Category Archives: Reconsideration Reviews

Consider Nominating This Blog for the 2015 Best Legal Blog Contest (Please)!

The 2015 Legal Blog Contest is here!

For all you that follow this blog, thank you! I hope that you agree that I provide you with valuable and up-to-date information on Medicaid/care regulatory issues. At least, that is my hope in maintaining this blog. And maintaining this blog takes a lot of time outside my normal, hectic legal career and my time as a mom and wife. Don’t get me wrong…I love blogging about these issues because these issues are near and dear to my heart. I am passionate about health care, health care providers, Medicaid and Medicare, and access to quality care.

If you are a follower, then you know that I try to keep my readers current on Medicaid/care fraud, federal and state laws, legal rights for health care providers, bills in the General Assembly germane to health care, extrapolation issues, CMS rulings, managed care matters, reimbursement rates, RAC audits and much, much more!

If you enjoy my blog, I ask a favor. Please consider nominating my blog for the 2015 Best Legal Blog Contest.

If you want to nominate my blog, please click here.

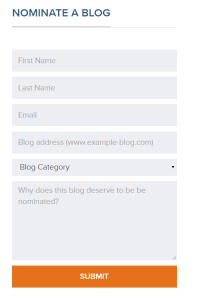

Scroll down until you see this:

Enter your name, email address, my blog address. which is:

For category, click on “Niche and Specialty.” I do not believe the other categories correctly describe my blog.

And type a reason why you enjoy my blog. Much appreciated!

NCTracks Lawsuit Dismissed! Judge Finds Providers Failed to Exhaust Their Administrative Remedies!

Remember July 1, 2013? Providers across North Carolina probably still suffer PTSD at the mention of the “go-live” date for NCTracks. If you remember July 1, 2013, you probably also remember that my former firm filed a class action lawsuit on behalf of the physicians in NC who suffered losses from NCTracks’ inception.

There was oral argument at the NC Business Court.

Judge McGuire, of the NC Business Court, dismissed the NCTracks class action lawsuit stating the providers failed to exhaust the administrative remedies. The Order reads, in part:

“Ultimately, the burden of proving that administrative remedies are inadequate in this action rests on Plaintiffs. Jackson, 131 N.C. App. at 186. Although sympathetic to the apparently difficult administrative process, the Court concludes that, particularly in light of the fact that not a single Plaintiff has attempted to use the available administrative procedures to resolve their Medicaid reimbursement claims, Plaintiffs have simply failed to satisfy this burden. Accordingly, Defendants’ Motions to Dismiss pursuant to Rule 12(b)(1) should be GRANTED.”

While I understand the logic applied to come to this decision, I do not necessarily agree with the outcome. There are exceptions to the exhaustion of administrative remedies, which, in my humble opinion, are present here.

(This blog contains my own opinions as to the NCTracks ruling and not those of my present or former firms. It is not intended to claim any ruling was incorrect or inconsistent with case law, rules, and statutes).

(Try to read the foregoing sentences in a fast-paced, tiny, whispery voice, like a pharmaceutical commercial).

Regardless, where does this decision leave the physicians in NC who suffered under an, admittedly, botched, beginning of NCTracks? (Even DHHS recognized the imperfections at the beginning).

First, what is the doctrine of failure of administrative remedies? (I was going to start with what is NCTracks, but you do not know what NCTracks is, you probably should begin reading some of my earlier blog posts: blog; and blog; and blog).

In a nutshell, the exhaustion doctrine dictates that if a party disagrees with an adverse action of a state agency that the party must exhaust its administrative remedies before asking for relief from a civil court judge.

What?

Law 101: The Office of Administrative Hearings (OAH) has limited jurisdiction. It only has jurisdiction over those matters specifically granted to it by statute. If you have an issue with a final adverse decision of a state agency, you sue at OAH. In other words, if you want to sue a state agency, such as DHHS, or any of its agents, like an MCO, you sue at OAH, not Superior Court. An Administrative Law Judge, or ALJ, presides over the court. While OAH is more informal than Superior Court, OAH follows the rules of civil procedure unless an administrative rule exists.

If a Superior Court were to find that the party failed to exhaust its administrative remedies, then the court would find that the party lacked subject matter jurisdiction; i.e., the court is holding that it does not have the authority to determine the legal question at issue.

You would be back to square one, and, potentially, miss an appeal deadline.

In the Medicaid world this is similar to a managed care organization (MCO) having an informal review process internally which would be required prior to bringing a Petition for Judicial Review at OAH.

