bar license is; it is a license to practice law and, literally, means that you can go past the bar in a courtroom.

Number One

The first way in which in attorney can represent an out-of-state client is because most Medicaid and Medicare provider appeals must be brought before Administrative Court. In North Carolina, our Administrative Court is called the Office of Administrative Hearings (OAH). OAH is the administrative agency for the Judicial Branch. An Administrative Court is the type of court specializing in administrative law, particularly in disputes concerning the exercise of public power. Their role is to ascertain that official/governmental acts are consistent with the law. Such courts are considered separate from general courts. For most state’s Administrative Courts, attorneys do not have to be licensed in that state. Most people don’t know the difference between Administrative Courts versus normal civil courts, like Superior and District courts. Or Magistrate Courts, for example, where Judge Judy would be. I certainly didn’t know what administrative law was even after I graduated law school. Quite frankly, I didn’t take the administrative law class in law school because I had no idea that I would be doing 89.125% administrative law in my real, adult life (I still file federal and state injunctions and sue the government in civil court, but the majority of my practice is administrative).

Administrative laws, which are applicable to Medicare and Medicaid providers, are laws pertaining to administrative agencies (seems self-defining). Administrative court is defined as a court that specializes in dealing with cases relating to the way in which government bodies exercise their powers.

There are literally hundreds of federal administrative agencies, including the Environmental Protection Agency, known as the EPA. If I have a pollution complaint, I contact the EPA. Another example is the Equal Employment Opportunity Commission, known as the EEOC. This agency is responsible for enforcing federal laws that make it illegal to discriminate a job applicant or employee. If I have a discrimination complaint, I contact the EEOC. Another example is the Consumer Product Safety Commission, known as CPSC, which is the independent agency that oversees the safety of products sold in the United States. If I have a problem with the safety of the product that I bought, I contact the CPSC. Complaints to government agencies, such as the EPA, do not go to normal, civil court. These complaints, otherwise known as petitions for contested case hearings, go to Administrative Court and are overseen by Administrative Law Judges (“ALJs”). Same is true for Medicare and Medicaid provider disputes. You cannot go to Superior Court until you have gone through Administrative Court otherwise your case will be kicked out because of an esoteric legal doctrine known as “exhaustion of administrative remedies.” See blog.

Here is a picture of North Carolina’s Raleigh OAH. You can see, from the picture below, that it does not look like a normal courthouse. It’s a beautiful building – don’t get me wrong. But it does not look like a courthouse.

Our OAH is located at 1711 New Hope Church Road, Raleigh NC, 27609. OAH used to be downtown Raleigh and one of the historic houses, but that got a little cramped.

Complaints about Medicare and Medicaid regulatory compliance issues go to Administrative Court because these complaints are against a government agency known as the Health Service Department or the Department of Health and Human Services, depending on which state within you live – the names may differ, but the responsibility does not.

Bringing a lawsuit in Administrative Court with an out-of-state attorney is the cheapest method. There is no need to pay local counsel to file pleadings. There is no need to pay to be pro hac-ed in (see below). Sure, you have to pay for travel expenses, but as we all know, you get what you pay for. If you don’t have an expert in Medicare or Medicaid in your state you need to look elsewhere. [Disclaimer – I am not saying you have to hire me. Just hire an expert].

Number Two

Very few states require administrative attorneys to have the State Bar license in which they are practicing. For those few States that do require a State Bar license, even for administrative actions, the second alternative to hire an attorney out-of-state is for the attorney to pro hac into that State. Pro hace vice is a fancy Latin phrase which means, literally, “for on this occasion only.” It allows out-of-state attorneys a way to ask the court to allow them to represent a client in a state in which they do not have a license. Again, the reason why this is important is that in a extremely, niche practices, there may not be an attorney with the expertise you need in your state. I know there are not that many attorneys that do the kind of law that I do, [possibly because it is emotionally-draining (because all your clients are financial and emotional distress), extremely esoteric, yet highly-rewarding (when you keep someone in business to continue to provide medically necessary services), but, at times, overwhelming and, without question, time-consuming]. Did someone say, “Vacation?” “Pro hac-ing in” (defined as the attorney asking the court to allow them to represent a client in a state for which they do not have a license for one-time only) is also helpful when I appear in state or federal courts.

Most states have a limit of how many times an attorney can pro hac. For example, in New Mexico, out-of-state attorneys can only pro hac into New Mexico State courts four times a year. The fee for an attorney to pro hac into a state court varies state-by-state, but the amount is nominal when you compare the fee against how much it would cost to hire local counsel.

Number Three

Thirdly, is by hiring local counsel. Some cases need to be escalated to federal or state court, and, in these instances, a Bar license in the state in which the case is being pursued is necessary. An example of why you would want to bring a lawsuit in federal or state court instead of an Administrative Court would be if you are asking for monetary damages. An Administrative Court does not have the jurisdiction to award such damages.

This is the scenario that I dislike the most because the client has to pay for another attorney only because their warm body possesses a State Bar license. Generally, local counsel does not do much heavy lifting. As in, they don’t normally contribute to the merits of the case. Because they have the State Bar license, they are used to file and sign-off on pleadings.

Cost

The first scenario – in which I represent a out-of-state client in Administrative Court, and do not need to hire local counsel or to get my pro hac, is the cheapest method for clients. As an aside, I spoke with an attorney from a bigger city yesterday and was amazed at his or her billable rates. Apparently, I’m steal.

The second most inexpensive way to hire an attorney from out-of-state is to have them get pro hac-ed in. There is a filing fee of, usually, a few hundred dollars in order to get pro hac-ed in. But, in some states, you don’t have to hire local counsel when you are pro hac-ed in.

The most expensive way to hire an out-of-state attorney is needing to hire local counsel as well. Let’s be honest – attorneys are expensive. Adding another into the pot just ups the ante, regardless how little they do. When attorneys charge $300, $400, or $500 an hour, very few hours add up to a lot of money (or $860/hour….what…zombies?).

If you do not agree with the decision that the Administrative Law Judge renders, then you can appeal to, depending in which state you reside, Superior Court or District Court. If you do not agree with the decision you receive in District Court or Superior Court, you then appeal to the Court of Appeals. On the appellate level, out-of-state attorneys would need to either be pro hac-ed on or hire local counsel.