Were you to bring a Petition for Judicial Review at OAH prior to attending an informal reconsideration review at the MCO, the ALJ would, most likely, dismiss the case for failure to exhaust your administrative remedies.

But in the NCTracks case, the Plaintiffs sued DHHS and Computer Science Corporation (CSC). CSC is, arguably, not a state agency. The only way in which you could sue CSC at OAH would be for an ALJ to determine that CSC is an agent of a state agency. And, who knows? Maybe CSC is an agent of DHHS. Judge McGuire does not address this issue in his Order.

Many of you may wonder why I opine that CSC is not an agent of the state, yet surmise that the MCOs are agents of DHHS. Here is my reasoning: DHHS, in order to bestow or delegate its powers of administering behavioral health to the MCOs, was required to request a Waiver from the federal government. Unlike with CSC, DHHS merely contracted with CSC; no Waiver was required. That Waiver (two Waivers, really, the 1915(b) and 1915(c)) allow the MCOs to step into the shoes of DHHS….to a degree…and only as far as was requested and approved by CMS…no more. I view CSC as a contractor or vendor of DHHS, while the MCOs are limited agents.

Going back to NCTracks…

One can surmise that, because Judge McGuire dismissed the entire lawsuit and did not keep CSC as a party, Judge McGuire opined that CSC is an agent of DHHS. But there is a possibility that the providers sue in OAH and an ALJ determines that OAH is not a proper venue for CSC. Then what? Back to Superior Court and/or Business Court?

Why do you have to exhaust your administrative remedies? It does seem too burdensome to jump through all the hoops.

The rationale behind requiring parties to exhaust their administrative remedies is that those entities (such as OAH) that hear these specialized cases over and over and develop an expertise to decide the certain esoteric matters that arise under their jurisdiction. Also, the doctrine of separation of powers dictates that an agency created by Congress should be allowed to carry out its duties without undue interference from the judiciary.

For example, Judges Don Overby and Melissa Lassiter, ALJs at the NC OAH have, without question, presided over more Medicaid cases than any Superior Court Judge in the state (unless a Superior Court is a former ALJ, like Judge Beecher Gray). The thinking is that, since Overby and Lassiter, or, ALJs, generally, have presided over more Medicaid cases than the average judge, that the ALJs have formed expertise in area. Which is probably true. It cannot be helped. When you hear the same arguments over and over, you tend to research the answers and form an opinion.

So there is the “why,” what about the exceptions?

There are exceptions to the general rule of having to exhaust your administrative remedies that may or may not be present in the NC tracks case. If you ask me, exceptions are present. If you ask Judge McGuire vis-à-vis his Order, there are no exceptions that were applicable.

One such exception to the general rule that you must exhaust your administrative remedies is if bringing a case at the informal administrative level would be futile. If you can prove futility, then you are not required to exhaust your administrative remedies. Another exception is if you are requesting monetary damages that cannot be awarded at the administrative law level.

Where the administrative remedy is inadequate, a plaintiff is not required to exhaust that remedy before turning to the courts. Shell Island, 134 N.C. App. at 222. The burden of establishing the inadequacy of an administrative remedy is on the party asserting inadequacy. Huang v. N.C. State Univ., 107 N.C. App. 110, 115 (1992).

What DHHS argued, in order to have the case dismissed for lack of subject matter jurisdiction, and Judge McGuire agreed with, is:

that adequate administrative remedies exist for all health care providers when NCTracks improperly denies claims.

This holding is not without questions.

Some providers re-bill denied claims over and over. There is a question as to when do you appeal? The first denial? The second? The Fourteenth? At which point do you accept the denial from NCTracks as a “final agency decision?” Do you use the “3 strikes and you’re out” rule? Do you give NCTracks a mulligan? Or do you wait until NCTracks “fouls out” with a 6th denial?

Another question that remains hanging in the wake of the NCTracks dismissal is how will providers handle the sheer volume of denials. Some providers receive voluminous denials. Some RAs can be hundreds of pages long.

Let’s contemplate this argument in a hypothetical. You run a nephrology practice. The bulk of your patients are Medicaid (90% Medicaid, although 50% are dual eligible with Medicaid/Medicare). You have approximately 500-700 patients, who come see your doctors because they are in need of dialysis. You know that if a person does not receive dialysis that there is a chance that the person can enter Stage 5 (end stage renal disease) and die quickly. However, upon July 1, 2013, when NCTracks went live, you stopped receiving Medicaid payments completely. Do you stop accepting and treating your Medicaid patients? Obviously you do not stop accepting Medicaid patients? But your practice cannot sustain itself. Even if you continue to treat Medicaid patients, at some point, you will be out of business, failing to meet payroll, and being forced to involuntarily not treat your patients.

Your patients in need of dialysis come to the office 3x per week. A single hemodialysis treatment typically costs up to $500 or more — or, about $72,000 or more per year for the typical three treatments per week.

Let’s approximate with 500 patients. 500 patients multiplied by 3x per week is 1,500 per week. That is 1,500 denials per week. What Judge McGuire is saying is that your office is burdened with appealing 1,500 denials per week. Or 6,000 denials per month. Or 72,000 appeals per year.

Which of your office staff will be charged with appealing at OAH 72,000 denials per year? The physicians? You, the office manager (because you obviously have nothing else to do)? The receptionist? Hire someone new? For how much? How will you recoup the cost of appealing 72,000 denials per year? How many hours does it cost to appeal one? Hire an attorney?

Obviously, my example is one of an extreme case with 100% denials. But the sentiment holds true even for 30%, 40%, or 50% of denials. The sheer volume would be overwhelming.

And you can imagine the backlog that would be created at OAH.

Judge McGuire’s decision that plaintiffs failed to exhaust their administrative remedies issue appears to be based, in part, that because no plaintiff had tried to go to OAH, plaintiffs could not convince him that the administrative remedy was non-functional.

“Significantly, none of the Plaintiffs even attempted to use the administrative procedures to address the failure to pay claims and other issues they allegedly encountered in attempting to use NCTracks. Instead, Plaintiffs allege that the administrative process would have been futile and inadequate to provide the relief they seek.” See Abrons Family Practice v. DHHS and CSC, ¶ 36 (emphasis added).

What now?

Well, first of all, when I moved to Gordon & Rees, I left this case in the capable hands of my former partners, so I have no special intelligence, but I wager that this is not the end.

There are choices. They could:

(1) Appeal the decision to the Court of Appeals;

(2) File an insurmountable number of petition’s at OAH; or

(3) Do nothing.

For some reason, I have my doubts that #3 will occur.

What do you think??? What should the Plaintiffs do now in the wake of this dismissal?

Liability Insurance for Health Care Providers: Is It Adequate?

When you, as a health care provider, undergo a regulatory Medicare or Medicaid audit, your liability insurance could be your best friend or your worst enemy. It is imperative that you understand your liability coverage prior to ever undergoing an audit.

There are two very important issues that you need to know about your liability insurance:

1. Whether your liability insurance covers your choice of attorney; and

2. Whether your liability insurance covers settlements and/or judgments.

I cannot express the importance of these two issues when it comes to regulatory audits, paybacks and recoupments. Let me explain why…

Does your liability insurance cover attorneys’ fees for your choice of provider?

I have blogged numerous times over the past years about the importance of knowing whether your liability insurance covers your attorneys’ fees. I have come to realize that whether your liability insurance covers your attorneys’ fees is less important than knowing whether your liability insurance covers your choice of attorney. Believe it or not, when it comes to litigating regulatory issues in the Medicare/Medicaid, attorneys are not fungible.

A client of mine summed it up for me today. She said, “I wouldn’t go to my dentist for a PAP smear.”

Case in point, here are some examples of misconceptions that attorneys NOT familiar with the Office of Administrative Hearings (OAH) might think:

• Myth: Getting the case continued is a breeze, especially if all the parties consent to it.

• Reality: Generally, OAH is reluctant to continue cases, except for good cause, especially when a case has pended for a certain amount of time. (This has been a more recent trend and could change in the future).

• Myth: When my case is scheduled for trial on X date, it will be a cattle call and we will only determine when the case will be actually heard, so I don’t need to prepare for trial. (This is true in superior court).

• Reality: Incorrect. Most likely, you will be heard. OAH has a number of administrative law judges (ALJs) who are assigned cases. Generally, they only schedule one case per day, although there are exceptions.

• Myth: Since we are going to trial next week, the other side must not intend to file a motion to dismiss or motion for summary judgment. I don’t need to prepare any counter arguments.

• Reality: The administrative rules allow attorneys to orally file motion the day of trial.

You can imagine how devastating attorney misconceptions can be to your case. An attorney with these misconceptions could very well appear unprepared at a trial, which could have catastrophic consequences on you and your company.

Tip:

Review your liability insurance. Determine whether your liability insurance covers attorneys’ fees. Then determine whether it covers your choice of attorney.

Does your liability insurance cover settlements and/or judgments?

Recently, a client was informed that the agency allegedly owes over $400,000 to the auditing agency. We will call him Jim. Jim came to me, and I instructed him to determine whether his liability insurance covers attorneys’ fees. It turned out that his insurance did cover attorneys’ fees, but only a certain attorney. Jim had overlooked our first issue.

Despite the fact that his insurance would not cover my fees, he opted to stick with me. (Thanks, Jim).

Regardless, once settlement discussions arose between us and the auditing entity, which in this particular case was Palmetto, I asked Jim for a copy of his liability insurance. If his liability insurance covers settlements, then we have all the incentive in the world to settle and skip an expensive hearing.

I was shocked at the language of the liability insurance.

According to the contract, insurance company would pay for attorneys’ fees (just not mine). Ok, fine. But the insurance company would contribute nothing to settlements or judgments.

What does that mean?

Insurance company could provide Jim with bargain basement attorneys, the cheapest it could find, with no regard as to whether the attorney were a corporate, litigation, real estate, tax, bankruptcy, or health care lawyer BECAUSE…

The insurance company has no skin in the game. In other words, the insurance company could not care less whether the case settles, goes to trial, or disappears. Its only duty is to pay for some lawyer.

Whereas if the insurance company were liable for, say, 20% of a settlement or judgment, wouldn’t the insurance company care whether the hired lawyer were any good?

Tip:

Print off your liability insurance. Read it. Does your liability insurance cover attorneys’ fees for your choice of provider?

Does your liability insurance cover settlements and/or judgments?

NC Medicaid Providers: Do Not Be a Cockey Lockey! Know Your Due Process Rights to Defend Against Administrative Penalties

An acorn falls on Chicken Little’s head. His first immediate thought is, “The sky is falling. The sky is falling.” So Chicken Little begins his travels to tell the king that the sky is falling. Along the way he meets Cockey Lockey, Ducky Lucky, Drakey Lakey and Goosey Loosey, to name a few of his well-feathered friends. Each new waterfowl asks Chicken Little where he is going. To which Chicken Little replies, “The sky is falling. The sky is falling. We have to tell the king.” And the fowl join Chicken Little in his travel to the king.

None of the characters question Chicken Little’s assertion that the sky is falling. They simply accept the fact that the sky is falling.

All too often, people, like Cockey Lockey and Goosey Loosey, accept what they are told without questioning the source.

Over and over I talk to health care providers who are told:

• by the Department of Health and Human Services (DHHS), Division of Medical Assistance (DMA) that they owe DMA hundreds of thousands of dollars for Medicaid overpayments;

• by the managed care organization (MCO) that the provider’s Medicaid contract is terminated;

• by a contracted entity that the provider is out of compliance with rules and regulations;

• by Program Integrity (PI) that there is a complaint filed against the provider; or

• by an MCO that its network is closed.

And some providers just accept the overpayment, the contract termination, the penalty, or the refusal to contract.

Don’t be a Cockey Lockey!

You do have rights! You deserve due process!

Let’s talk about the possible penalties allowed by Medicaid regulations and your right to defend against such penalties and the procedural safeguards enacted to protect you.

10A NCAC 22F .0602 governs “Administrative Sanctions and Remedial Measures,” and it enumerates the following possible sanctions for provider abuse:

• Warning letters for those instances of abuse that can be satisfactorily settled by issuing a warning to cease the specific abuse. The letter will state that any further violations will result in administrative or legal action initiated by the Medicaid Agency.

• Suspension of a provider from further participation in the Medicaid Program for a specified period of time, provided the appropriate findings have been made and provided that this action does not deprive recipients of access to reasonable service of adequate quality.

• Termination of a provider from further participation in the Medicaid Program, provided the appropriate findings have been made and provided that this action does not deprive recipients of access to reasonable services of adequate quality.

• Probation whereby a provider’s participation is closely monitored for a specified period of time not to exceed one year. At the termination of the probation period, the Medicaid Agency will conduct a follow-up review of the provider’s Medicaid practice to ensure compliance with the Medicaid rules.

Remedial Measures are to include:

• placing the provider on “flag” status whereby his claims are remanded for manual review;

• establishing a monitoring program not to exceed one year whereby the provider must comply with pre-established conditions of participation to allow review and evaluation of his Medicaid practice, i.e., quality of care.

Furthermore, certain factors must be considered prior to the levy of a sanction, including:

• seriousness of the offense;

• extent of violations found;

• history or prior violations;

• prior imposition of sanctions;

• period of time provider practiced violations;

• provider willingness to obey program rules;

• recommendations by the investigative staff or Peer Review Committees; and

• effect on health care delivery in the area

All of this information is found in 10A NCAC 22F, et al, which is an administrative code. The code also defines provider fraud and abuse. The penalties enumerated above are penalties allowed for instances of provider abuse, but, only after proper investigation, proper notice to the provider, and proper consideration of lesser penalties. In other words, due process.

For example, 10A NCAC 22F.0302 states that “[a]busive practices shall be investigated according to the provisions of Rule .0202 of this Subchapter.”

Rule .0202 requires a preliminary investigation prior to a full investigation. Additionally, Rule .0302 requires the investigative unit to prepare a “Provider Summary Report,” furnishing the full investigative findings of fact, conclusions, and recommendations. Then the Department is to review the Provider Summary Report and make a “tentative” recommendation as to the penalty, and that tentative recommendation is reviewable under Rule .0400, which allows a reconsideration review. The provider will receive the results of the reconsideration review within 5 business days following the date of the review.

If a provider is unhappy with the results of a reconsideration review, then the provider can appeal to the Office of Administrative Hearings (OAH) within 60 days.

All of the above-mentioned administrative procedures exist in order to protect a provider from unfair, arbitrary, capricious, erroneous actions by DMA and any of its contracted entities. That means Public Consulting Group (PCG), Carolinas Center for Medical Excellence (CCME), all the MCOs, HMS, and any other state contractor must also follow these administrative procedures.

So next time you are told that you owe hundreds of thousands of dollars to the state, that your Medicaid contract has been terminated, or your Medicaid reimbursements are being withheld, do not take these penalties at face value! Know you rights!

Do not be a Cockey Lockey!!

General Assembly in Full Swing: What Medicaid Bills Are On the Agenda??

It’s that time of year again. The legislators are back in town. Moral Mondays resume. And all eyes are on the General Assembly. But, this is the short session, and the General Statutes limit the powers of legislative law-making in the short session.

For those of you who do not know how our General Assembly (GA) works and the difference between the short and long sessions, let me explain:

In odd-numbered years, the GA meets in January and continues until it adjourns. There is no requirement as to the length of the long session, but it is normally about 6 months. In the long session, everything is fair game. New laws or changes to the existing laws can be proposed in long sessions for all of the subjects on which the GA legislates.

The short session reconvenes every even-numbered year and typically lasts 6 weeks. Last year the long session adjourned July 26, 2013, and the GA reconvened May 14, 2014.

There are limits as to what measures may be considered in the short session. In fact, at the end of the long session, the GA passed Resolution 2013-23, which states exactly what topics/bills may be considered in the short session.

So…the question is: What Medicaid bills may be considered during this short session?

H0674

H0867

H0320

Now there are of course, exceptions. For example, any bill that directly and primarily affects the State Budget can be introduced. Obviously, a Medicaid bill could, arguably, directly and primarily affect the budget.

The bills I enumerated above, however, are the bills that are allowed to be considered in the short session because they constitute a crossover bill, that is, these bills were passed one house and were received in the other during last year’s long session and are considered “still alive” for consideration during the current short session.

So what do these Medicaid bills propose?

House Bill 674 could be a game changer for Medicaid providers. The bill, which passed the House last year with a vote of 116-0, would direct the Program Evaluation Division to study the contested case process in regards to Medicaid providers. There are 3 key components in this study according to the bill:

1. The Division must review the procedures for a contested case hearing under NCGS 150B and determine whether there is a way to streamline the process and decrease backlog.

2. The Division must consider alternative methods of review other than the contested cases.

3. The Division must review NCGS 108C-12 to determine whether any amendments to the law would improve the cost-effectiveness and efficiency of the Medicaid appeal process. (NCGS 108C-12 is the statute that allows providers to appeal adverse decisions to the Office of Administrative Hearings (OAH)).

Whew. The Program Evaluation Division would have its work cut out for it if the bill passes!

House Bill 674 was received by the Senate on May 5, 2013, and it passed its first reading.

House Bill 867 is named “An Act to Allow for the Movement of Certain Medicaid Recipients,” and it purports to allow those recipients with an 1915(c) Innovations Waiver slot to move about the State and for the slots to be recognized uniformly across the State. This way a person with an Innovations Waiver would not need to re-apply in another county if he or she moves there. However, for those served by the managed care organizations (MCOs), residency is determined by the county in which the recipient currently resides.

Then we come to House Bill 320. See my blog,”HB320: The Good News and the Bad News for NC Medicaid Providers.”

House Bill 320 mainly speaks to Medicaid recipient appeals, but imbedded within the language is one tiny proposed change to NCGS 108C-1. Just an itty, bitty change.

NCGS 108C-1 provides the scope of 108C (which applies to providers) and currently reads, “This Chapter applies to providers enrolled in Medicaid or Health Choice.”

If House Bill 320 passes, NCGS 108C-1 will read, “This Chapter applies to providers enrolled in Medicaid or Health Choice. Except as expressly provided by law, this Chapter does not apply to LME/MCOs, enrollees, applicants, providers of emergency services, or network providers subject to Chapter 108D of the General Statutes.”

What????

If House Bill 320 passes, what, may I ask, will be a Medicaid provider’s appeal options if NCGS 108C does not apply to MCOs? And would not the new scope of NCGS 108C-1 violate the State Plan, which explicitly gives OAH the jurisdiction over any contracted entity of the Department of Health and Human Services (DHHS)? See my blogs on MCOs: “NC MCOs: The Judge, Jury and Executioner,” and “A Dose of Truth: If an MCO Decides Not to Contract With You, YOU DO HAVE RIGHTS!”

I also wonder, if House Bill 320 passes, what effect this revision to NCGS 108C-1 will have. Arguably, it could have no effect because of the above-mentioned language in the State Plan, the 4th Circuit Court of Appeals case that determined that MCOs are agents of the state, and the fact that the Department is defined in 108C-2 to include any of its legally authorized agents, contractors, or vendors.

On the other hand, in every single lawsuit that I would bring on behalf of a provider against an MCO, I would have another legal obstacle to overcome. The MCO’s attorney would invariably make the argument that OAH does not have jurisdiction over the MCO because the scope of 108C has been changed to exclude the MCOs. They have been arguing already that OAH lacks jurisdiction over the MCOs since NCGS 108D was passed, but to no avail.

Needless to say, the MCO lobbyists will be pushing hard for H 320 to pass. H 320 passed its 3rd reading on May 15, 2013, by a vote of 114-0, and the Senate received it on May 16, 2013.

NC Medicaid Providers, Are You Required to Seek an Informal Appeal Prior to Filing a Contested Case at OAH?

Recently, numerous clients have come to me asking whether they have the right to appeal straight to the Office of Administrative Appeals or whether they have to attend informal appeals first, whether the informal appeal is within a managed care organization (MCO), the Division of Medical Assistance (DMA) or any other entity contracted by DMA.

The answer is: No, you are not required to go through the informal review prior to filing a contested case at OAH, but, in some cases, the informal review is beneficial.

Let me explain.

N.C. Gen. Stat. 150B-22-37 (Article 3) applies to:

“[A]ny dispute between an agency and another person that involves the person’s rights, duties, or privileges, including licensing or the levy of a monetary penalty, should be settled through informal procedures. In trying to reach a settlement through informal procedures, the agency may not conduct a proceeding at which sworn testimony is taken and witnesses may be cross-examined. If the agency and the other person do not agree to a resolution of the dispute through informal procedures, either the agency or the person may commence an administrative proceeding to determine the person’s rights, duties, or privileges, at which time the dispute becomes a “contested case.”

N.C. Gen. Stat. 150B-22.

“Any dispute between an agency and another person”…Obviously DMA is a state agency, but is Public Consulting Group (PCG)? Is the Carolinas Center for Medical Excellence (CCME)? East Carolina Behavioral Health? HMS?

What if you disagree with a prepayment review result that CCME conducted? DMA had nothing to do with the actual prepayment review. Can you bring a contested case at OAH against CCME?

Yes. But include DHHS, DMA as a named Respondent. If you include the state agency that contracted with the entity, then jurisdiction is proper at OAH. The argument being that the actions of a contracted entity is imputed to the principle (DMA).

“Should be settled through informal procedures…” Notice it states “should,” not “must.” Time and time again when a provider skips the informal review within the entity (for example, let’s say that MeckLINK terminates Provider Jane’s Medicaid contract and files a grievance with OAH instead of through MeckLINK first) the counsel for the entity (MeckLINK in this example) argues that OAH does not have jurisdiction because Jane failed to exhaust her administrative remedies. As in, Jane should have appealed through MeckLINK first.

In my opinion, appealing to the very entity that is causing the grievance is futile. The decision was made. The entity is not going to rule against itself.

Plus, there is no requirement for any petitioner to exhaust informal appeals prior to appealing to OAH. When you receive a Tentative Notice of Overpayment from PCG, you can go to an informal review or you can appeal in OAH.

The “failing to exhaust administrative remedies” argument is being misapplied by the entities. In order to file judicial review in Superior Court or a declaratory judgment action in Superior Court, you must exhaust all administrative remedies prior to seeking relief in Superior Court. But the requirement to exhaust administrative remedies is not applicable to filing at OAH.

The upshot is that any person aggrieved may bring a contested case in OAH without attending an informal appeal first.

However, there are some occasions that, in my opinion, the informal appeal is useful. Such as an overpayment found by PCG. If you receive a Tentative Notice of Overpayment by PCG, the informal reconsideration review at DMA can be helpful for a number of reasons.

1. It forces you to review the audited documents with a fine tooth comb prior to getting in front of a judge.

2. It allows you to find all PCG’s mistakes, and there will be mistakes, and bring those mistakes to the attention of the auditor.

3. It gives you a chance to decrease the alleged amount owed before a contested case.

Keeping those positive aspects in mind, most likely, the reconsideration review will NOT resolve the case. Although it has happened occasionally, more times than not, you will not agree with the reduced amount the DHHS hearing officer decides. The alleged overpayment will still be extrapolated. The alleged overpayment will still be ridiculous.

Other than an overpayment, I have found very little use for the informal appeals.

NC Medicaid Audits: Is There a Silver Lining? (Maybe Even Two!)

Normally I am “silver lining” type of person. You know…the whole, “The sun will come out tomorrow, bet your bottom dollar that tomorrow, there’ll be sun,” mentality…

But when it comes to North Carolina Medicaid audits conducted by Public Consulting Group (PCG) or HMS, I have failed to find the silver linings. You, as a health care provider, receive a Tentative Notice of Overpayment (TNO) for $1 million and go through various stages of acceptance: surprise, horror, anger, befuddlement, and fear. In order to defend yourself, you have to shell out tens of thousands of dollars for an attorney (hopefully one that understands Medicaid audits). Then spend countless hours compiling all the documents for the attorney to review and use at the reconsideration review. Then take off a day to attend the reconsideration review, losing even more clinical hours, only to disagree with the Department of Health and Human Services (DHHS) Hearing Officer’s decision. Spend more money in legal fees to appeal the DHHS decision to the Office of Administrative Hearings (OAH). Possibly hire an extrapolation expert at even more expense. Only to prove, finally, that the PCG and/or HMS audit was erroneous and you owe nothing. Or $100. Or $1000.

Where is the silver lining in that process?

That you owe nothing in the end? But you paid exhorbent amounts to the attorney.

Well, there could be a silver lining… (maybe even two)…

Recently, the IRS released a couple private letter rulings as to whether paid overpayments could be tax-deductible.

OK, what the heck is a private letter ruling?

According to Wikipedia, private letter rulings “(PLRs), in the United States, are written decisions by the Internal Revenue Service (IRS) in response to taxpayer requests for guidance. A private letter ruling binds only the IRS and the requesting taxpayer. Thus, a private ruling may not be cited or relied upon as precedent.”

The most important part of the above-referenced definition of a PLR is that the PLR is binding only on the IRS and the requesting taxpayer. Obviously, this means that if the IRS wrote 2500 PLRs saying that paid overpayments in Medicaid audits are tax-deductible, those 2500 PLRs are not binding as to you (unless you were one of the 2500 taxpayers asking for a PLR).

Regardless, PLRs are demonstrative as to how the IRS determines [whatever is determines in the PLR]. Because, despite the fact that PLRs are not binding on all taxpayers, I would find it odd if the IRS issued 2500 PLRs stating that the paid overpayments are tax-deductible, then the IRS turn around and refuse to allow you to treat the overpayment as a tax deduction. Although, I am sure stranger things have happened.

In the first PLR, which, BTW, is not fun to read. Who uses all this legalese??? Taxpayer B asks whether (1) the money he paid to the insurance company could be deducted as a loss incurred in a trade or business; and (2) the money paid to a Government Entity E and Government Entity F in the tax years in which the installment payments are made under the settlement agreement can be deducted. (I made Taxpayer B a male because the PLR makes him a male. I have no idea as to the gender of Taxpayer B).

In Year 1, the Insurance Company sued … Taxpayer B for insurance fraud, demanding both compensatory and punitive damages. In the second year, the state of New Jersey indicted Taxpayer B… for insurance fraud. Taxpayer B agreed to pay $X in restitution to Government Entity E and Government Entity F.

Taxpayer B has represented (a) that he previously included in his gross income in prior tax years the amounts he now seeks to deduct and (b) that he and all other defendants in [both] lawsuits are jointly and severally liable for the amounts due under the settlement agreement because the language of the settlement agreement imposes joint liability upon the defendants and New Jersey law imposes joint and several liability upon members of a limited liability company.

So…can Taxpayer B deduct the money paid to the insurance company and the government as a business loss????

Or, in other words, could you (a health care provider who accepts Medicaid) deduct any money paid to PCG or HMS arising our of a regulatory audit as a business loss?

According to the PLR:

We conclude that Taxpayer B may deduct the payments he made to the Insurance Company and to Government Entity E and Government Entity F in the years the payments were made or will be made, provided that he received or will receive no contribution from any other party and included the amounts he paid or will pay in his gross income in prior tax years.

Yes!

The second PLR is basically identical to the first, except that Taxpayer A is at issue. For the PLR, click here.

So what does this mean? Why should North Carolina Medicaid providers care that 2 taxpayers were able to deduct the monies paid to the government/insurance companies as a business loss?

Because, these PLRs are demonstrative that, perhaps, the IRS would view regulatory audit paybacks to PCG or HMS as an allowable tax deduction as a business loss.

So, you receive a TNO in the amount of $1 million. You spend $20,000 litigating the $1 million to $1000. I know, it sucks, right?? (Not that the amount was decreased by $999,000, but that it cost $20,000 to reduce the amount $999,000).

The silver lining? Maybe you can deduct the $1000 paid as a business loss.

But what about the $20,000 attorneys’ fees???

Let me preface this with:

I am no tax expert. I know Medicaid, not tax. If you want real tax advice, go to a real tax attorney. But, I did find…Publication 529, which states the following:

Legal Expenses

You can usually deduct legal expenses that you incur in attempting to produce or collect taxable income or that you pay in connection with the determination, collection, or refund of any tax.

You can also deduct legal expenses that are:

- Related to either doing or keeping your job, such as those you paid to defend yourself against criminal charges arising out of your trade or business,

- For tax advice related to a divorce if the bill specifies how much is for tax advice and it is determined in a reasonable way, or

- To collect taxable alimony.

A definitive answer?

No.

But…a possible two silver linings! The sun will come out tomorrow, bet your bottom dollar that tomorrow, there’ll be sun!!!!

CMS Adding 5th RAC: Medicaid Audits Expected to Increase

It is wise to worry about tomorrow today. -Aesop’s Fables, “The Ant and the Grasshopper”

CMS has announced that it will add a 5th Medicare RAC to focus on home health and durable medical equipment (DME). Obviously, with the aid of a 5th RAC, the other RACs will have more free time to focus on other health care providers.

So what does a 5th RAC for Medicare mean for Medicaid in North Carolina. First, many providers that accept Medicare also accept Medicaid. The two programs do have some commonality. Also, NC started out with one RAC. As the federal government increased the number of RACs, NC has slowly increased the number of RACs. We started with Public Consulting Group (PCG) in January 2012 and added HMS October 2012. Then, of course, we have The Carolina Centers for Medical Excellence (CCME), approved through an RFP, performing “Quality Improvement Strategy functions” on the behalf of DMA.

Expected Future for NC Medicaid Providers? More and more and more and more audits.

Remember the ant in the “Ant and the Grasshopper?” If not, here is the fable.

Quick Synopsis: All summer long the grasshopper played while the ant dutifully collected food for the winter, while the grasshopper made fun of him. Once winter came, the grasshopper had no food, and the ants says, “You should have thought of winter then!”

So, providers, be the ant!

NC Medicaid Audits: Are There Legal Grounds to Recoup Monetary Damages?

Speaking Engagement! 05.11.2013 12:00pm — 2:00pm (Lunch will be provided) To register, please contact referral@ahbpsych.com.

3326 Chapel Hill Blvd, Suite D, Durham, NC

Presented by: Williams Mullen and AHB Psychological Services

Providers of Medicaid Behavioral Health Services:

Have you been placed on Pre-Payment Status and been unable to meet the standards to get off of Pre-payment Status?

Have you been told that you are Not in Good Standing with DMA and have been unable to receive assistance restoring your standing?

Have you been wrongly denied access to one of the new MCO provider networks?

Have you been told that your Medicaid number is being terminated or has been terminated?

Have your Medicaid payments been wrongly suspended?

Have these actions resulted in loss of income, your business closing, emotional stress, or other negative consequences?

If so, please join us!

Guest Speaker will be Attorney Knicole C. Emanuel of Williams Mullen Law Firm. Ms. Emanuel focuses her practice on Medicaid Law and has assisted providers in navigating Medicaid investigations and audits.

Lunch will be provided so please RSVP by Thursday, May 9th at 5pm to referral@ahbpsych.com.